The oil and gas exploration industry, particularly in West Texas, is a significant demand driver for flatbed carriers, as this region accounts for 44-46% of all U.S. drilling rigs. The Permian Basin, with the highest concentration of drilling rigs in the country, requires substantial amounts of drilling pipe and oil well casing. However, active drilling rigs in the Permian Basin have decreased by approximately 15% over the past year, dropping from over 300 at the beginning of 2025 to around 255 by late summer, reaching the lowest level since late 2021.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

This decline in rig counts has directly impacted flatbed carrier demand for specialized loads such as drill pipe and casing, which are highly correlated with rig activity. Consequently, trucking demand for new pipe deliveries to drilling sites has softened due to fewer wells being drilled. While other energy sector activity and construction regionally support overall flatbed demand, spot market volumes for pipe and oilfield steel in the West Texas oil patch have decreased. As a result, flatbed carriers heavily reliant on new-well drilling, particularly those involved in drill pipe, casing, and rig mobilization work, have experienced a 6% reduction in truckloads in 2025. Despite this, spot rates are averaging $2.60/mile, which is $0.12/mile higher than the previous year.

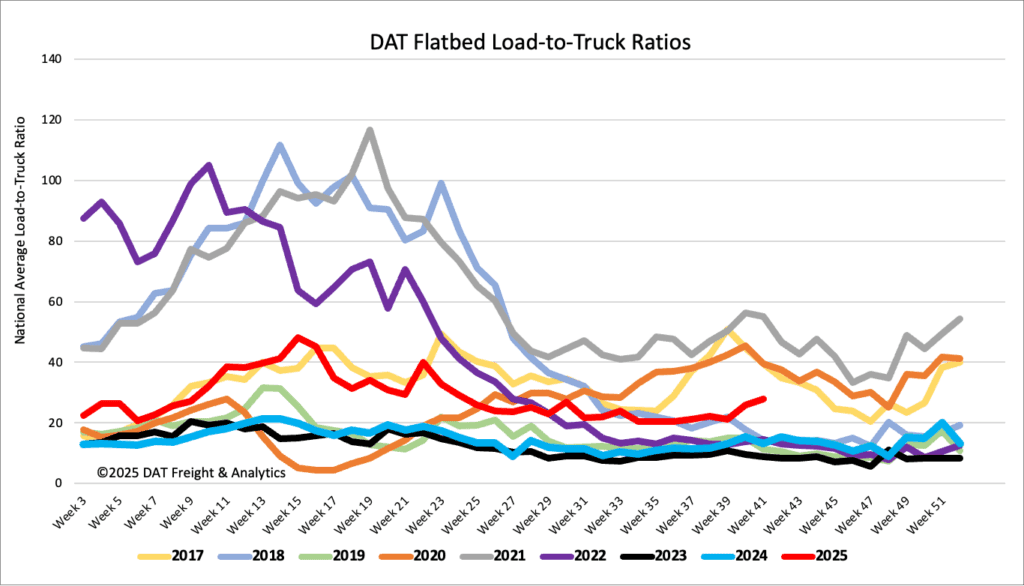

Load-to-Truck Ratio

Flatbed load posts saw a 1% decrease last week after three weeks of increases, while carrier equipment posts dropped by 8%. As a result, the flatbed load-to-truck ratio rose to 27.97.

