U.S. Bank recently published its quarterly Freight Payment Index, which represents freight shipping volumes and spend on national and regional levels. The report indicated a softening in the freight market in the first quarter of 2021.

Like many economic indicators, the U.S. Bank indices were impacted by the sharp downturn in activity during the third week of February when the Polar Vortex gripped the nation. The freight spend index dropped 4.7% in Q1’21 compared to Q4’20. The shipments index also reported a decrease of 8.3% in Q1’21 and 5.4% year-over-year.

All regional shipment indexes posted declines this quarter:

- Midwest: -10.9%

- West: -10.2%

- Southwest: -6.4%

- Southeast: -5.8%

- Northeast: -5.8%

“Household spending power is strong heading into the spring and summer as much of the population received the government stimulus,” the report noted. “Additionally, household savings are up significantly over the past year. Factory output is expected to increase, and home construction should remain strong, both leading to rising freight volumes on top of solid retail sales.”

Find loads and trucks on the largest load board network in North America.

All rates exclude fuel unless otherwise noted.

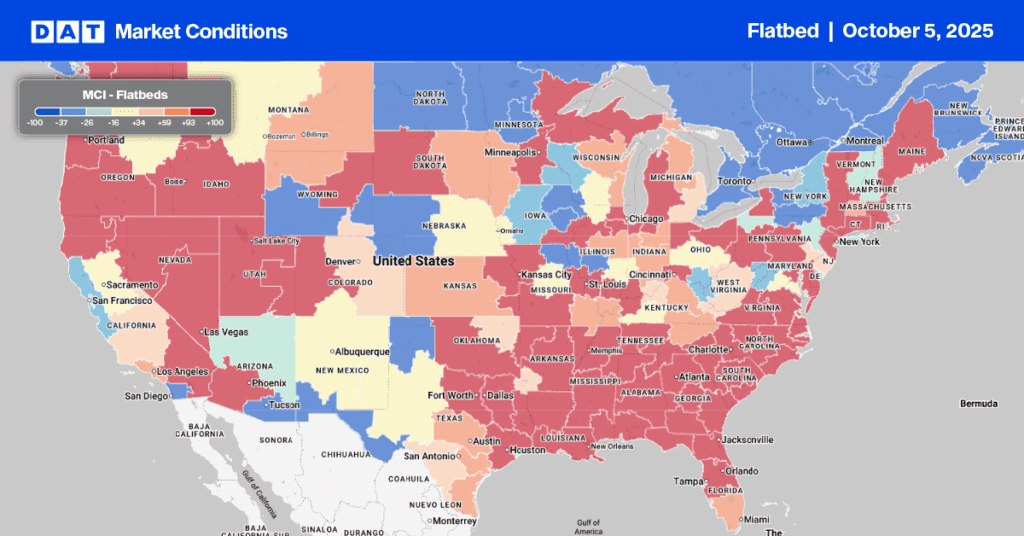

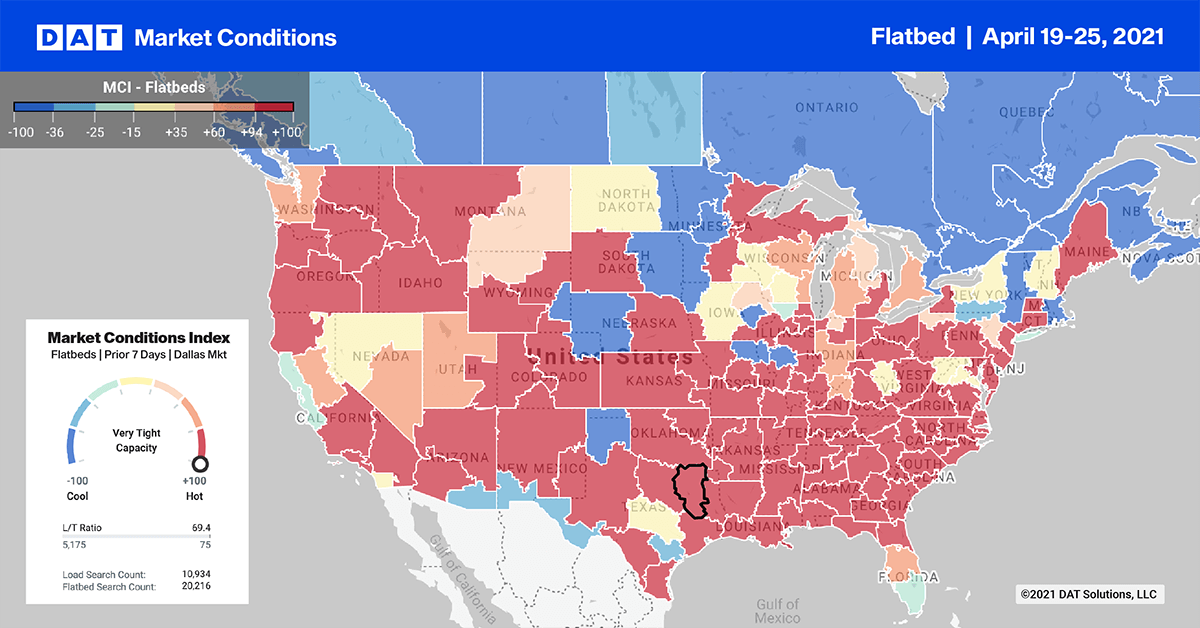

The flatbed sector remains unseasonably tight even though load posts in the top 10 markets dropped 2% last week. Top 10 spot rates dropped $0.08/mile to an average of $3.27/mile, which is still $0.69/mile higher than the all-market average of $2.58/mile.

- Little Rock, AR, had very tight capacity, with spot rates jumping $0.23/mile to $3.44/mile

- Montgomery, AL, volumes increased by 7%, but capacity eased following a $0.59/mile drop in spot rates to $4.15/mile

After being flat for the last 12 months at around $2.10/mile, spot rates on the 1,500-mile haul from Houston to Los Angeles jumped last week to $2.72/mile and were as high as $3.24/mile for top-paying loads. Rates on the return trip to Houston were also up, averaging $1.97/mile last week making the roundtrip rate around $2.34/mile.

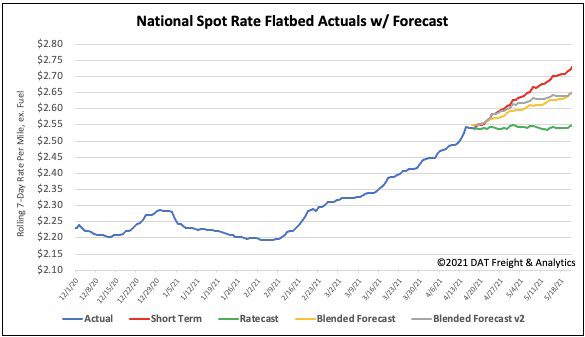

Spot rates forecast

Flatbed spot rates continued to climb last week, moving up by another $0.03/mile to $2.58/mile. Spot rates are now $0.89/mile higher than the same week last year, $0.28/mile higher than the same time in 2018 and have increased by $0.39/mile since the start of this year.

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset

- Blended Scenario: More heavily weighted towards the longer-term models

- Blended Scenario v2: More heavily weighted towards the shorter-term models