According to the latest Institute for Supply Management (ISM) Manufacturing Report On Business, the manufacturing sector contracted for the fourth consecutive month in June. This follows a two-month expansion and a preceding 26-month period of contraction in economic activity.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Susan Spence, MBA, Chair of the Institute for Supply Management Manufacturing Business Survey Committee, issued the report today: “The Manufacturing PMI registered 49 percent in June, a 0.5-percentage point increase compared to the 48.5 percent recorded in May. The overall economy continued in expansion for the 62nd month after one month of contraction in April 2020. (A Manufacturing PMI above 42.3 percent, over a period of time, generally indicates an expansion of the overall economy.)

Highlights from the report include:

- The New Orders Index contracted for the fifth month in a row, registering 46.4 percent—1.2 percentage points lower than May’s 47.6 percent. This follows a three-month period of expansion.

- The Production Index returned to expansion territory at 50.3 percent, a 4.9-percentage point increase from May’s 45.4 percent.

- Survey respondents consistently cited tariffs and geopolitical instability (Middle East, Ukraine, Iran, China) as major disruptors, causing significant uncertainty, collapsed orders, rising material costs (up 6-10%), and stalled long-term planning across various industries, including fabricated metal, wood, chemical, machinery, food/beverage, computer/electronic, petroleum/coal, primary metals, miscellaneous manufacturing, and transportation equipment.

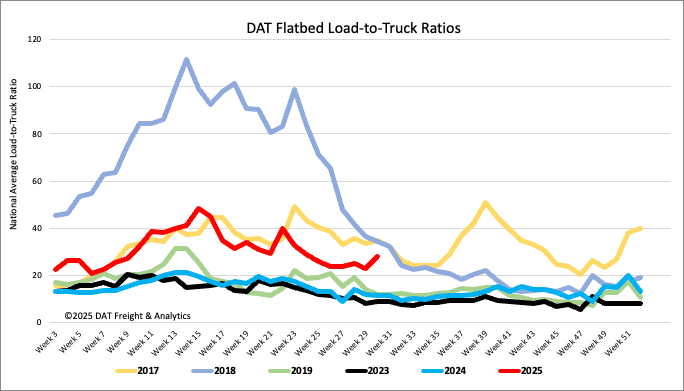

Load-to-Truck Ratio

Flatbed load posts saw a significant increase of 47% last week, and 19% year-over-year, during the first full shipping week after Independence Day. This led to a 23% rise in the flatbed load-to-truck ratio, reaching 28.04, even as flatbed carrier equipment posts also increased by 20%.

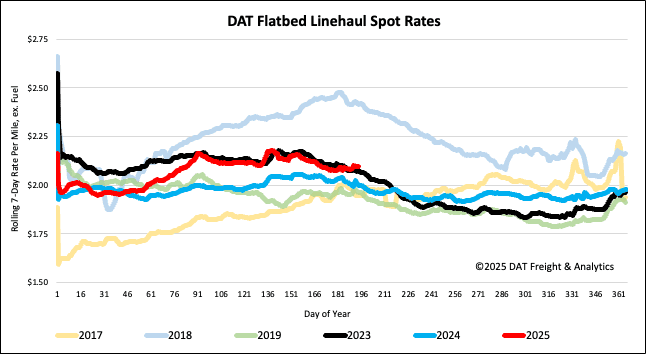

Spot rates

For the second consecutive week, the national average flatbed spot rate, excluding fuel, remained unchanged at just over $2.10 per mile. Despite this stability, the current rate reflects a $0.10 per mile increase compared to the same week in 2024.