The pandemic has driven consumers to shift purchases to online retail. This continues to drive demand for warehouse space as businesses retool their supply chains, especially in booming freight markets like Phoenix, AZ.

Phoenix was named the top growth market in North America for large-warehouse leasing activity by CBRE, with 9.1% of its inventory absorbed in 2020. Transaction activity reached a record level for big-box warehouses (200,000 square feet or larger). This was caused by user demand that was stoked by growth in online shopping and retailers stockpiling inventory due to the pandemic.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Phoenix was also a top 10 overall transaction activity market. It has 13 million square feet of transactions in this category with an additional 8.3 million square feet of big-box space under construction.

“[Phoenix is] strategically located with the ability to quickly reach consumers across the western U.S.,” says CBRE Executive Vice President Joe Cesta. “It benefits from occupiers and residents leaving more challenging regulatory environments in coastal states, and Phoenix is forecast to lead the country in rent growth over the next five years.”

For Phoenix, this may help explain the increasing inbound dry van volumes in the last year, which was driven by a staggering volume of imported e-commerce freight from overseas via the Ports of Los Angeles and Long Beach.

Shifting freight volume patterns

The most recent Logistics Manager Index (LMI) reports warehouse capacity continues to oscillate. April registered 41.8% capacity, which is the eighth consecutive month below 50%.

Previous predictions from the LMI reports indicated a major change from the pre-COVID days to the present. New data suggests that the consumer demand for e-commerce — resulting in higher warehouse demand — appears only to be growing. This reflects the contraction in this space.

For carriers and brokers looking to identify shifting patterns in both inbound and outbound freight volumes, they need to look at the Q121 Industrial Market Outlook report by Colliers International. It has identified the largest and fastest growing warehouse markets.

Atlanta, Dallas, the Inland Empire in Southern California, Chicago, Phoenix and Columbus, OH, rounded out the top markets for occupancy gains in Q1 of 2021. Each market posted more than 5 million square feet of positive absorption (the total new square footage leased by tenants) during the first three months of the year. Phoenix was also one of the top 26 markets to post positive occupancy gains in the first quarter.

Only five industrial markets posted negative absorption, including Milwaukee, WI; Huntsville, AL; and Norfolk, VA.

Emerging markets to watch

“Markets experiencing the most activity growth (absorption as a percent of inventory) include emerging markets such as Salt Lake City, Stockton, Columbus and Savannah,” noted the Colliers International report. “Demand for logistics and distribution space, primarily fueled by e-commerce occupiers, supports the strong growth seen in these cities.”

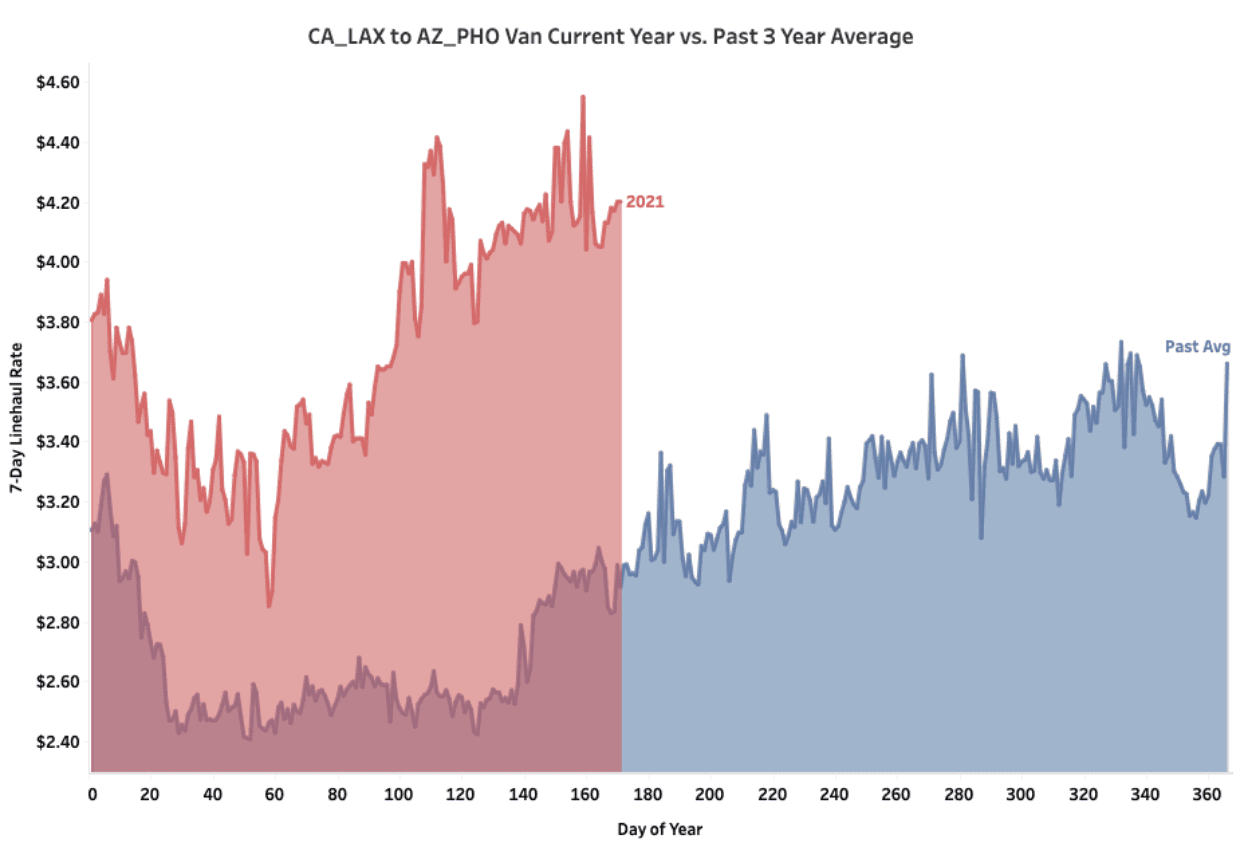

Carriers still consider Phoenix a backhaul market. The market averages 41% more inbound spot market loads compared to outbound loads. But with the influx of e-commerce freight volume on the I-10 between Los Angeles and Phoenix, spot rates have jumped in the last 12 months. Spot rates are currently at $4.20/mile, which is $1.16/mile higher than the three-year average on this 372-mile haul.