If you are looking to move van or reefer loads out of the Southeast this week, you may have to pay more than you expected for those trucks. In some cases, you’ll pay a lot more.

Rates rose sharply last week for box-like trailers, with and without refrigeration. Compared to the average rates for April, dry van prices rose by 7¢ per mile to a national average of $1.57, and reefer rates jumped 11¢ to $1.90.

A small part of the increase can be attributed to rising diesel costs, which added 2¢ per mile to the average fuel surcharge. The main reason for the increase is new, seasonal demand, especially from fruit and vegetable harvests in the Southeast and in California. Reefer capacity is tight and getting tighter, which adds to pressure on van capacity and rates in the same markets.

A quick glance at last week’s Hot States map reveals elevated demand for vans, and a shortage of trucks, across the southern band of states known as the Sun Belt.

Vans are in high demand in the Sun Belt, and rates rose sharply last week. Four of the top five markets for van load posts are in the Southeast region: Atlanta, Charlotte, Greenville, and Lakeland. (The fifth is Houston.)

The map looks similar for reefers (below) with the exception of Florida. Harvests are already winding down in the Sunshine State, so load-to-truck ratios are not as high as they are in neighboring states, even though outbound rates are still elevated. Peaches are not yet ripe in southern Georgia, but onions are rolling out of agricultural areas near the coast. Onions are also being harvested in southern California. while central California is shipping cherries and seasonal vegetables, including asparagus.

If you need to haul temperature-controlled freight out of the Southeast, you may be paying more for those trucks right now. Outbound rates are up sharply in Atlanta, as well as other markets in the region. California is also hot for reefers, with rates trending up in Ontario and Sacramento.

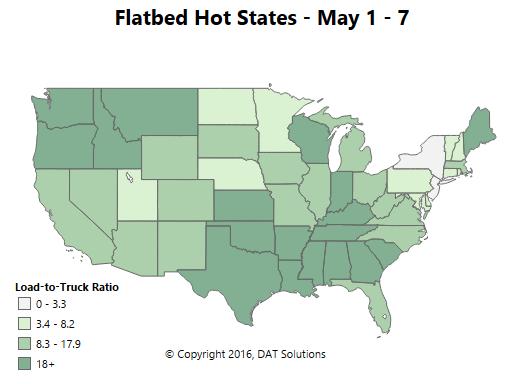

Flatbed freight volume was disappointing last week, after a strong month of April. Rates are up for flatbeds in some Sun Belt markets, particularly Jacksonville in the Southeast, Dallas and neighboring Fort Worth, plus Phoenix. The Midwest is quiet, however, with weak volume out of Rock Island, IL, as well as Pittsburgh, Harrisburg and Baltimore to the east.

Flatbed markets in the Midwest and Northeast were quiet last week. Rates are up in some Sun Belt markets, however, including Dallas and Fort Worth.

Daily maps, along with detailed information on demand, capacity and rates for individual markets and lanes, can be found in the DAT Power load board. Rates are derived from actual rate agreements and contracts, as reported in DAT RateView.