Economic activity in U.S. manufacturing closed 2025 on a weak note, with the ISM Manufacturing PMI slipping to 47.9 in December, marking the tenth straight month of contraction and the lowest reading of the year. The New Orders Index remained in contraction at 47.7, while backlogs also stayed below 50, signaling that factories are not replenishing pipelines and are instead working through limited demand. For flatbed carriers, that combination points to softer 2026 truckload demand in core industrial verticals like metals, machinery, fabricated products, and construction inputs, as shippers trim production schedules and run plants below capacity.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

From a flatbed perspective, the ongoing contraction in new orders and weak employment readings suggest fewer project starts and capital-spending moves that normally generate heavy-haul and open-deck freight, particularly in structural steel, building materials, and industrial equipment. With customer inventories still described as “too low” but not yet translating into sustained order growth, the first half of 2026 is likely to resemble a grind: shorter lead times, more spot freight tied to fill-in orders, and increased pricing pressure as carriers compete over a smaller pool of loads. Flatbed fleets that are most exposed to discretionary industrial and construction projects may see the deepest demand headwinds, while those with diversified books—energy-related, infrastructure tied to public funding, and niche manufacturing and data center construction—will be better positioned to ride out the manufacturing slowdown until new orders move back into consistent expansion territory.

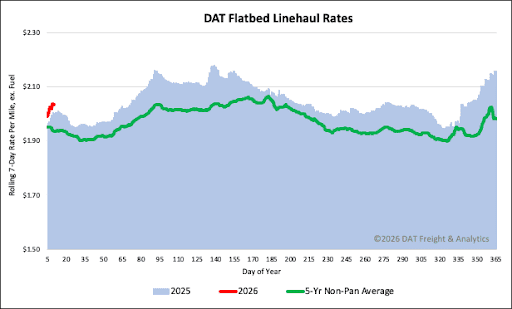

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted. The rate charts exclude 2021 and 2022, years influenced by the pandemic.

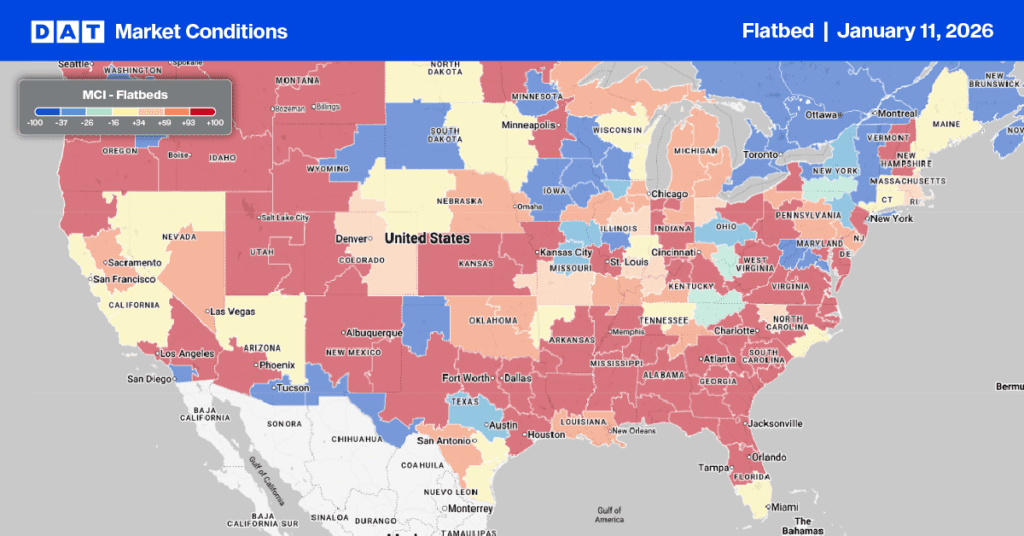

Flatbed load post volumes were almost double the volume compared to the same week last but much closer to the 10-year average for Week 2 on the shipping calendar. The national flatbed load-to-truck ratio ended the week at 44.07 resulting from a tightening of available capacity and whilst national average linehaul spot rates did not reflect it, regional spot rates and load post volumes did.

In the southeast for example, spot rates were up $0.09 per mile last week, paying carriers an average of $2.57 per mile while load post volumes more than doubled across the region. Excluding the record-setting rates witnessed in 2022, the Southeast is starting the year with the highest flatbed linehaul rates seen in a decade.

The national average spot rate for flatbed carriers settled at just over $2.18 per mile last week, holding steady after five consecutive weeks of increases. This current national average rate marks a significant year-over-year increase, sitting $0.17 per mile (about 8%) higher than the rate recorded during the same period last year. Furthermore, it exceeds the 5-year average (excluding pandemic-influenced years) by $0.23, an increase of 11%.