California’s short 6-week cherry season reaches its peak this week and before quickly winding down after contributing around 20% to the national annual volume.

Nearly all of the cherry production is centered around Lodi, CA in the Stockton freight market. The famous Bing cherry variety is grown here because of the ideal climate that provides cold winter temperatures and warm, but not too hot, temperatures in the spring and summer months.

Cherry harvest volume varies from year to year as cherries ripen on the tree, not after picking. This makes them susceptible to heat, heavy rain and wind as has been the case this season. For reefer carriers looking to load fresh cherries, transit schedules are very tight as cherries have an extremely short shelf life and must be transported quickly but carefully to reduce damage.

The 2021 crop is estimated to total 8 million boxes, down from initial estimates of 9.47 million earlier in the season. Carriers can expect to move around 3,270 truckloads this season, which is just under 550 more than last year but at much higher rates this year.

Currently, spot rates to all destinations are averaging $3.44/mile, which is 6% higher than last month. On the 800-mile run north to Seattle, loads out of Lodi are paying $4.50/mile, which is up $1.58/mile since February. On the 2,000-mile run to Chicago, rates have increased by $1.46/mile over the same timeframe to reach $3.25/mile this week.

Find loads and trucks on the largest load board network in North America.

Note: All rates exclude fuel unless otherwise noted.

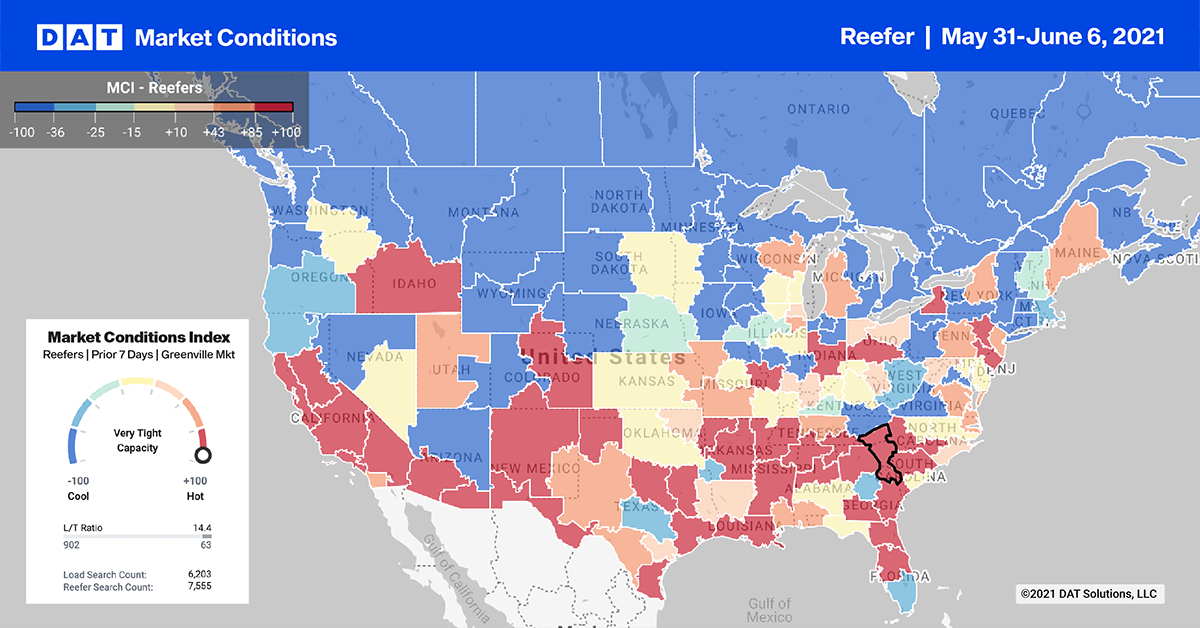

The top 10 outbound load post volumes in the reefer sector cooled last week following the Memorial Day weekend surge in demand for temperature-controlled freight. Volumes decreased by 25% while the average spot rate increased by just $0.01/mile to an average of $3.15/mile.

