It’s been a slow spring for fresh produce, but there are some hot spots, especially in the southernmost states. Freight volumes surged about 25% out of both Miami and Lakeland, FL, and some lanes about of Florida saw rates jump as much as 85¢ per mile. That helped boost the national average reefer rate to $2.18/mi., which is 3¢ higher than the April average. Here’s what’s happening in some of the top reefer markets.

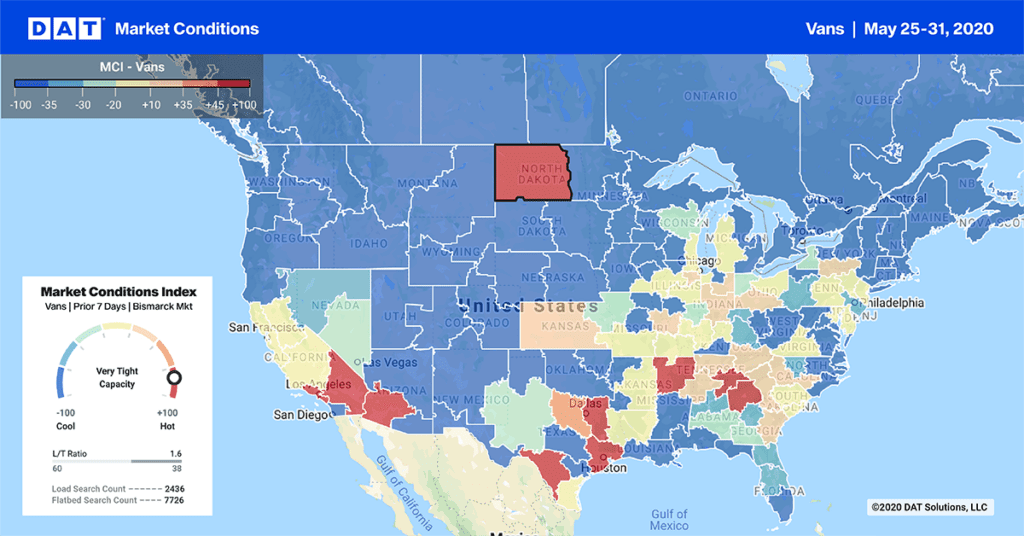

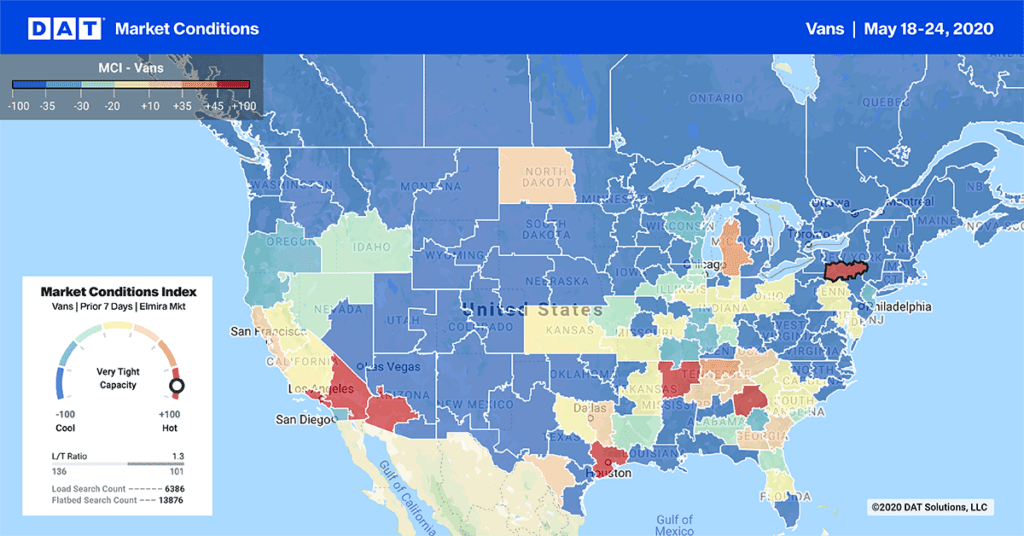

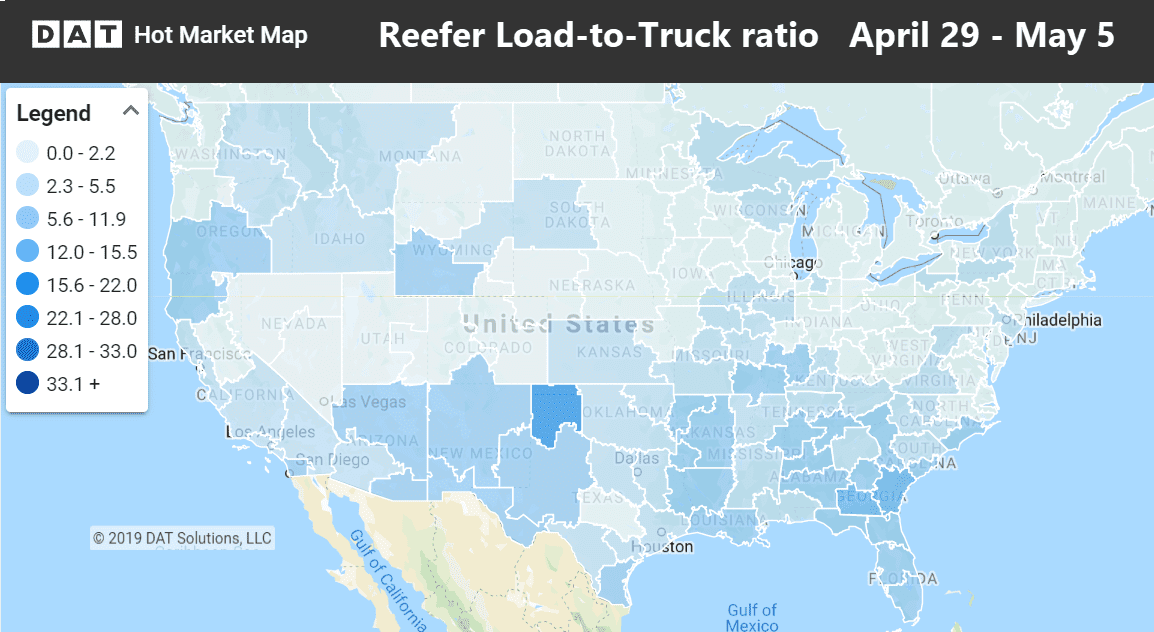

The national average load-to-truck ratio for reefers increased to 2.9 loads per truck last week. Dark areas show where there’s the greatest demand. The Hot Market Map is one of the many useful tools in the DAT Power load board and DAT RateView.

The national average load-to-truck ratio for reefers increased to 2.9 loads per truck last week. Dark areas show where there’s the greatest demand. The Hot Market Map is one of the many useful tools in the DAT Power load board and DAT RateView.

Florida – In the past few weeks, Florida has been a mixed bag: one week Miami is up and Lakeland down, and the next week Lakeland is up and Miami down. Last week both markets were up big. Rates shot up 28% coming out of Lakeland and 25% out of Miami.

California – Overall, California has been slower than usual, with freight volumes down about 3%, due to heavy rain. California’s wet winter and spring will be a positive later in the summer, but for now it’s causing a delay in spring planting and harvesting. One exception has been the Ontario market (including the Coachella and Imperial Valleys), where rates increased last week. Table grapes from the Coachella Valley are expected to hit 5 million cartons this year, up significantly from last year.

South Texas – Freight volumes were up 25% coming out of the McAllen, TX market, but that wasn’t enough to boost rates.

Arizona – Both volumes and rates remained about the same from the U.S./Mexico border market of Nogales, AZ.

Rising rates

- Lakeland, FL to Baltimore surged 85¢ to $2.86/mi.

- Lakeland, FL to Charlotte jumped 57¢ to $2.62/mi.

- Miami to Boston added 62¢ to $3.09/mi.

- Miami to Baltimore gained 51¢ to $3.05/mi.

- Imperial Valley, CA to Chicago recovered somewhat, adding 24¢ to $1.93/mi.

Falling rates

- Green Bay to Minneapolis dropped 28¢ to $2.52/mi.

- Fresno to Denver fell 15¢ to $2.32/mi.

Find loads, trucks and lane-by-lane rate information in DAT load boards, including rates from DAT RateView.