The American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index was unchanged in February after increasing 0.4% in January. Compared with February 2021, the SA index rose 2.4%, the sixth straight year-over-year gain and the largest over that period. In January, the index was up 0.9% from a year earlier. In 2022, year-to-date, and compared with the same period in 2021, tonnage was up 1.7%.

“February was the first month that the index didn’t increase since July,” said ATA Chief Economist Bob Costello. Despite a string of gains, the index is still off 1.8% from March 2020. The index is also off 4.2% from the all-time high in August 2019. It is important to note that ATA’s data is dominated by contract freight, not the spot market.

“Demand for trucking freight services remains strong, but for-hire contract carriers are capacity constrained due to the driver and equipment markets. The spot market has been surging as these carriers can’t haul all of the freight they are asked to move,” he said. “So the fact that the tonnage index hasn’t fully recovered is a supply problem, not a lack of demand. Other ATA data shows that for-hire carriers are operating around 7% fewer trucks, both company and independent contractor equipment, than before the pandemic.”

Even though port congestion on the West Coast is easing as the number of vessels waiting to unload nears 40 (down from 109 on 1/9) according to The Marine Exchange, it hasn’t stopped importers redirecting loaded containers to other less-congested ports. The Gulf Coasts’ Port Houston has been one of the larger ports to benefit from the coastal shift away from the congested West Coast – February’s import volumes were up 37% y/y. Furniture imports are up 9% y/y nationally, ranking as the number commodity for containerized imports, but in Houston, furniture volumes are up 17% y/y. Most of those shipments come from Mainland China, where total volumes are 39% higher y/y in Port Houston.

According to Port Houston, “this is the biggest February Port Houston has ever seen in terms of containers.” In response to this strong growth, the port is opening additional gates and adding three new neo-Panamax ship-to-shore cranes allowing Port Houston to receive larger ships than ever before.

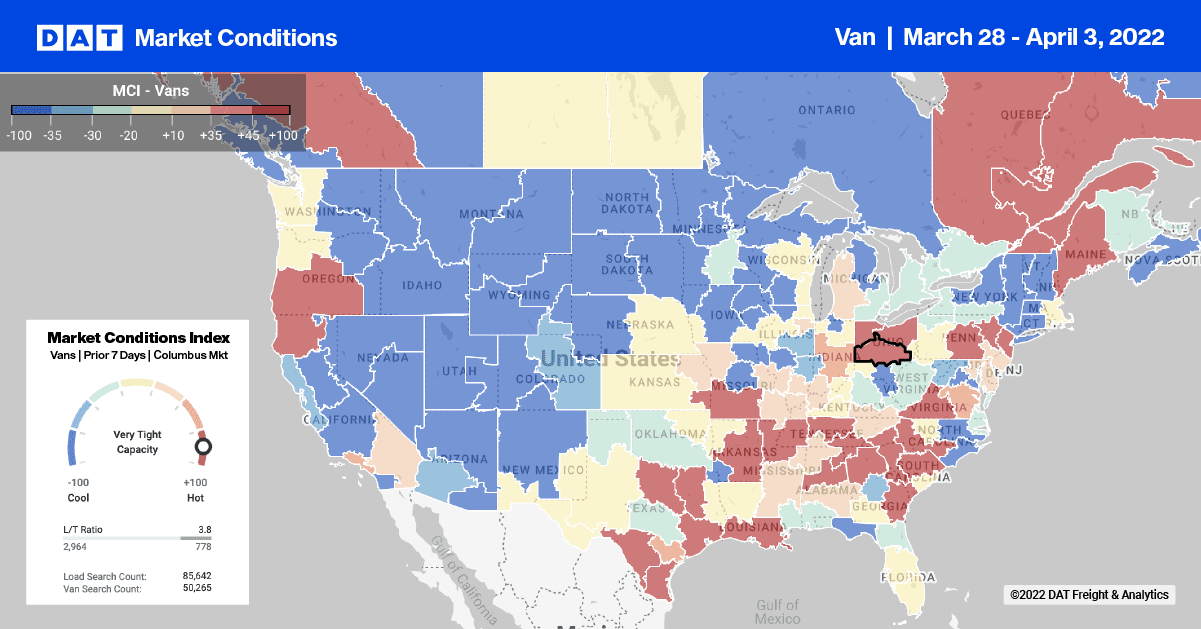

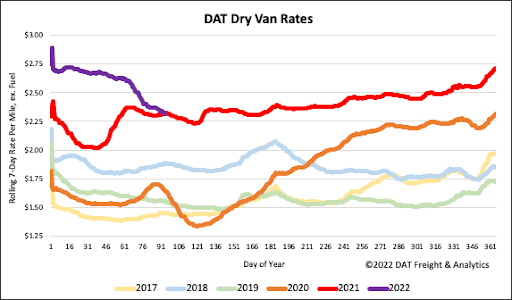

For truckload carriers, this means more volumes, just as the Houston freight market becomes the number one dry van market for load post volumes. Volumes have jumped by 27% following last week’s 4% w/w increase in the previous month. Shippers and brokers still have plenty of available capacity as dry van spot rates reach $2.35/mile excl. FSC after dropping by $0.11/mile in the last month.

In the nation’s largest port, load post volumes in Los Angeles decreased by 4% w/w, with a recent slide in outbound spot rates slowing to an average of $2.41/mile excl. FSC last week after decreasing by just $0.01/mile w/w. Spot rates on the high-volume Los Angeles to Chicago hit $2.00/mile excl. FSC is now $0.43/mile lower than the previous year.

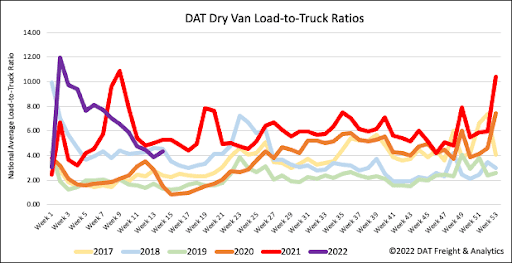

Dry van load post volumes increased by 6% last week but remain down by 22% m/m and 9% compared to the previous year. Last week, fewer carriers posted their equipment for loads, decreasing by 5% w/w and 12% y/y. The net impact on the dry van load-to-truck (LTR) ratio was an 11% w/w increase from 3.87 to 4.30.

Dry van spot rates are now just one penny per mile higher than this time last year after dropping another $0.04/mile last week and $0.30/mile in the previous four weeks. Since the start of the year, spot rates have plunged by $0.43/mile to a national average of $2.35/mile excl. FSC this week.