For flatbed carriers and brokers, Texas has been a strong performer benefiting from the 2022 coastal shift in imports away from the West Coast. At $2.33/mile, excluding fuel, outbound linehaul rates in Texas are at the second-highest level in seven years. They are a direct result of the substantial increase in breakbulk import volumes into the Port of Houston, much of which is destined for oil and gas exploration.

Last year the Journal of Commerce reported that steel generally accounts for an average of 70 to 75% of the port’s total breakbulk volumes. The remaining came from project cargo imports, forest products, heavy machinery, and turbines. According to Dominic Sun, director of trade development for Port Houston, “The energy sector is also anticipating a boost following the federal government’s decision in late March to auction off 1.6 million acres of federal waters in the Gulf of Mexico for exploration.” The number of oil and gas drilling rigs continues to climb and now stands at 878, an increase of around 10% in the last year.

Total breakbulk imports in March were down 1%y/y but up 6% m/m sequentially. The Gulf Coast continues to have the highest volume of breakbulk tonnage, followed by the East and West Coasts. Gulf Coast breakbulk tonnage is up 7% m/m but down 11% y/y as imports slow down seasonally. Houston is ranked first, carrying 27.8% of the total Gulf tonnage volume – tonnage was up 10% m/m but down 18% y/y.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

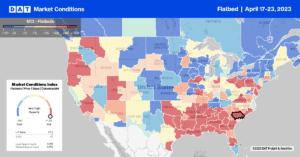

Flatbed linehaul rates in Oregon, at $2.98/mile, were within $0.20/mile of the record-high rates reported in 2021 and 2022 last week. Solid gains were reported in Medford, Or, the region’s largest flatbed spot market – volumes were up 2% w/w, and spot rates jumped by $0.27/mile to $3.00/mile for outbound loads. Medford to Denver loads at $2.03/mile have been around this level for the last five months, while loads to Phoenix have increased by $0.30/mile in the previous month to $2.52/mile.

Flatbed capacity loosened in Texas following last week’s $0.04/mile decrease, the first in three months. At $2.29/mile, average outbound rates are $0.02/mile lower than in 2018. On the West Coast in Los Angeles, spot rates reversed a three-week slide increasing by $0.14/mile to $1.99/mile in 13% higher volume. In nearby Ontario, capacity tightened for the fourth week – outbound spot rates increased by $0.24/mile to $2.26/mile. Ontario to Phoenix loads at $3.36/mile was the highest in seven months and almost $0.60/mile higher than the March average. In the Southeast, a 10% higher volume in Montgomery increased spot rates by $0.16/mile to $2.87/mile.

Load-to-Truck Ratio (LTR)

Flatbed volumes increased for the second week following last week’s 5% w/w increase. Except for 2020, last week’s load post volume was the lowest recorded in seven years. Carrier equipment posts were flat last week but also at the highest level in seven years resulting in last week’s flatbed load-to-truck (LTR) ratio increasing from 11.95 to 12.56.

Spot Rates

At a national average of $2.16/mile, flatbed rates ended Week 16, where they started at the beginning of this year. Flatbed linehaul rates decreased by a penny-per-mile last week, almost $0.50/mile lower than the previous year.