Flatbed report: Texas leads the way in manufacturing and infrastructure investments

According to Goldman Sachs, Texas is the leading state in terms of projects that have broken ground (about 25% of all projects in the US), driven in part by semiconductor plants from major manufacturers. The research firm is tracking over $1 trillion in manufacturing and infrastructure investments that have been announced, including semiconductor plants ($222 billion, or 43%), electric vehicle and battery plants ($114 billion, or 22%), and clean energy projects ($86 billion, or 17%).

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Instead of focusing on announced projects, Goldman Sachs Research looked at individual projects that have broken ground since 2021 to understand the timing of construction schedules and any increased costs. The research concluded “that a subset of announced projects that have already broken ground for construction is on track to be more than $80 billion in 2022 and 2023, compared with around $23 billion per year between 2011 and 2021.”

It’s taken longer than expected for some of these mega projects to translate into equipment orders because of the nature of the work. A typical non-residential construction project takes 18–24 months from breaking ground to the start of production, whereas a semiconductor plant usually takes 36–60 months. According to Goldman Sachs Research, equipment providers should see an uptick in orders from these projects in the first half of this year.

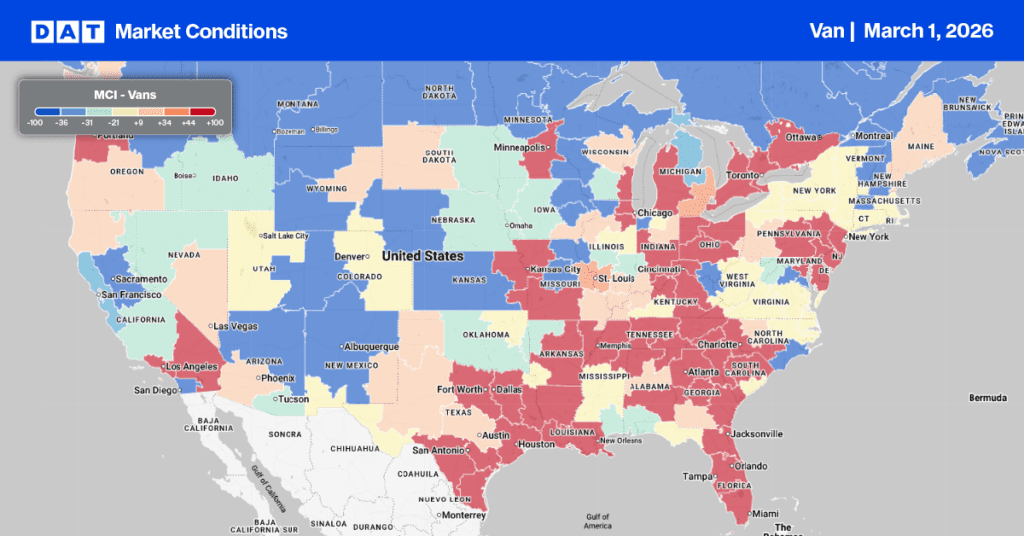

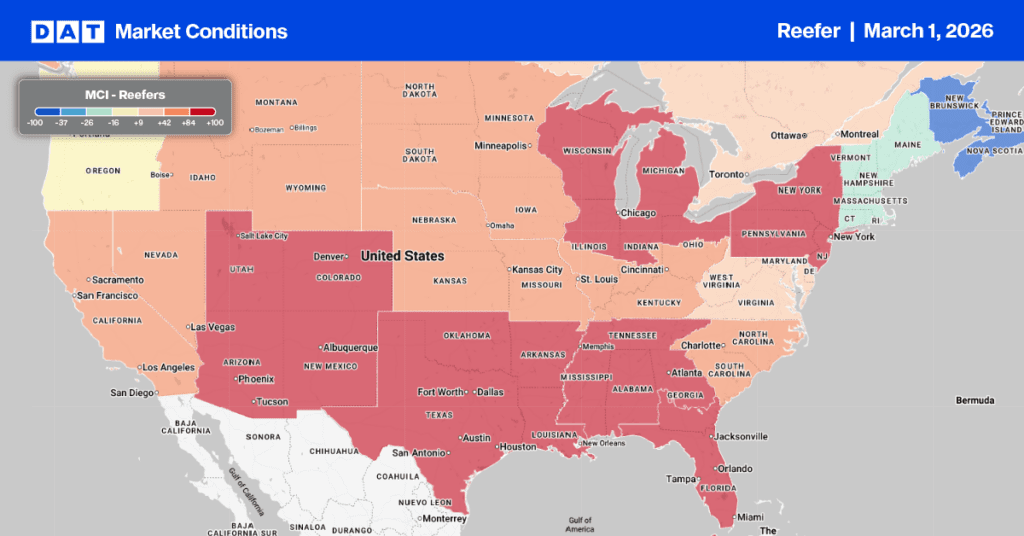

Market watch

All rates cited below exclude fuel surcharges unless otherwise noted.

