Although the flatbed and specialized carriers market is past peak season, imports of tractors, agricultural machinery, and garden equipment are down 17% y/y and trending close to 2021 levels according to the latest data from IHS Markit. Baltimore is still ranked number one, handling 18.3% of the total tonnage with July volume up 19% y/y and up 34% YTD. Savannah is ranked second with 11.6% of total tonnage. Baltimore is still the primary port for imported agricultural machinery volume and is experiencing its highest tractor volume year in the past five years. Volumes are up 33% year-to-date (YTD) and 11% y/y.

On the domestic side, self-propelled combine sales continued to increase in the U.S., but total farm tractor unit sales in the U.S. and Canada declined in July, according to the latest data from the Association of Equipment Manufacturers (AEM). According to Curt Blades, senior vice president at the association, “We’re still seeing moderate growth in the traditional agricultural market that has shown a steady rise all year in North America. The softness in the compact and sub-compact tractor market in both the U.S. and Canada is something we have been experiencing for some time after record growth in the segment during the recent pandemic.”

The AEM reports total farm tractor sales in the U.S. fell 5.2% for the month versus July 2022 and are down 9.1% YTD. For specialized drop-deck carriers, combine sales were up 10.6% y/y and up 41.2% y/y, while 4WD tractors were up 1.2% y/y and 36.2% y/y.

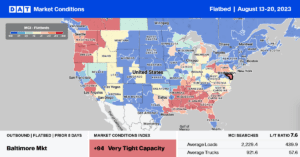

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

In Portland, the largest flatbed spot market in the Pacific Northwest, capacity tightened last week following last week’s $0.16/mile increase to $2.49/mile. Loads south to Stockton paid carriers $2.30/mile, while loads to Denver and Phoenix paid $2.11 and $1.96/mile, respectively.

Flatbed carriers were in solid demand along the southern border in Laredo, with spot rates jumping by $0.24/mile to $2.01/mile. In the sizable steel-producing market of Gary, IN, flatbed spot rates increased by $0.10/mile to $2.47/mile last week.

In Miami, flatbed capacity was unusually tight last week — spot rates surged, increasing by $0.46/mile for northbound loads to an average of $2.20/mile. State-level Florida rates are still around 2019 levels at $1.57/mile. In Montgomery, AL, outbound rates paid carriers $2.44/mile following last week’s $0.16/mile increase, while in nearby Birmingham, spot rates were up a penny per mile to $2.38/mile.

Load-to-Truck Ratio (LTR)

Flatbed spot market volumes continue to fall following last week’s 22% w/w decline. To give you a sense of just how soft the flatbed market is, last week’s spot market volume was around 25% of what it was this time in 2018, a year considered very good for flatbed demand. Carrier equipment posts were also down, resulting in the flatbed load-to-truck ratio (LTR) decreasing slightly from 5.51 to 5.45, the lowest in the previous six years.

Spot Rates

At $1.92/mile, the national average flatbed spot rate is $0.38/mile lower than last year and only $0.07/mile higher than in 2019. Since this year’s high of $2.16/mile (recorded in the first week of June), flatbed spot rates have been on a steady downhill run, dropping $0.24/mile since then.