Sales of farm tractors and combine harvesters continue to track closely with the 5-year average, even though last month’s volume was almost 5% lower than in August 2022. In contrast, heavy-duty row crop tractor unit sales continued to increase in the U.S. According to Curt Blades, Senior Vice President of Industry Sectors and Product Leadership at the Association of Equipment Manufacturers (AEM), “North American row-crop farmers continue to add and adopt new technology to their equipment fleets to help reduce costs and improve yields. The appeal of the newer equipment centers on improved fuel efficiency, better GPS technology, and improved automation features, which is why farmers continue making these investments.”

In the U.S. market, 100+ hp 2WD tractors and 4WD tractors were the only segments to grow y/y. Both those segments, along with self-propelled combines, remain positive for the year. The biggest overall growth among tractors happened in 4WD units, growing more than 20% in August.

- 2WD tractors were down 7.5% y/y for the month of August.

- 4WD tractors were up 21% y/y, although they account for a small portion of the market.

- Self-propelled combine harvesters were down 2% y/y.

In Canada, 100+ hp 2WD tractors were the only growth segment, up more than 5%, staying positive year-to-date, along with 4WD tractors and combines.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

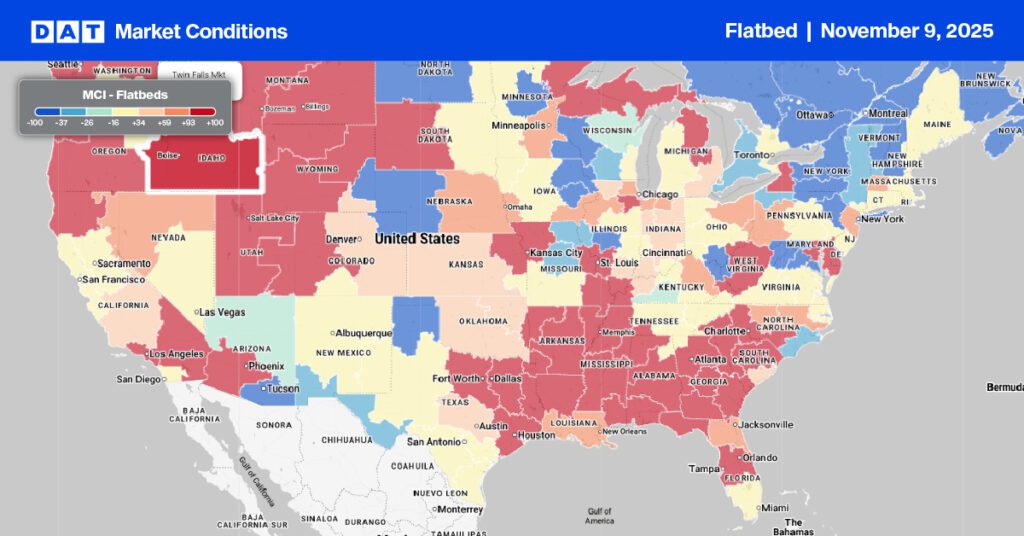

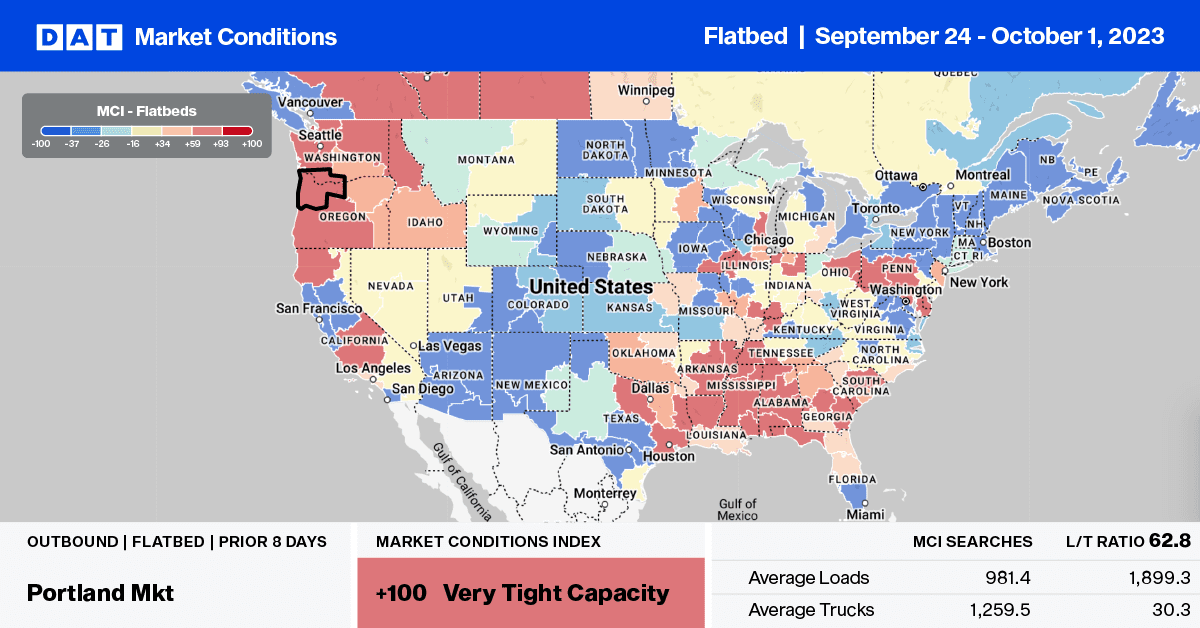