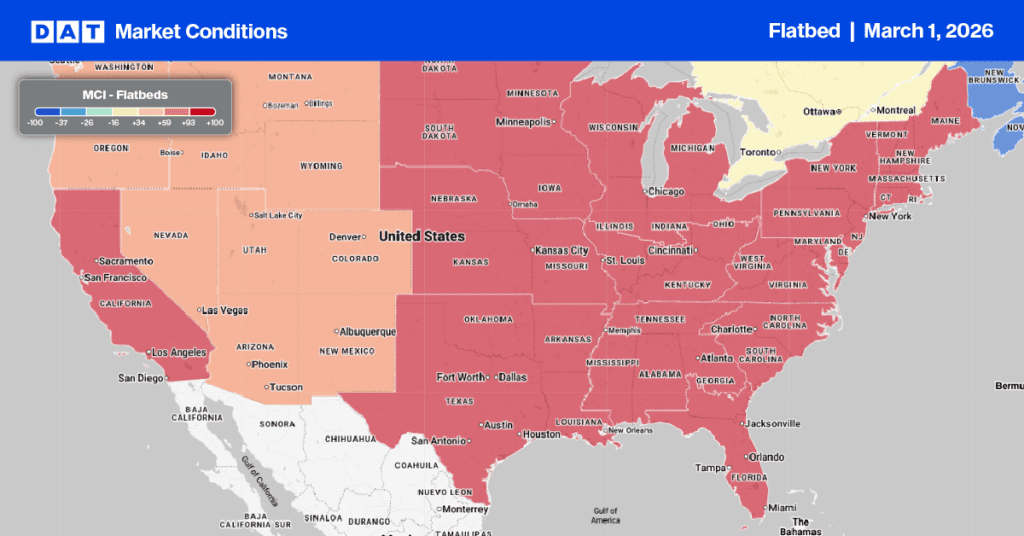

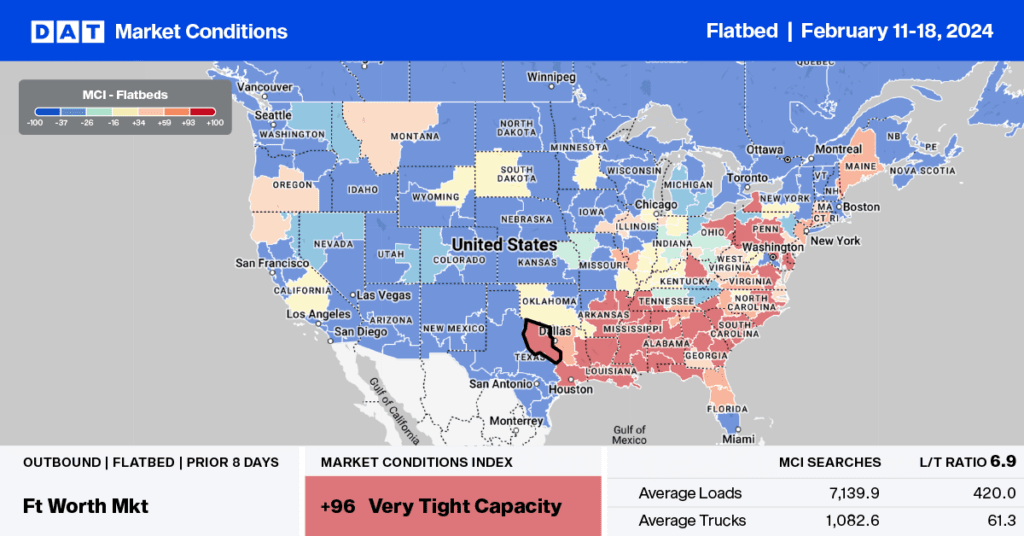

Boosted by investments in manufacturing and infrastructure, Texas’s inbound truckload volumes are around 2% higher than last year. Outbound volumes are 4% lower y/y, contributing to excess outbound flatbed and dry van capacity. Inbound flatbed rates have been around $2.00/mile since the start of the year but around $0.18/mile lower than last year—Houston to Ft. Worth, one of the busiest flatbed lanes in the country, paid carriers an average of $2.17/mile last week, the lowest in 12 months.

Carriers reported solid gains in the Atlanta flatbed market last week, where linehaul rates increased by $0.10/mile to $2.14/mile. On the top spot market lane south to Lakeland, FL, Atlanta outbound carriers were paid an average of $2.46/mile last week, the highest in six months. Across the Southeast