The surge in data center construction over the past several years has become a significant driver of flatbed truckload demand in the U.S. Freight brokers and specialized carriers have noted an uptick in oversized loads, many destined for new or expanding data centers in remote areas. This may well explain why the flatbed spot market has performed so well while the flatbed contract market has been more sub-seasonal in comparison.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

For flatbed carriers, the data center boom represents a much-needed diversification and growth opportunity. According to Census data, data center construction spending is now running at a pace of roughly $41B per year, up more than 200% since the launch of ChatGPT. As agricultural machinery, oil, and traditional construction sectors experience cyclical slowdowns, data centers have helped stabilize fleet utilization and rates, providing a strong foundation for the segment heading into 2026.

Flatbed market watch

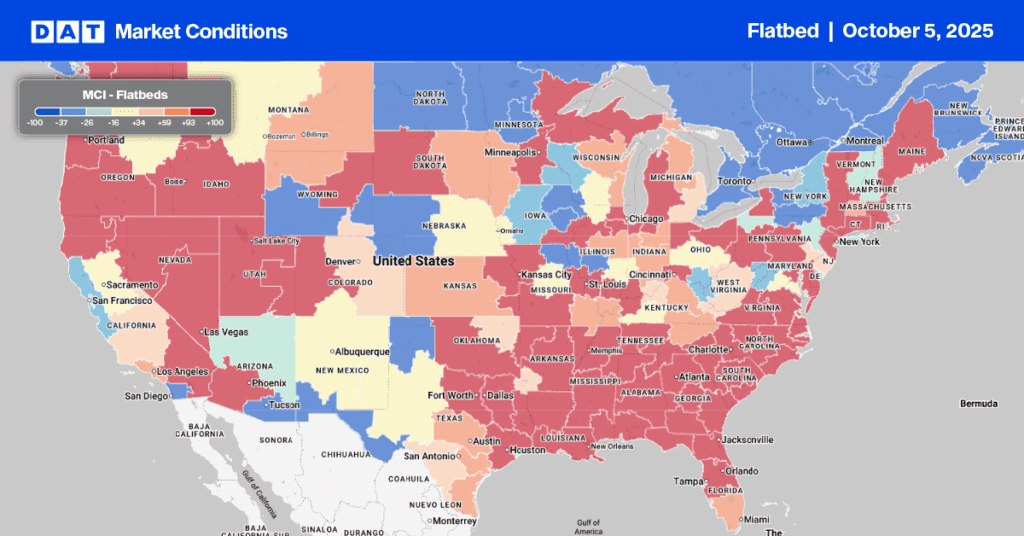

Last week, the flatbed load-to-truck ratio climbed to 30.02, as flatbed load posts remained relatively stable while equipment posts decreased by 5%. Brokers reported significant capacity constraints along the southern border, particularly on the high-volume Laredo to Houston lane, where load posts jumped by nearly 30%. Laredo, the busiest inland port in the United States for truck traffic, handles more commercial truck crossings than any other port of entry and is most affected by ongoing Immigration and Customs Enforcement (ICE) activities.

Laredo to Houston spot rates jumped $0.12 per mile to almost $3.00 per mile last week on a 17% lower volume of loads moved, while loads to the Dallas-Ft Worth Metroplex rose $0.03 per mile, paying carriers an average of $2.62 per mile. In Miami, load posts increased by 24% week over week; outbound spot rates rose by $0.08 per mile on a 16% lower volume of loads moved. Inbound spot rates also increase by $0.03 per mile and by $0.04 on the top lane from Atlanta to Miami.

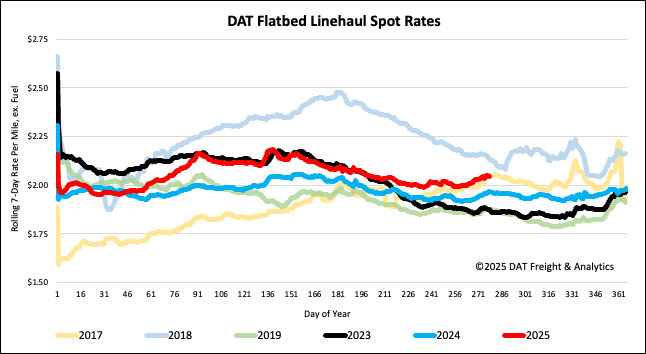

National flatbed spot rates

Flatbed rates experienced a modest increase last week, rising by just under a penny to $2.07 per mile. This current rate is $0.08 higher than last year and $0.17 higher than in 2023. Notably, the 2025 spot rate continues to track closely with 2017, a year marked by a strong industrial economy for flatbed carriers. We are carefully observing this trend, as its consistency suggests more than mere coincidence. We believe the ongoing AI-driven data center construction boom is likely a significant factor in the heightened demand for open-deck carriers in the spot market.