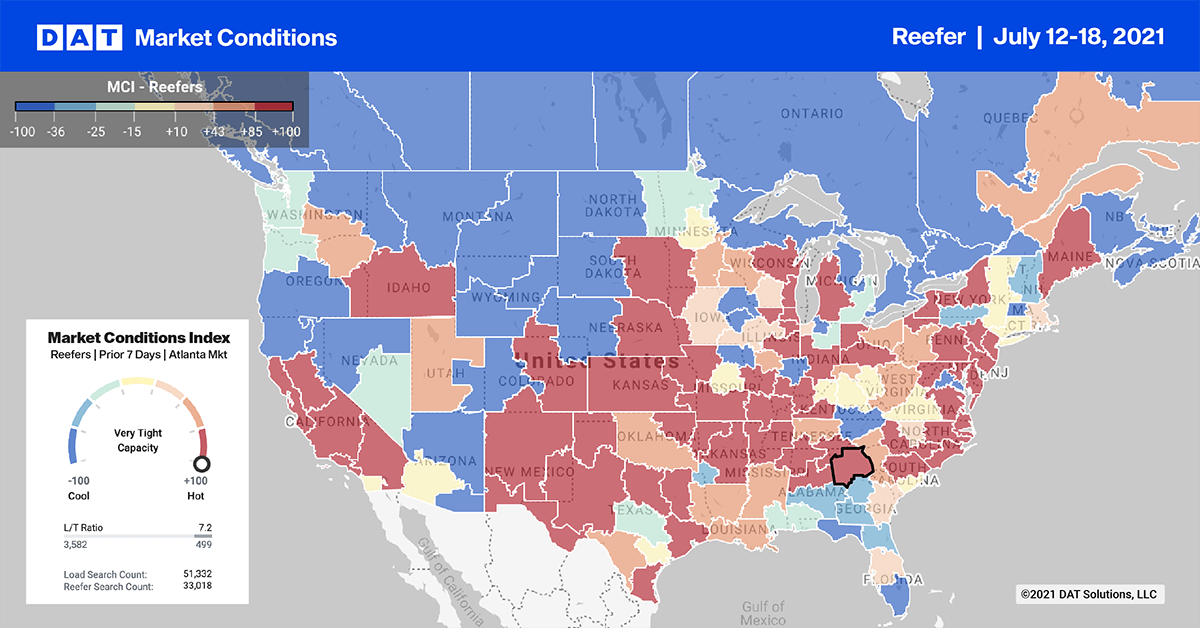

Truckload capacity eased last week following the surge in produce volumes leading up to the July 4 long weekend. According to the USDA, domestic and imported truckload produce volumes dropped 15% last week and are now down 3% year-over-year. This is the equivalent of 1,600 fewer weekly loads compared to this time last year.

Only four produce regions reported a shortage of trucks compared to six the week prior:

- South Georgia: sweet corn

- Southeast Missouri: cantaloupes and watermelons

- South Carolina: cantaloupes and watermelons

- Eastern North Carolina: sweet potatoes

Weekly produce volumes will typically drop by around 21% between now and Thanksgiving. So we’re on track seasonally to see lower truckload volumes in the reefer sector, even though some produce regions are still to begin harvesting.

Imported produce market

While the peak season is behind us, Mexico contributes 92% of volumes across the southern border. Close to one third of all volume continues to cross in the McAllen, TX market followed by 26% in Nogales in the Tucson market.

The top southern product import commodities are:

- Tomatoes at 14%

- Avocados at 9%

- Peppers at 7%

Our northern border receives 8% of imported produce volumes. The top northern produce import markets are:

- Detroit, which accounts for 38% of truckload volume

- Houlton, ME, has 15% of truckload volume and receives the majority of Prince Edward Island’s potatoes to the U.S.

Potatoes make up 37% of produce volume from Canada, followed by cucumbers (15%) and tomatoes (14%).

Find loads and trucks on the largest load board network in North America.

Note: All rates exclude fuel unless otherwise noted.

It’s Beer Week in Omaha, NE,where more than 50 different breweries, craft beer bars, restaurants and hobby shops celebrate the industry. Inbound reefer spot rates from Chicago, the beer capital of the U.S. are at $3.10/mile this week. This is slightly lower than the 12-month high.

Out west in Denver, which is the state with the second highest number of breweries, reefer rates have increased by $0.25/mile in the last few weeks to reach $1.94/mile.

From Chicago to Atlanta, reefer rates surged last week increasing by $0.31/mile to $3.71/mile. Further north in Green Bay, reefer rates to Minneapolis spiked by $0.54/mile to $3.34/mile after averaging $2.70/mile since last November.

In Florida where peak produce season is in the rearview mirror, reefer spot rates from Lakeland to Baltimore have cooled off rapidly. Rates have dropped by $0.97/mile to $2.26/mile since the peak in May at $3.23/mile.

Further south in Miami, spot rates have dropped even further. On the 664-mile run to Atlanta, rates are down $1.18/mile since the $2.79/mile peak, also in May.

Spot rates

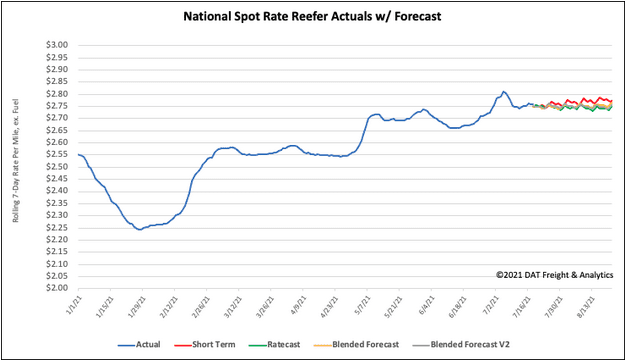

After dropping by $0.05/mile the week prior, reefer spot rates dropped another $0.02/mile last week to an average of $2.76/mile. Spot rates are still 26% or $0.71/mile higher than this time last year and $0.24/mile higher than this time in 2018.

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset

- Blended Scenario: More heavily weighted towards the longer-term models

- Blended Scenario v2: More heavily weighted towards the shorter-term models