Region, flatbed capacity has been steadily tightening on higher volumes since mid-November – spot rates have increased 2% in the last month while truckload volumes have jumped by 30% over the same timeframe.

Load-to-Truck Ratio (LTR)

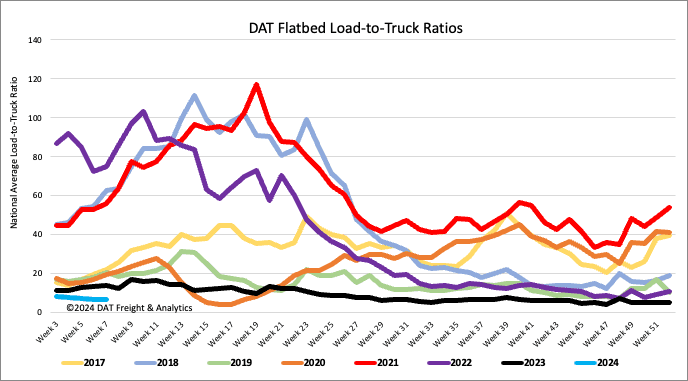

After dropping for the sixth straight week, flatbed load post (LP) volumes were the lowest in eight years following last week’s 9% decrease and 59% lower than last year. Carrier equipment posts (EP) were also down, resulting in last week’s load-to-truck ratio decreasing by 2% to 6.62, the lowest flatbed LTR recorded since 2017.

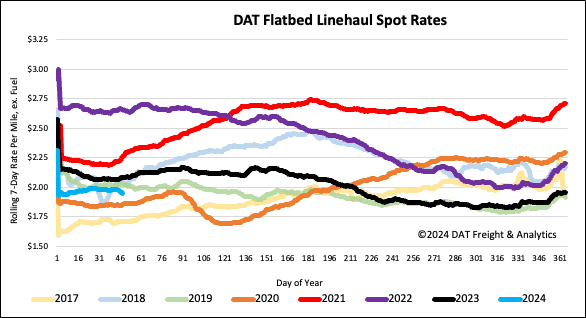

Spot rates

Flatbed spot rates decreased for the third week following last week’s $0.02/mile decrease. At $1.97/mile, the national average is around $0.13/mile lower than last year and $0.09/mile lower than in 2018 and 2019.