The daffodils are already popping up in my yard, but a frost still poses a potential threat to their longterm health. Like the flowers, truckload freight volume and rates are showing signs of life, too, but it’s hard to tell when the turnaround will take hold.

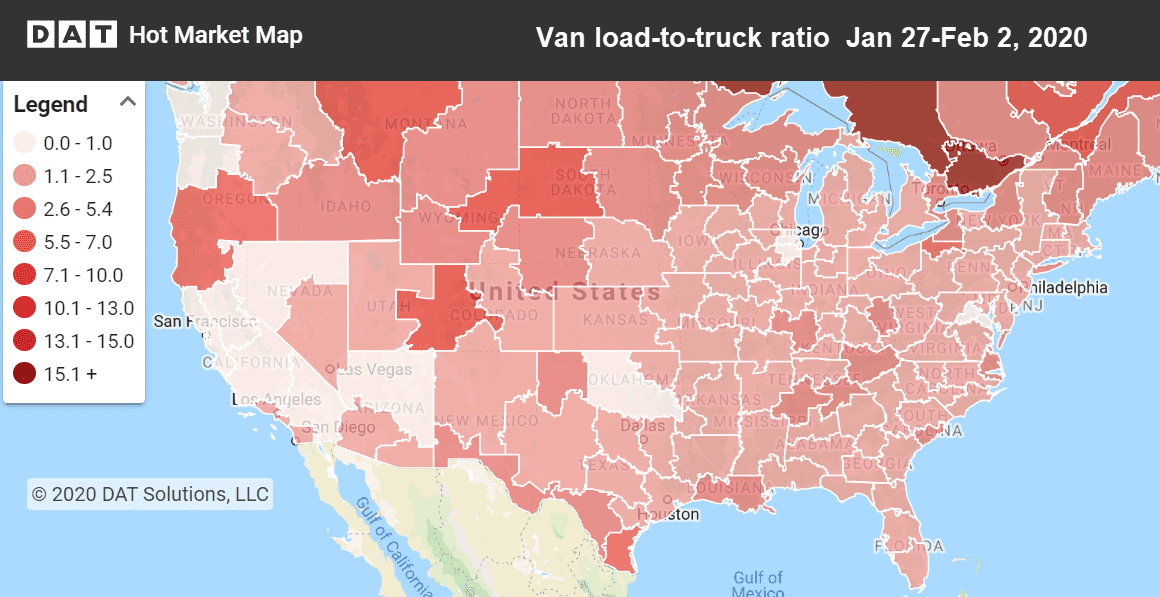

On a national level, rates edged up a penny or two last week, but the average rates are still lower than they were in January for dry van, reefer, and flatbed equipment. Those overall numbers don’t tell the whole story, however. Spot freight volume is holding steady, and rates are not nearly as low as they were in February 2017, even though they do look anemic compared to the past two years. Load-to-truck ratios are on the rise this week, a signal that better times are ahead.

There’s snow in the forecast this week in the Midwest, which could slow the rebound’s momentum temporarily. When the roads are clear again, pent-up demand should drive rates up. Soon after the thaw, load counts should continue to rise. When the weather is consistently mild, freight volumes will take off, as construction and drilling projects start back up, and fresh produce is harvested in the U.S. mainland.

Another nice feature of spring: people spend more time outdoors instead of huddling in their homes, catching and spreading viruses. That should take the edge off coronavirus fears. For now, the Centers for Disease Control (CDC) expressed cautious optimism about containing the outbreak in the U.S., although Wall Street traders responded by selling off a lot of stocks early this week. The primary targets for divestment were airlines, cruise ship operators, and tech companies that are feeling an immediate, direct impact to their business results.

Imports are down at the Ports of Los Angeles and Long Beach, which is not unexpected. Less freight is crossing the Pacific from China, where factories extended their New Year’s closures due to coronavirus and related quarantines. There are still plenty of loads available in the L.A. market, but outbound rate trends haven’t rebounded yet, and inbound rates aren’t much better.

For example:

- Los Angeles to Chicago dropped 5¢ last week, to $1.28 per loaded mile, and Chicago to L.A. lost 3¢ to $1.40.

- Los Angeles to Atlanta average rates fell 6¢ to $1.40, while Atlanta to L.A. slipped 3¢ to $1.33.

Get full details on the lanes that are most important to your business, with DAT RateView.

Rate trends are mixed

On the other side of the country, a handful of lane rates are moving higher.

- Buffalo to Columbus added 4¢ to $1.79 per mile, while Columbus to Buffalo rates rose 7¢ to a $3.02 average for the week. That’s a win-win.

- Philadelphia to Atlanta edged up 3¢ to $1.57, and Atlanta to Philly held steady at $2.02.

- Atlanta to Lakeland, FL, was up 6¢ at $2.59, and Lakeland to Atlanta dropped 3¢ to $0.97 per mile. That’s $1.78 per loaded mile for the roundtrip average. Meh.

The rising trend is far from universal anywhere in the U.S., however.

- Philadelphia to Buffalo plummeted 11¢ to $2.20 per mile, and Buffalo to Philly dropped even more to $2.75, but those still aren’t bad rates for February.

- Memphis to Columbus lost 9¢ to $1.83 and Columbus to Memphis gained 4¢ to $1.67, so the weekly average roundtrip rate chalked up a net loss.

- Denver to Chicago is never good, and last week it got 5¢ worse at $1.05 per mile. There’s not much freight, either. Chicago to Denver added 3¢ to $2.39.