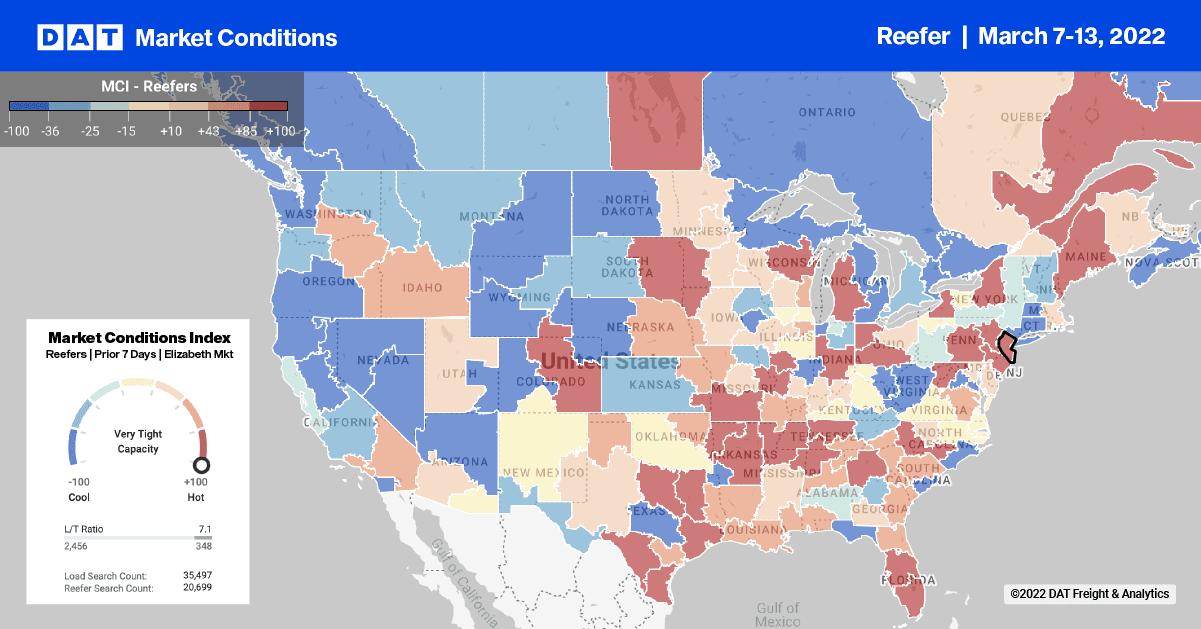

Truckload capacity has been tight in Central and South Florida in the last few weeks as the region transitions from Winter vegetables (lettuce, peppers, tomatoes, and celery) to Spring fruits including strawberries and blueberries. Nationally, potatoes are the number one commodity being moved this week (3,200 truckloads) followed by apples (2,600 truckloads) and onions (1,500 truckloads). Strawberries rank third at approximately 1,300 truckloads per week with the bulk coming from Florida (42%) and Mexico (40%) followed by California (19%) growers, according to the USDA.

The upcoming produce shipping season is also just around the corner. Once we get into April, we’ll be at the starting line for the 2022 produce season, which begins domestically in Georgia and parts of South Carolina. In the interim, reefer carriers will be kept busy in the southern tier of the country, especially in Lakeland, Florida, and McAllen, Texas where imports from Mexico start arriving in greater quantities.

Reefer capacity tightens in Florida, where spot rates have increased for the last three weeks. Outbound rates averaged $2.07/mile excl. FSC previous week followed a $0.14/mile w/w increase in spot rates and a 10% w/w increase in load post volumes. Reefer rates jumped by $0.34/mile last week to $2.78/mile excl. FSC for loads from Miami to Baltimore and by almost the same amount top Hunts Point, NY where rates averaged $2.83/mile excl. FSC.

Further west in the Rio Grande Valley in southern Texas, capacity tightened as Mexico’s production imports continued to increase. In the McAllen market, reefer rates increased by $0.10/mile last week to an average outbound rate of $2.99/mile excl. FSC, while nearby in Laredo, rates averaged $2.94/mile excl. FSC last week.

Loads from Pharr, TX to Hunts Point in New York City averaged $3.13/mile excl. FSC last week was $0.40/mile higher than this time in 2021, and according to DAT’s Ratecast, spot rates are projected to end March around $0.16/mile higher at $3.29/mile excl. FSC before peaking at $3.49/mile excl. FSC in June. Loads west to Phoenix were up by $0.42/mile last week to an average of $2.81/mile excl. FSC while loads to Los Angeles were up by $0.54/mile to an average of $2.49/mile excl. FSC. Compared to this time last year, loads between Pharr and Los Angeles are now $0.74/mile higher. For loads east on the 1,300-mile haul to Orlando, spot rates were flat at $3.29/mile excl. FSC but remain almost $0.50/mile higher y/y.

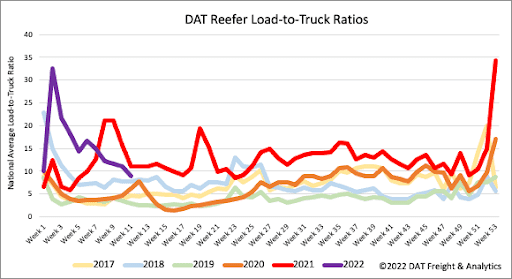

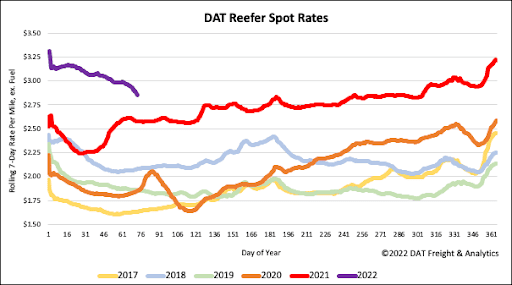

Reefer load post volumes have dropped 31% in the last month as reefer capacity continues to loosen ahead of produce season, which starts next month. Last week, load post volumes fell 12%, and equipment posts increased by 9% w/w, resulting in the reefer load-to-truck ratio decreasing by another 5% w/w from 11.03 to 8.88.

Reefer spot rates have dropped by just under $0.19/mile in the last month following last week’s decrease of $0.09/mile. The reefer national average spot rate ended last week at $2.88/mile excl. FSC is still $0.28/mile higher than the previous period last year.