Reefer carriers are feeling the pain of coronavirus-related closures, as volume and rates declined sharply for reefer equipment in the past two weeks.

Restaurants and cafeterias are closed nationwide, with some exceptions for takeout and drive-up service. Shutdowns of commercial food-service locations, including at schools and universities, airports, a big segment of refrigerated shippers and their freight, even as grocery stores continue to replenish inventories at an accelerated pace. Schedules are scrambled and routes are disrupted.

That would usually create favorable conditions for spot market participants, but the absence of all that food service cargo means there’s a huge number of shippers and consignees that are inactive. The carriers who served those customers are now looking for new loads, so there are more trucks available to haul for supermarkets and big-box stores. Of course, the competition drives rates down. So here we are.

Market conditions improve in South Texas and South Florida

Luckily for reefer carriers, there are still some markets where conditions are improving, and rates may start to rise soon. That’s because more fresh produce is coming into season, just as other refrigerated foods are still being re-supplied to grocery stores at a more normal cadence.

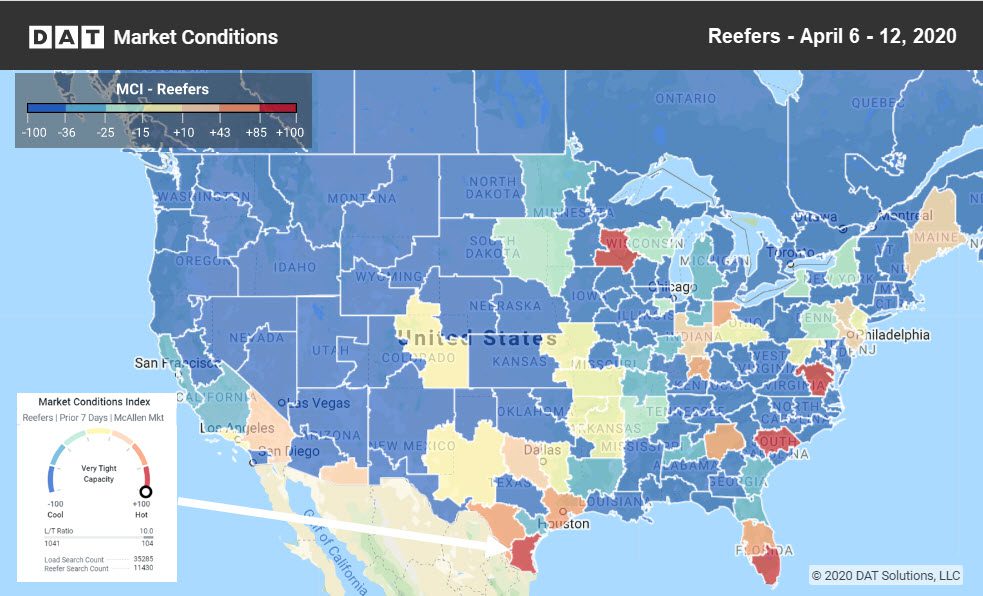

Market conditions were favorable to reefer carriers in McAllen, TX, and a few other metro areas last week, as seen in the new map and gauge features of DAT RateView and DAT Power.

Produce season bolsters rates to some degree, but for now, lane rates are trending down all over the country. Of the top 78 high-volume reefer lanes that we track every week, only one got a rate increase last week compared to the week before: Denver to Houston rose 3¢ last week to an average of $1.87.

There were more hot markets last week for reefers than for vans. McAllen, TX and Miami, FL were the two standouts, with high load posts and truck searches by brokers, and high load-to-truck ratios – McAllen was 10.1 and Miami at 7.1. Remember the national average was 2.6, so those ratios are pretty high. You’d expect rates to rise there, but it didn’t happen last week.

Loads are plentiful in some markets, but rates slip lower

There’s still plenty of reefer freight to be found in the Mexican border markets of McAllen and Tucson, but rates dropped lower last week. We’re talking about a lot of the same lanes where rates dropped two weeks ago – and they fell some more last week.

- Tucson to Los Angeles dropped 26¢ to $2.18 per loaded mile. Rates also declined in double digits from Tucson to Dallas, to New York City, and to Chicago.)

- McAllen, TX, to Atlanta lost 29¢ to $2.16, after dropping 20¢ in the previous week. Lane rates also dropped from McAllen to Elizabeth, in Northern New Jersey.)

- Twin Falls, ID, to Phoenix lost 26¢ to $2.04, and rates fell in double digits from Twin Falls to Baltimore, to L.A., and to Chicago.

- Miami to Elizabeth, NJ, dropped18¢, to $1.72 per loaded mile.

This is not happy news, but the current situation won’t last forever. Businesses will re-open, and life will gradually return to something approaching normality. Meanwhile, hang in there, stay safe and keep up those hand-washing and social-distancing habits. We’re in this together, and we’ll get out of it together, too.