Reefer capacity was even tighter than the dry van market on the West Coast where outbound spot rates in Los Angeles and Ontario, CA, increased $0.09/mile and $0.04/mile respectively last week. Average outbound rates in Los Angeles ended last week at $3.57/mile and higher in Ontario at $3.66/mile.

In other California markets including Fresno, San Francisco and Stockton, capacity was also tight pushing up reefer spot rates by $0.06/mile to an average of $3.40/mile.

Spot rates

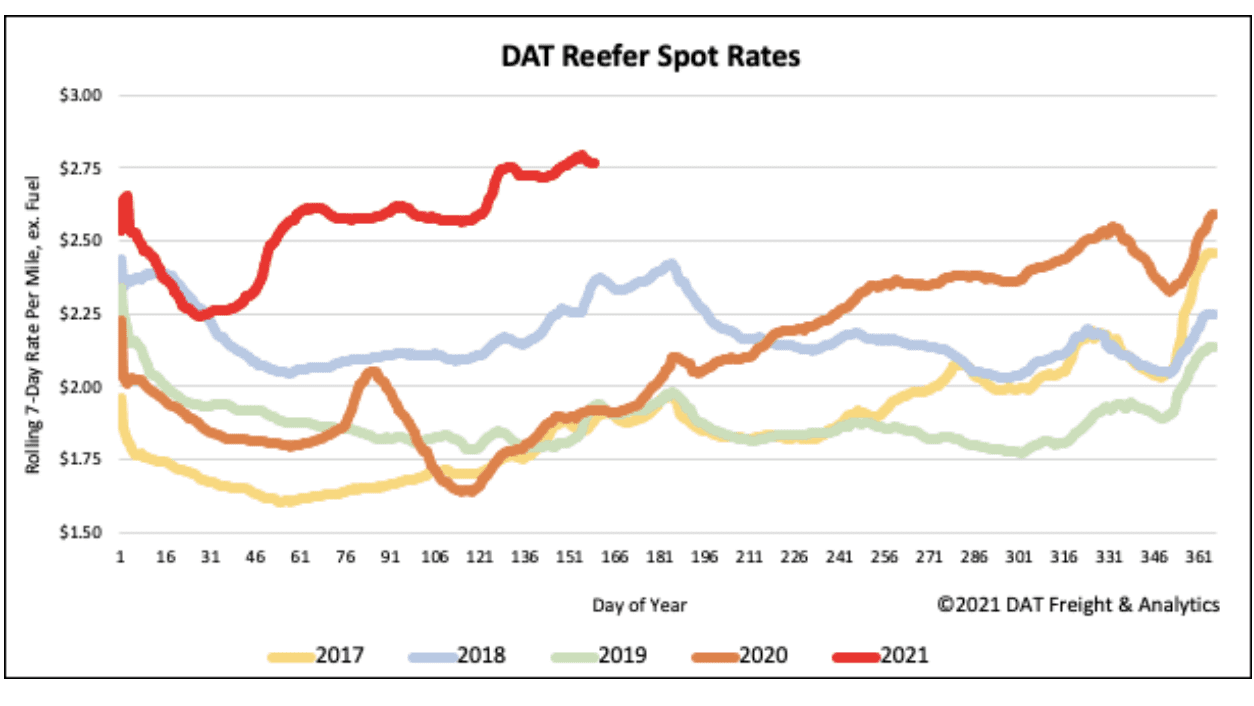

Reefer capacity tightened last week with spot rates increasing by $0.02/mile over the course of the week to $2.76/mile. Reefer spot rates are still at record-high levels and are now $0.85/mile higher this time last year and $0.40/mile higher than this time in 2018.

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset

- Blended Scenario: More heavily weighted towards the longer-term models

- Blended Scenario v2: More heavily weighted towards the shorter-term models