Flatbed capacity continues to tighten in the PNW’s Portland market, where linehaul rates jumped by $0.15/mile to $2.52/mile last week. In the last two weeks, load post volume has increased by 32%, with spot rates increasing by almost $0.50/mile over the same timeframe. Portland to Denver loads paid carriers an average of $2.27/mile, the highest in 12 months, while regional loads to Stockton, CA, also paid carriers $2.27/mile.

At $2.74/mile, Oregon state average rates are the second-highest in eight years, surpassed only by 2018, when rates averaged $0.05/mile higher. In Twin Falls, the second-largest flatbed spot market in the PNW, load posts have increased for the last five weeks, including last week’s 22% w/w gain. Linehaul rates averaged $1.52/mile, up $0.06/mile w/w. Twin Falls to Denver loads paid carriers $2.00/mile last week, almost identical to last year and the highest since May.

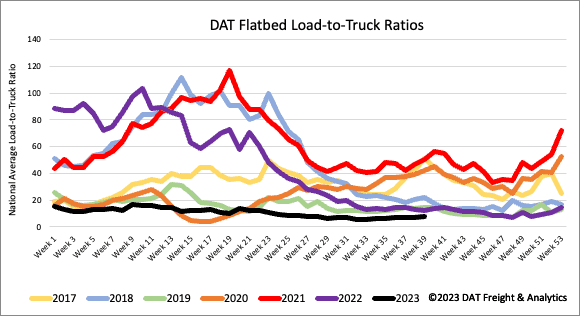

Load-to-Truck Ratio (LTR)

Flatbed load post (LP) volume improved last week, increasing by 7% w/w and 18% m/m. Carrier equipment posts were down by just over 7% w/w again last week, increasing the flatbed load-to-truck ratio (LTR) by 16% w/w to 8.08. After six weeks of gains, last week was the first time the flatbed LTR has been over 8.0 since the end of June.

Spot Rates

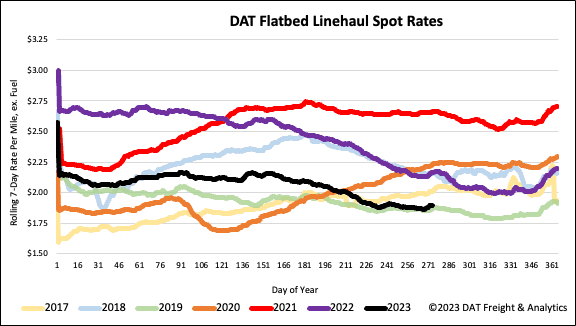

Last week’s flatbed linehaul rates regained the prior week’s losses, increasing by just over a penny per mile to a national average of $1.92/mile, where they’ve been sitting for the last two months. Compared to last year, flatbed spot rates are $0.27/mile lower and only $0.03/mile higher than in 2019.