Homebuilders and buyers share a gloomy outlook for residential construction as we head into 2024, creating some headwinds for flatbed carriers. The National Association of Home Builders (NAHB) Housing Market Index (HMI), based on the sentiment of NAHB members, registered 34 in November, the lowest level since the end of last year.

Many homeowners are reluctant to move on from low-interest rate mortgages, adding to the low housing inventory levels. Along with higher short-term interest rates, the cost of financing for home builders and land developers has added another headwind for the nation’s housing supply, contributing to historically low levels of flatbed demand.

According to the Fannie Mae Home Purchase Sentiment Index (HPSI), “Consumers’ perceptions of homebuying conditions remain overwhelmingly pessimistic, as only 14% of consumers believe it’s a good time to buy a home, a new survey low. Pluralities of respondents also continue to expect both home prices and mortgage rates to increase over the next 12 months.”

Doug Duncan, Fannie Mae Senior Vice President, and Chief Economist, said, “The combination of persistent affordability challenges and less rosy household finances remain the primary drivers of the low-level plateauing of housing sentiment. Even if mortgage rates decline over the next year, which we currently expect, it’s unlikely to affect affordability meaningfully. The lack of housing inventory will likely remain a challenge, and home purchase sentiment may continue to be suppressed. As our forecast indicates, we believe it will be a couple of years before home sales return to more normal, pre-pandemic levels.”

Find flatbed loads and trucks on North America’s largest on-demand freight marketplace.

All rates cited below exclude fuel surcharges unless otherwise noted.

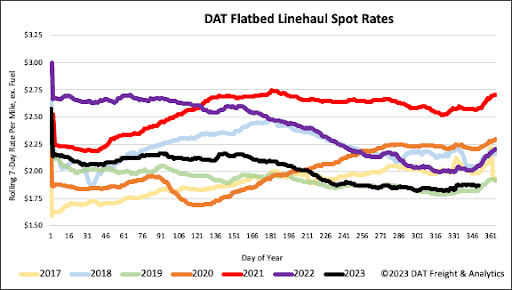

In the Southeast Region, around 65% of the nation’s total of new single-family homes are started each month, and 45% of raw steel is produced, contributing to a quarter of the weekly spot market volume for flatbed carriers. Still, with excess capacity in the overall market, regional linehaul rates are 5% lower than last year but have regained that lost ground, increasing by the same amount in the last month to average outbound rates of $2.06/mile. Compared to 2019, Southeast regional flatbed linehaul rates are just $0.13/mile higher.

Solid gains were reported in Mobile last week, where linehaul rates averaged $2.04/mile following a month of gains. On the top lane between Mobile and Lakeland, FL, carriers were paid an average of $2.18/mile and $2.19/mile to Bowling Green, KY. Alabama state average rates typically peak mid-year. This year rates averaged $2.84/mile before steadily declining through year-end, averaging $2.14/mile last week.

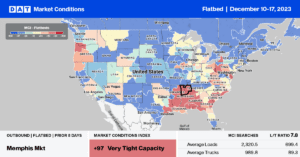

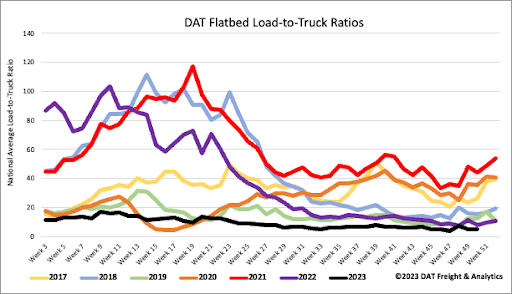

The volume of flatbed load posts (LP) decreased by 2% last week as the flatbed market follows seasonal trends, cooling off during winter. Carrier equipment posts (EP) decreased by 6% w/w, resulting in last week’s flatbed load-to-truck ratio (LTR) increasing to 5.27.

Flatbed linehaul rates were flat last week, averaging $1.90/mile. Flatbed spot rates are $0.18/mile lower than last year and $0.04/mile higher than in 2019. Compared to the prior two freight recessionary periods in 2016 and 2019, flatbed linehaul rates increased by $0.10/mile from this point to the end of the year. Like the reefer and dry van sectors, this year’s spot market is tracking the closest to 2019; both were mostly flat during November before starting the year-end climb as capacity tightens.