The US manufacturing sector is in its strongest position since 2022, according to the latest report from the Institute for Supply Management (ISM). The March Manufacturing Purchasing Managers Index (PMI) indicated that the sector moved into expansion for the first time since September 2022.

According to the ISM, the Manufacturing PMI registered 50.3% in March, up 2.5 percentage points from the 47.8% recorded in February. The ISM PMI is a diffusion index where values below 50 indicate contraction, while values over 50 indicate economic expansion.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

The ISM’s manufacturing business survey committee chair Timothy Fiore said, “Demand was positive, output strengthened, and inputs remained accommodative. “Demand remains at the early stages of recovery, with clear signs of improving conditions. Production execution surged compared to January and February as panelists’ companies reentered expansion. Suppliers continue to have capacity but are showing signs of struggling, largely due to their raw material supply chains.”

Of the six biggest manufacturing industries contributing to the PMI, four — Food, Beverage & Tobacco Products; Fabricated Metal Products; Chemical Products; and Transportation Equipment, which account for a combined 54% of manufacturing gross domestic product (GDP) — registered growth in March.

Market watch

All rates cited below exclude fuel surcharges unless otherwise noted.

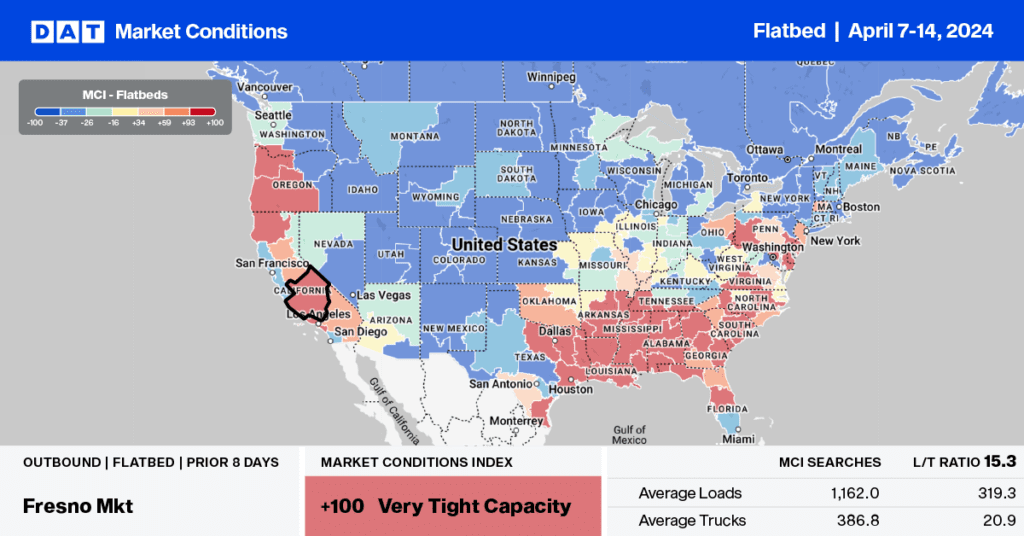

Following the Francis Key Bridge collapse in Baltimore three weeks ago, long-haul flatbed capacity remains tight even though the volume of loads moved begins to decline, down 11% last week after being up 10% in the last four weeks and 76% y/y. Over the same timeframe, spot rates are up 4.0% m/m and 3.8% m/m, following last week’s 6% increase in outbound linehaul rates. On the high-volume lane west to South Bend, IN, the load volume dropped by almost a half last week after doubling in the last month, with spot rates decreasing by $0.08/mile to $1.95/mile. There was a surge in demand for loads to Savannah last week, which is typically a low-volume freight lane for flatbed carriers. The volume of loads moved spiked 72% w/w, driving up spot rates by almost a dollar per mile to $3.29/mile over the last seven days.

President Biden and Maryland Gov. Wes Moore are working to an aggressive timeline to get the port up and running again, perhaps by the end of May. Gov. Moore said, “It’s realistic. And I think that it’s going to take some time. It’s going be a 24/7 operation” to return it to full functioning by the end of May. In the interim, Mark Schmidt, vice president at Ports America Chesapeake, which operates the 320-acre Seagirt Marine Terminal, said, “Seagirt typically sees 3,500 to 4,000 truck transactions daily, but that is down to a few hundred now.”

After detailed studies and engineering assessments by local, state, and federal organizations, in collaboration with industry partners, the U.S. Army Corps of Engineers (USACE) expects to open a limited access channel 280 feet wide and 35 feet deep to the Port of Baltimore within the next four weeks – by the end of April. This channel would support one-way traffic in and out of the Port of Baltimore for barge container service and some roll-on/roll-off vessels that move automobiles and farm equipment to and from the port.

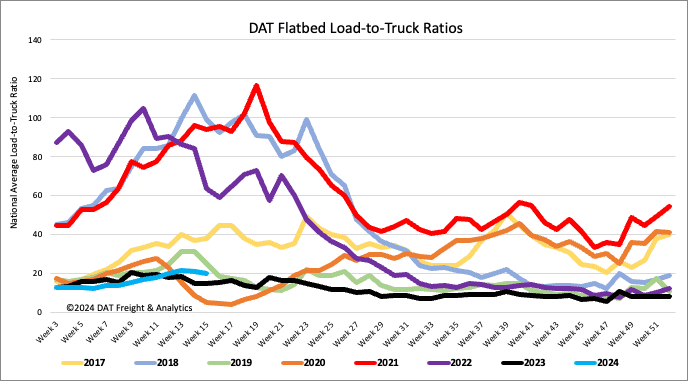

Load-to-Truck Ratio

We’re at that time of the year when flatbed load post volumes start to cool off following the first-half surge. Flatbed load post volumes fell for the third week following last week’s 6% w/w decrease and almost identical to volumes this time last year. Equipment posts decreased by just over 1% w/w, decreasing the load-to-truck ratio by 5% to 20.35.

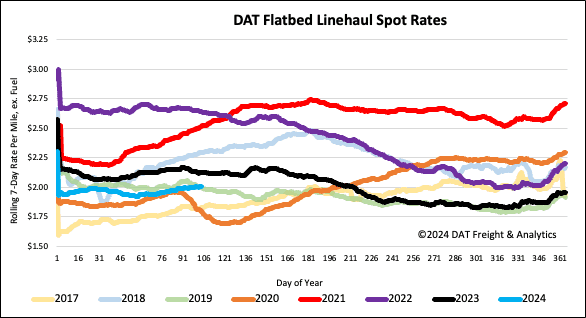

Spot rates

After increasing steadily for the prior seven weeks, flatbed linehaul rates leveled off last week, down by almost a penny per mile to just over $2.02/mile. Flatbed linehaul rates remained $0.12/mile lower than last year and $0.01/mile lower than in 2019.