Van volumes got a bit of a boost late last week. Three of the most important van markets — Chicago, Dallas, and Los Angeles — all showed increased load counts. In Los Angeles, the load-to-truck ratio went from 1.8 on Tuesday to 4.1 loads per truck on Friday, signaling that import traffic has resumed shipping eastward.

Increased volumes did not translate into higher rates, however. In the top 100 van lanes last week, rates rose in only one-third of the lanes. Usually there’s a lag between volume increases and rate increases, so we may see rates stabilize or rise next week. The national average van rate for October so far stands at $1.81/mi., which is 3¢ lower than the September average.

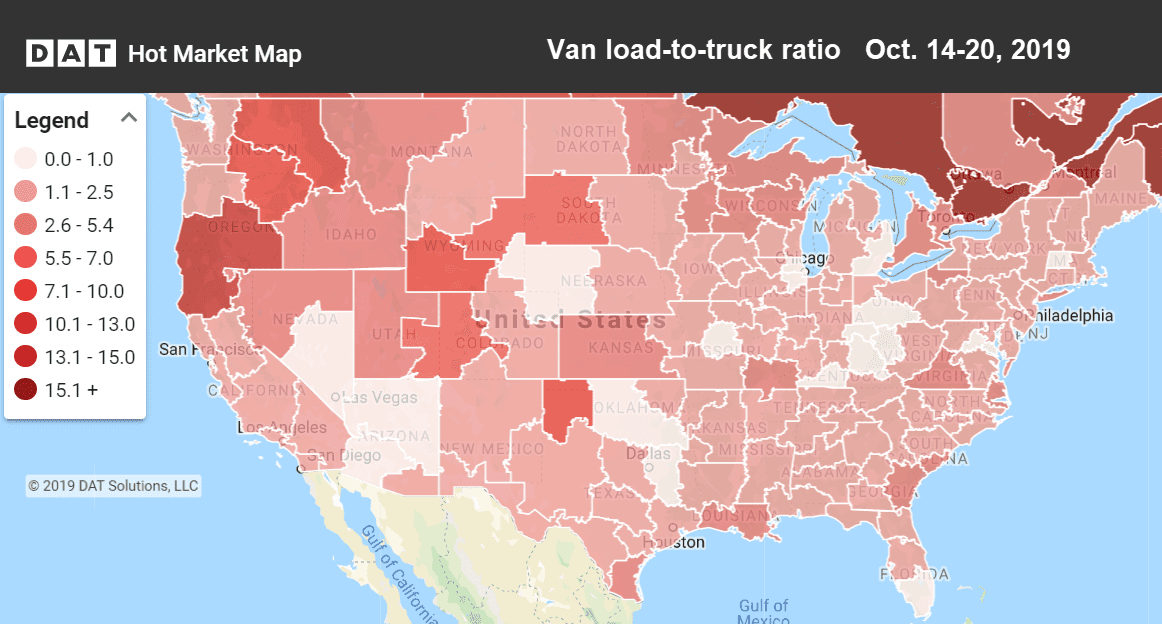

High load-to-truck ratios were seen in several western markets last week. Hot Market Maps show the number of available trucks vs. available loads and are available in the DAT Power load board and DAT RateView.

Rising markets and lanes

On average, rates rose from Seattle and Philadelphia last week. Seattle has been one of the few markets to see prices rise over the past month.

- Seattle to Salt Lake City increased 7¢ to $1.94/mi.

- Seattle to Los Angeles moved up 6¢ to $1.36/mi.

- Portland, OR to Stockton, CA, added 5¢ to $1.53/mi.

Falling markets and lanes

Average rates coming out of Columbus, OH fell last week and have been dropping the entire month of October. Freight volumes in Columbus increased more than 15% last week, so things could turn around soon.

- Buffalo to Allentown, PA slipped back 11¢ to $3.05/mi.

- Columbus to Atlanta fell 12¢ to $1.93/mi.

- Stockton to Portland dipped 9¢ to $2.48/mi.