For flatbed carriers, especially those in Texas and neighboring states, the falloff in oil and gas drilling activity is something to be concerned about. According to Baker Hughes, the U.S. oil and gas rig count fell by 44 in May, the biggest drop in three years as energy firms curtail investment in new drilling rigs. The oil and gas rig count, an early indicator of future output and flatbed demand for drilling products, fell by nine to 711 in the week to May 26, the lowest since May 2022. Baker Hughes has issued the weekly rig count report since 1944, making it a reliable indicator of demand in the flatbed sector.

Although crude oil (West Texas Intermediate WTI) is trading around the $70-per-barrel mark, which is highly favorable for exploration and production activities, the massive drop in gas prices has already caused some companies to reduce production by cutting some rigs. Most of the recent rig reductions were in Haynesville, Louisiana, where the

total count dropped by three to 54, the lowest since February 2022. According to analysts at Goldman Sachs, “Our view is that current gas prices incentivize Haynesville producers to halt growth ultimately, so we see further declines from the current count as likely.”

All rates cited below exclude fuel surcharges unless otherwise noted.

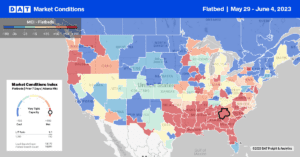

Outbound flatbed volumes in key steel-producing markets were boosted last week by higher production volumes, up by almost 2% y/y. In Gary, IN, the largest flatbed market for steel, outbound rates increased by $0.15/mile to $2.76/mile after dropping for the prior three weeks. Loads 450 miles west to Minneapolis were paying $2.92/mile, up $0.12/mile compared to the last two months. At $2.76/mile, regional loads east to Cleveland are $0.10/mile higher than the previous month, while loads to Pittsburgh at $2.59/mile is the highest since last August.

Capacity in the combined Little Rock/Memphis markets was tight following last week’s $0.16/mile increase to $2.85/mile, while capacity loosened in the large Houston market. Rates decreased by $0.07/mile to $2.41/mile for outbound loads after increasing for the three weeks prior. On our benchmark flatbed lane between Houston and Ft. Worth, linehaul rates were flat at $2.98/mile. Texas state average rates at $2.35/mile are within $0.12/mile of 2018. In Florida, spot rates continue to tighten in the Lakeland market following last week’s $0.06/mile increase to $1.92/mile.

Load-to-Truck Ratio (LTR)

Last week’s spot market flatbed volume dropped by 17% w/w and was almost five times lower than the previous year. Volumes are around half the average for Week 22 in pre-pandemic years and practically identical to 2019. Carrier equipment posts were down 19% w/w and 14% higher than in 2019, resulting in last week’s flatbed load-to-truck (LTR) ratio remaining flat at 12.71.

Spot Rates

Flatbed linehaul rates were up by almost $0.03/mile last week to a national average of $2.21/mile. Spot rates have gained $0.07/mile in the previous month, although they are $0.40/mile lower than last year.