Two West Coast hurricanes in August and October have resulted in higher onion prices in the Pacific Northwest (PNW) in December, according to Owyee Produce in Parma, ID. Hurricane Hillary hit the West Coast of the United States in late August, followed by Otis in October, making landfall near Acapulco, on Mexico’s southern Pacific coast. Both damaged regional onion crops impacted volumes and prices almost four months later.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Hurricane Hillary sent torrential rains up the West Coast and to the Pacific Northwest (PNW), drenching the onion crop in the Pacific Northwest (PNW). Wet onions don’t store as well as they tend to shrink more in storage, and according to Oywee Produce, “instead of getting 80 or 90% pack-out, we might be getting 60 to 65% pack-out reducing production by 10 to 15%”. The pack-out rate is the percentage of onions deemed acceptable for the fresh market.

Market watch

All rates cited below exclude fuel surcharges unless otherwise noted.

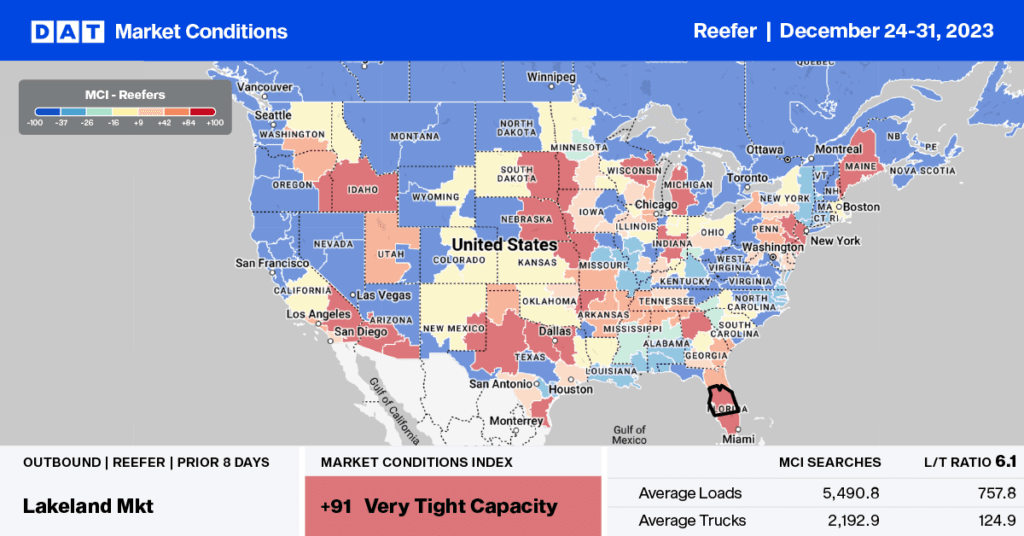

At $2.14/mile, outbound rates in Oregon are the highest in nine years, excluding the pandemic-impacted markets in 2021 and 2022. Reefer capacity was very tight in the Pendleton market, where linehaul rates increased by $0.10/mile to an average of $2.15/mile last week. The USDA reported a slight shortage of trucks to haul dry onions and potatoes last week, and on the long-haul lane south to Los Angeles, carriers were paid an average of $1.85/mile, almost identical to spot rates last year.

On the southern border in McAllen, reefer capacity tightened for the fourth week following last week’s $0.22/mile increase to an average of $2.50/mile for outbound loads. The volume of outbound loads moved was 18% higher last week, driving up spot rates to $2.88/mile on the high-volume lane north to Ft. Worth. The USDA also reported a slight shortage of trucks at the Nogales and Calexico border crossings for imported loads of Mexican produce. Outbound reefer rates in these locations are expected to climb in the lead-up to this year’s Super Bowl in Las Vegas.

Load to Truck Ratio (LTR)

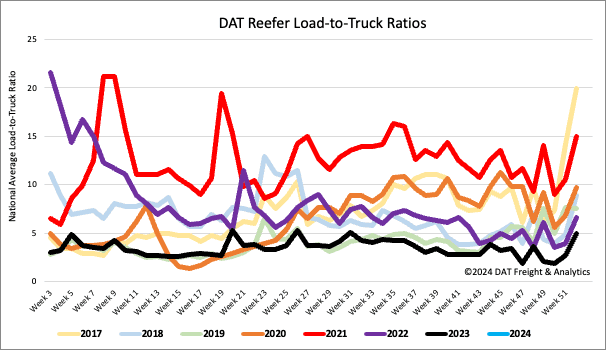

Reefer load post (LP) volumes are just over 60% lower than last year, impacted by 13% fewer produce loads from the 19 growing regions tracked by the USDA. Carrier equipment posts (EP) are 30% lower than last year, resulting in last week’s reefer load-to-truck ratio (LTR) starting in 2024 at 5.40, almost half what it was in 2023.

Spot rates

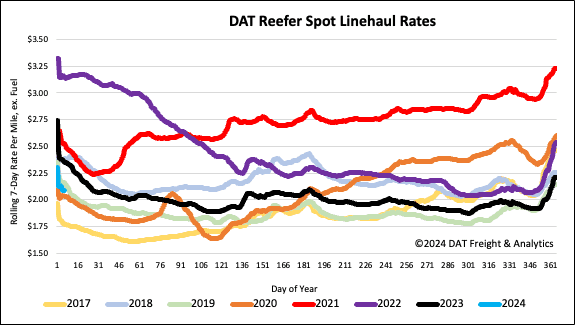

Reefer linehaul rates ended 2023 at $2.18/mile following a late surge before the break, where rates jumped by $0.19/mile the week before Christmas. Since then, spot rates have lost about half of that gain, ending last week at $2.11/mile and $0.26/mile lower than last year. Compared to the start of 2020, when the market was oversupplied, linehaul rates will start 2024 at $0.06/mile higher.