The February Logistics Managers Index (LMI) came in at 54.7 in February, down (-2.9) from January’s reading of 57.6. While the overall diffusion index remains in expansion territory (values above 50 indicate expansion and below indicate contraction), February’s numbers broke the streak of two consecutive readings of increased growth. Notable movers in February were Transportation Costs, which decreased 5.9 points, contracting at the fastest rate in the 6.5-year history of the index. Also worth noting was the loosening in Warehousing Capacity for the first time in 2.5 years of contraction. Up 10.2 points in February, Warehousing Capacity crossed into expansion territory at 56.6, providing some relief for consumers and firms battling a lack of warehouse space and congestion throughout the supply chain.

The LMI report noted that the Chinese manufacturing PMI was up to 52.6, the highest expansion rate since April 2012, indicating the much-awaited Chinese economy returning online. When these goods arrive from China, firms may find that many supply chain bottlenecks have eased over the past several years. This should translate to improved network velocity for truckers as trucks spend less time loading and unloading at shippers and receivers.

Other trends worth noting from the LMI report include consumer spending patterns and new investments in warehouse facilities. According to Zac Rogers, Assistant Professor at Colorado State University, “consumers are still spending in different ways than during the pandemic. U.S. consumers are now dedicating 33% of their spending towards goods, similar to pre-pandemic levels of 30%. Regarding physical goods, U.S. consumers continue to spend on necessities like groceries and energy, turning away from discretionary spending on apparel and electronics.” For carriers and brokers, this supports the ongoing shift in the freight mix we’ve observed for several months.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

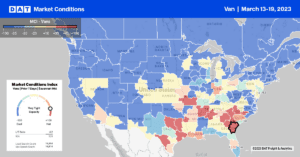

In DAT’s Top 10 spot markets, which accounted for 26% of volume last week, Atlanta regained the number one position following a 4% w/w increase, although capacity was flat at $1.67/mile for outbound loads. At $1.70/mile, state-level rates in Georgia were just $0.04/mile higher than in 2019 last week. High-volume lanes to the south include Lakeland, FL, where the volumes of loads moving were down by 8% last week, reporting the lowest spot rate in 12 months at $2.48/mile. Atlanta to Miami volumes were 8% lower last week, with rates also hitting a new 12-month low at $2.13/mile.

The Dallas/Ft. Worth metroplex, the largest dual-market metropolitan area for spot market volume, accounted for just over 5% last week. Outbound spot rates were flat at $1.58/mile, while solid gains were reported in San Antonio, with rates increasing by $0.08/mile to $1.87/mile. Houston, the number two spot market in the country, reported a 23% w/w increase in volume, pushing up outbound spot rates by $0.03/mile to $1.73/mile. State-level rates in Texas at $1.69/mile are identical to dry van rates in 2018.

Load-to-Truck Ratio (LTR)

Dry van load posts reversed the downward trend of the prior two weeks following a 4% w/w gain last week. Spot market capacity loosened for the third week, although identical to the previous year, following last week’s 1% increase. The net result was a slight dry van load-to-truck ratio (LTR) increase from 2.03 to 2.09.

Linehaul Spot Rates

Dry van linehaul rates continue to lose ground, decreasing by just under $0.01/mile last week to $1.72/mile. Spot rates continue to track closest with 2019 levels, ending last week at $0.12/mile higher. Based on the volume of loads moved, the average rate for the top 50 dry van lanes was $0.20/mile higher, which averaged $1.92/mile last week. On DATs Top 100 dry van lanes, linehaul rates decreased on 68% of lanes, increasing on only 11% with the balance remaining neutral.