Economic activity in the manufacturing sector contracted in July for the fourth consecutive month and the 20th time in the last 21 months, according to the Institute for Supply Management (ISM). In the latest July report, Timothy R. Fiore, ISM Chairman, said, “The Manufacturing PMI registered 46.8% in July, down 1.7 percentage points from the 48.5% recorded in June. U.S. manufacturing activity entered deeper into contraction. Demand was weak again, output declined, and inputs stayed generally accommodative.”

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

The New Orders Index remained in contraction territory, registering 47.4%, 1.9 percentage points lower than the 49.3% recorded in June. Fiore noted, “Demand remains subdued, as companies are unwilling to invest capital and inventory due to current federal monetary policy and other conditions. Production execution was down compared to June, likely adding to revenue declines and putting additional pressure on profitability. Suppliers continue to have capacity, with lead times improving and shortages not as severe.”

Notably, all six of the largest manufacturing industries—machinery, Transportation Equipment, Fabricated Metal Products, Food, Beverage & Tobacco Products, Chemical Products, and Computer and electronic Products—contracted in July,” says Fiore.

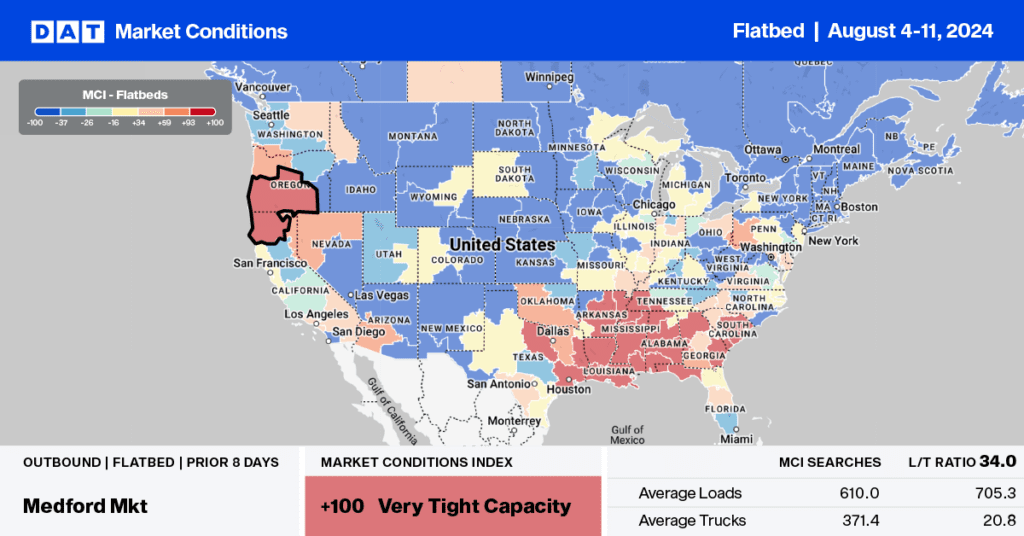

Market Watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

This week, we’re examining the large flatbed market in Lakeland, FL, which accounted for 54% of outbound loads moved last week. At $1.52/mile, outbound market average rates are well below operating costs for most carriers. In contrast, on high-volume lanes to Miami, for example, which accounted for a third of loads last week, linehaul rates were much higher, averaging $2.61/mile, up $0.22/mile in the last month and $0.31/mile higher than last year.

The explosion of residential construction, with seven out of the top 10 growth markets in Florida, has driven substantial recent flatbed demand. According to the U.S. Census Bureau, around 60% of new home starts are in the Southeast Region, requiring a substantial volume of inbound regional and local freight shipments. Flatbed inbound volumes into the Lakeland market are up 62% in the last month following last week’s 13% w/w increase. Spot rates are $0.22/mile higher at $2.61/mile over the same timeframe.

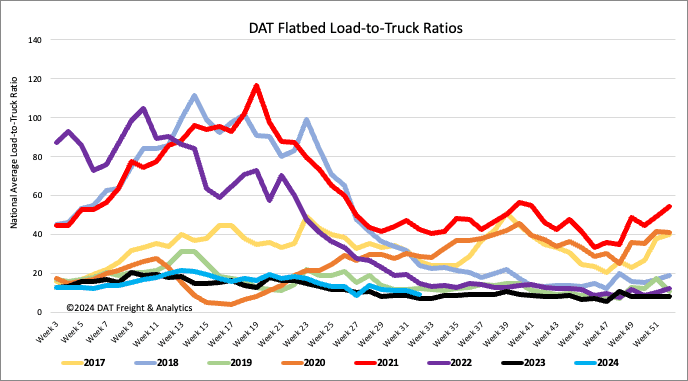

Load-to-Truck Ratio

Flatbed load post volumes dropped by 15% last week and remain 1% higher than last year and 43% lower than the Week 32 eight-year average, excluding years impacted by the pandemic. Carrier equipment posts were up 2% w/w, resulting in last week’s flatbed load-to-truck ratio decreasing by 17% to 9.49.

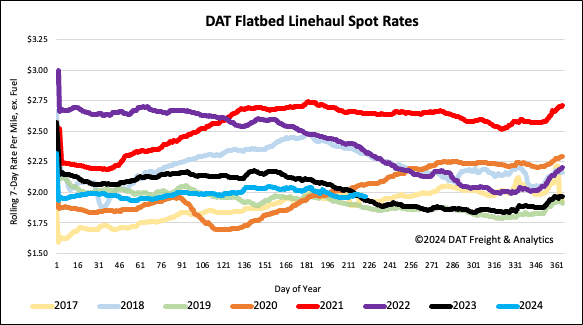

Spot rates

The national volume of loads moved dropped by 7% last week, resulting in a loosening of flatbed capacity and a $0.02/mile decrease in spot rates to a national average of $1.99/mile. Flatbed spot rates are $0.02/mile higher than last year but $0.10/mile higher than 2019.