According to Professor Jason Miller, a supply chain expert at Michigan State University, there’s some good and bad news for trucking companies based on the December data from the for-hire trucking ton-mile and revenue indexes (TTMI). December’s TTMI, based on output across 41 freight-generating industries, was down 0.1% from November, which is effectively unchanged sequentially. Miller suggested that “freight volumes have likely found the bottom of the trough of the current cycle. The bad news is we have yet to see an improvement in ton-miles in a meaningful manner. For example, I’m certainly not expecting robust growth in 2024 as we saw in 2017 to exit the 2015-2016 freight recession.”

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

The good news is that during the last quarter of 2023, the TTMI revenue index, based on multiplying ton-miles by the PPI (producer price index) for truck transportation, was the first quarter where seasonally adjusted revenue rose. According to Prof. Miller, “the last time that happened was Q2 2022, suggesting that across all trucking, the sharp decline in seasonally adjusted revenue carriers experienced since Q2 2022 is likely behind us.” Miller notes that for the next bull market cycle to emerge, there needs to be “a roughly 2-4% swing in the balance of demand (measured by ton-miles) or capacity (measured using the CES monthly payroll data for truck transportation establishments.”

Market watch

All rates cited below exclude fuel surcharges unless otherwise noted.

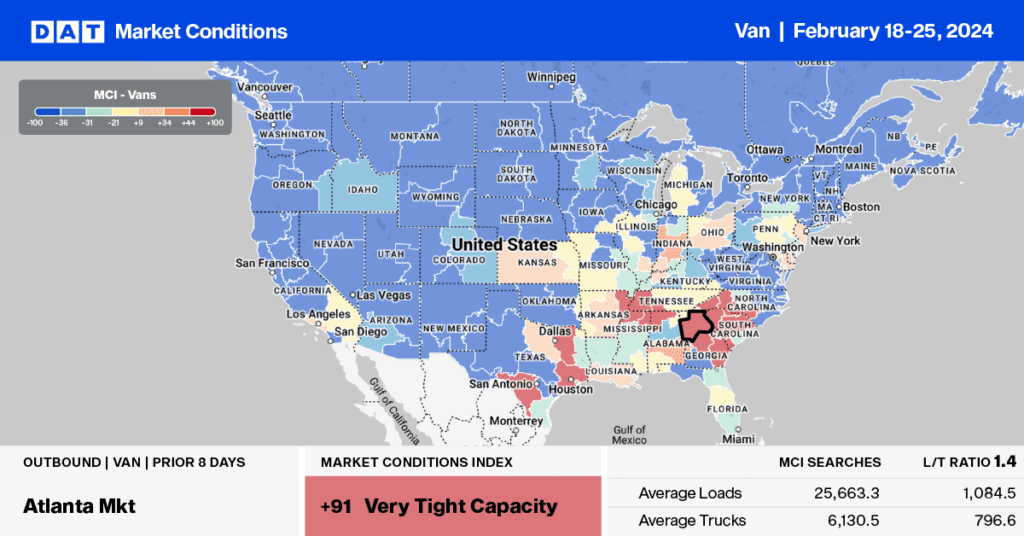

Truckload capacity tightened slightly in the Southeast following last week’s $0.01/mile gain. At $1.51/mile, the regional average is $0.01/mile above 2020 and $0.03/mile lower than 2019. Based on the number of loads moved, Atlanta, the largest spot market in the region, volumes are just over 1% higher than last year. However, with excess truckload capacity in the market, linehaul rates were down slightly last week, averaging $1.53/mile for outbound loads.

On the high-volume lane south to Lakeland, FL, loads moved are 11% higher than last year, but linehaul rates are just over 3% lower, averaging $2.40/mile in the last week. At $1.04/mile, outbound Florida rates are the second lowest in eight years and only $0.03/mile higher than in 2016. Loads from Miami to Atlanta are 55% higher than last year. In comparison, linehaul rates are 10% lower, paying carriers an average of $0.51/mile last week, the lowest in 12 months, highlighting the freight imbalance between Georgia and Florida. In the spot market, Miami receives almost twice the volume of inbound loads compared to outbound, whereas the Atlanta market is balanced.