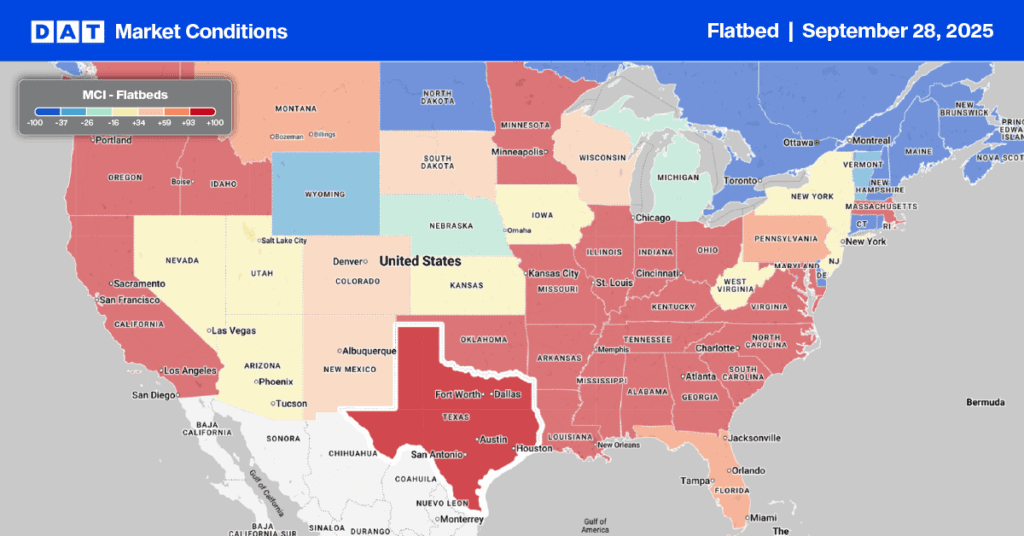

In the Southeast Region, Birmingham experienced a 17% increase in load posts last week, with an average load-to-truck ratio of 17.4. Outbound spot rates climbed by $0.05 per mile to $2.59 per mile, which is $0.13 higher than last year. However, capacity loosened on the top volume lane to Lakeland, FL, causing spot rates to fall by $0.06 to $2.73 per mile.

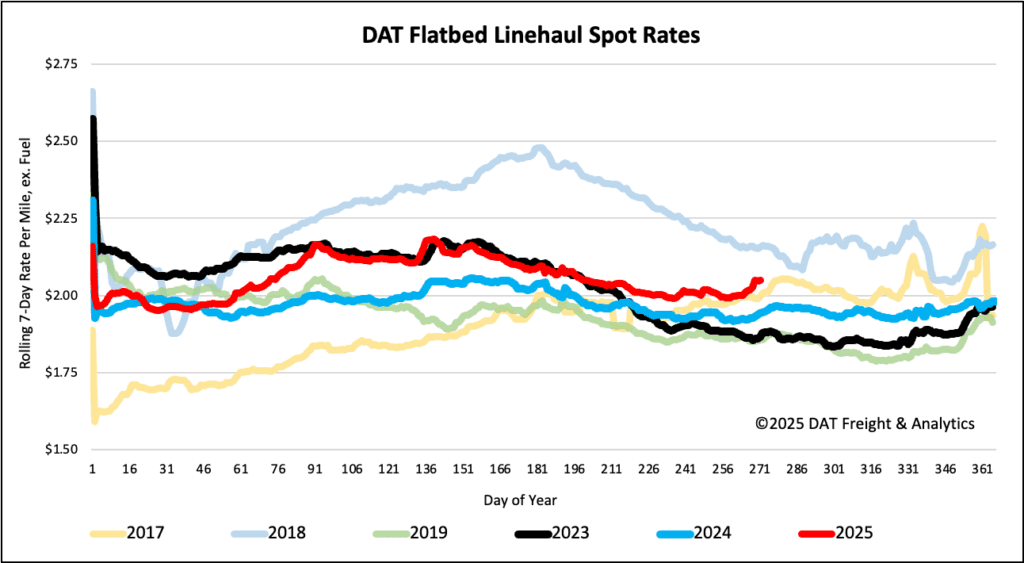

Spot rates

Flatbed rates saw an increase of nearly two cents per mile last week, reaching just over $2.06 per mile. This rate is now $0.11 higher than last year and $0.18 higher than in 2023. It also maintains a $0.05 per mile lead over 2017, a year characterized by a robust industrial economy for flatbed carriers. We are closely monitoring this trend as it appears to be more than coincidental.