March is typically the peak of imports for farming machinery and construction equipment in the Port of Baltimore, receiving just over 12% of the annual volume. For auto haulers and flatbed carriers, the port closure is a big deal, considering the port is the largest port in the country for the import of roll-on/roll-off cargo, including automobiles, tractors, trucks, farm machinery, excavators, backhoes, wood chippers, forklifts, and hay balers.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

It’s also the closest port on the East Coast to the farm and construction machinery center in the Quad Cities region on the Mississippi River (Davenport, Rock Island, East Moline, and Bettendorf). Case New Holland Agriculture, Caterpillar, John Deere, AGCO (Fendt, Massey Ferguson), CLAAS, Komatsu, and John Deere are all big customers of the Port of Baltimore and will have to find alternatives to ship goods to their assembly plants and in return, exports via another port. John Deere’s world headquarters are in Davenport, IA, and Caterpillar is in Mapleton, IL, 100 miles southeast.

Market watch

All rates cited below exclude fuel surcharges unless otherwise noted.

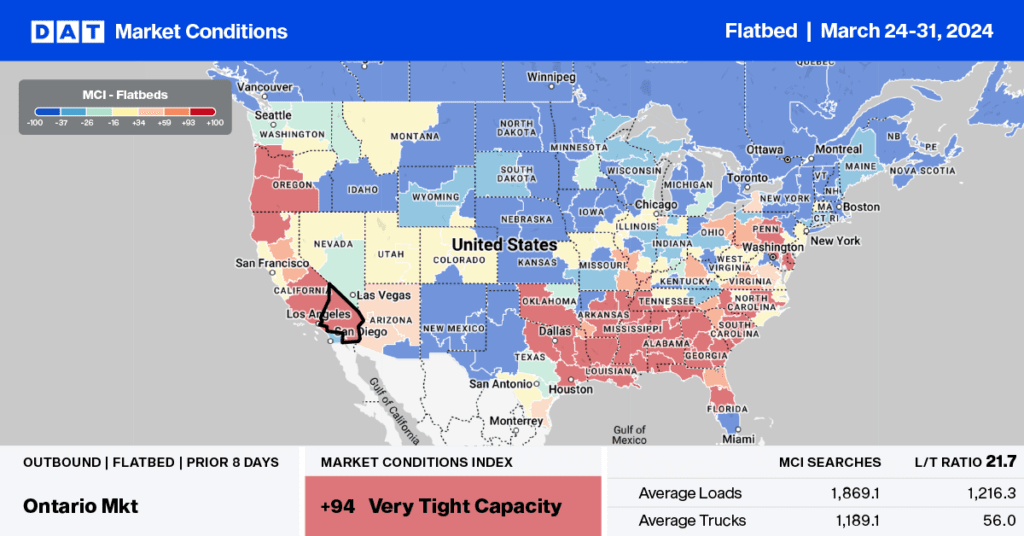

Baltimore is a major flatbed spot market, consistently ranking in the Top 10 nationally this time of the year during peak machinery import season. Last week’s bridge collapse saw a surge in loads moved, up 57% w/w, while sufficient available capacity resulted in market average linehaul rates dropping by $0.05/mile. At a lane level, the impact on spot rates was mixed. There was a surge in linehaul rates early last week on key freight lanes as the market processed the impact of the bridge collapse, including Baltimore to Chicago loads moved, which increased by 117% w/w, driving up spot rates by $0.25/mile to $2.03/mile.

Capacity tightened rapidly on the Baltimore to Gary, IN, steel market, where loads moved, and linehaul rates surged, with spot rates increasing by $0.23/mile to $2.02/mile. Linehaul rates to nearby South Bend, IN, were flat, paying carriers an average of $1.98/mile, and even though the volume of Detroit loads more than doubled, linehaul rates dropped by $0.13/mile to $2.14/mile.

Volumes for regional loads to Charlotte, NC, increased by 21% last week, and linehaul rates increased by $0.03/mile to $1.96/mile. At $2.30/mile, outbound Maryland spot rates are identical to last year and in 2019.

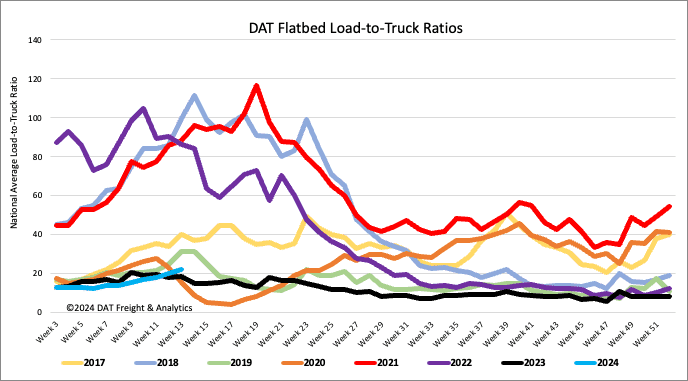

Load-to-Truck Ratio

After increasing for the past seven weeks, flatbed load post volumes were flat last week and 7% lower than last year. Available capacity decreased following the 10% drop in equipment posts, increasing the load-to-truck ratio by 11% to 22.03.

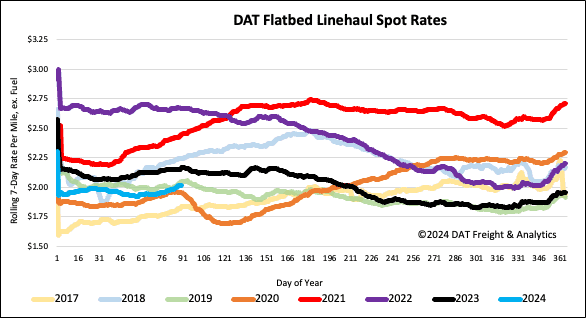

Spot rates

The volume of flatbed loads moved increased by 9%, 12% in the last month, and 8% year-over-year (y/y). Available capacity continues to tighten, with flatbed spot rates up by just over $0.01/mile last week to a national average of $2.03/mile. Flatbed linehaul rates are 0.15/mile lower than last year and $0.03/mile lower than in 2019.