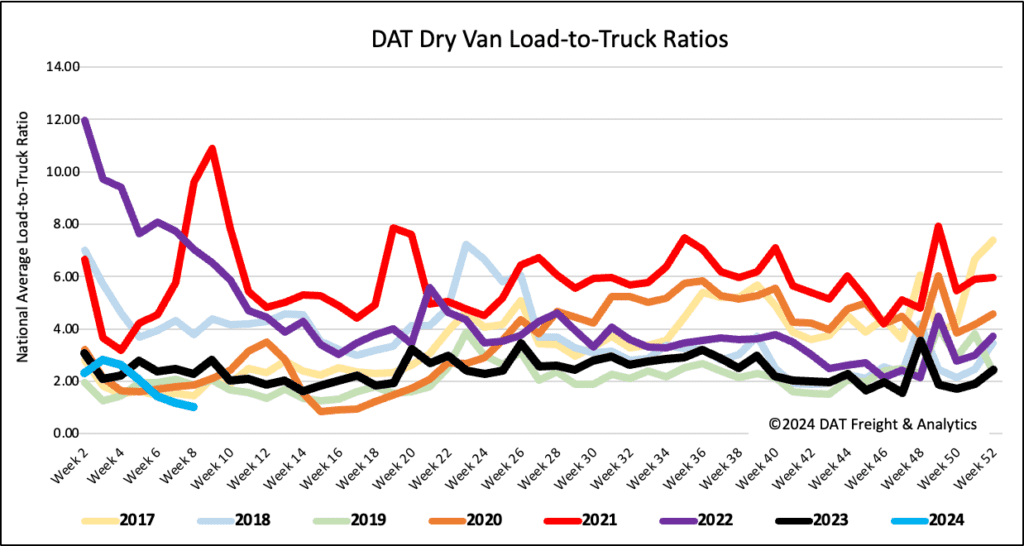

Load-to-Truck Ratio (LTR)

National spot market load post (LP) volumes dropped for the fifth consecutive week following last week’s 15% week-over-week (w/w) decline. LP volumes have remained at their lowest in eight years and 63% lower than last year. Carrier equipment posts (EP) decreased by 4%, resulting in last week’s dry van load-to-truck ratio (LTR) dropping by 12% to 1.02, 21% above the previous low of 0.84 recorded at the start of the pandemic in 2020.

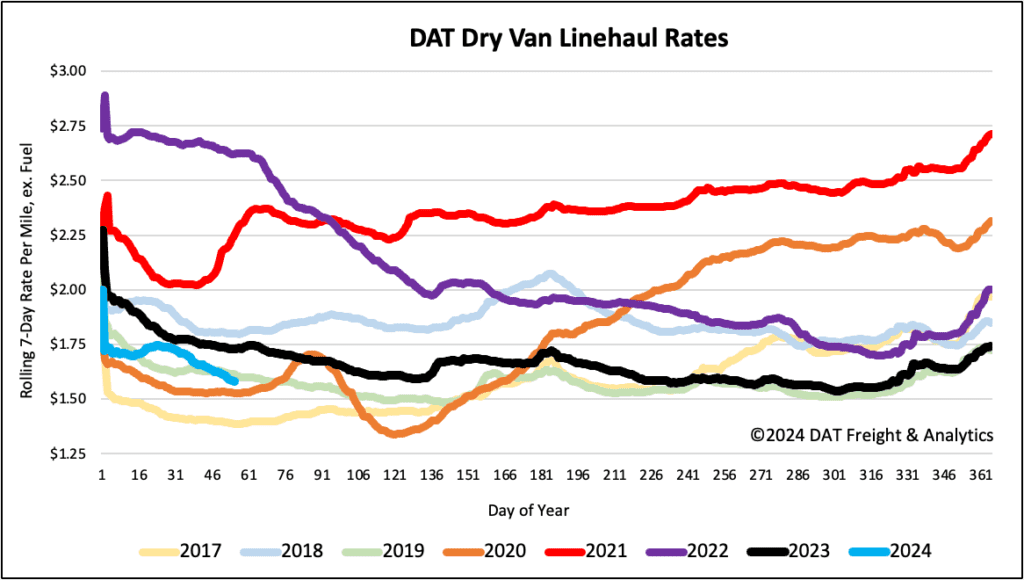

Linehaul spot rates

Dry van linehaul rates dipped below 2015 levels last week and are currently around $0.05/mile lower than 2019, following another $0.04/mile w/w decrease. At $1.59/mile, linehaul rates are $0.15/mile lower than last year. Based on the volume of loads moved, DAT’s Top 50 lanes averaged $1.84/mile last week, $0.25/mile higher than the national average.