The pains of high inflation are highlighting how consumers are managing their food budgets and where they are focusing their spending. The food industry is a large contributor to the freight market and accounts for approximately 20% of the tonnage shipped in the U.S., according to the Bureau of Transportation Statistics. The latest report from the Bureau of Labor Statics indicates that food inflation is up 10.9% y/y, with the food at home category up 13.1% and food away from home category up 7.6% y/y.

A report by industry analytics provider IRI finds that consumers are bargain hunting when grocery shopping, eating more meals at home, and cutting back on dining out. In addition, the findings indicate that flexible work schedules enable up to 20 million U.S. workers to work from home, which keeps 62.5% of the food dollar based on retail at-home sales. Another finding is that consumers are bargain hunting, preferring more mainstream and value brands over premium ones. This trend continues for dining out, with consumers favoring value food service outlets, like quick service restaurants, as evidenced by the growth in average customer check versus menu prices.

Foot traffic data from Placer.ai shows that the dining out category is seeing fewer visits this summer as y/y visits are down 3% for the June to August time frame. Foot traffic in the grocery category also declined 4% y/y for June through August. These declines show that it is likely that the high food costs are contributing to how often consumers shop and dine out versus pandemic restrictions. Although spending patterns and demand for specific categories may change, the food industry will remain steady regardless of the economic factors at hand, as this is one necessity of life.

All rates cited below exclude fuel surcharges unless otherwise noted.

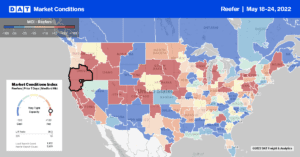

After dropping for the prior three weeks, outbound linehaul rates remained flat last week at an average outbound rate of $2.45/mile in Los Angeles. Rates 270 miles northeast to Las Vegas increased to $4.99/mile last week, which is $0.87/mile lower than the previous year but $1.36/mile lower than last November’s $6.35/mile peak. Farther north in Stockton, CA, capacity was tight following a $0.14/mile increase in outbound rates to an average of $2.58/mile. On the short-haul lane south to Los Angeles, linehaul rates increased slightly to $2.81/mile last week or around $0.76/mile lower than the previous year.

In the Pacific Northwest market of Twin Falls, ID, spot rates increased for the fourth week to an average of $2.09/mile, up $0.25/mile in the last month. Loads 630 miles south to Stockton, CA, at $2.40/mile, were paying almost $0.35/mile than the August average last week, which is also around $0.10/mile higher than the previous year. In the cross-border Laredo market, load posts jumped by 25% w/w. Even though imported produce volumes are identical to the previous year, reefer linehaul rates increased by $0.09/mile to an average outbound rate of $2.20/mile last week. In Michigan, produce season continues to push higher volumes into the market and drive up spot rates following last week’s $0.24/mile increase to $3.12/mile. That’s an increase of $0.54/mile in the previous three weeks.

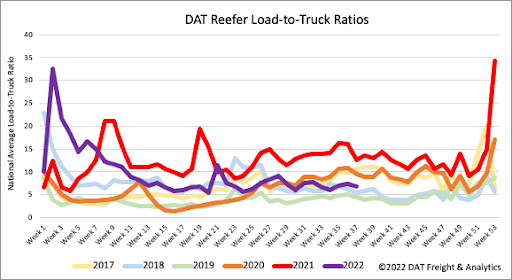

Following the rush by shippers to get freight into position ahead of Labor Day celebrations, reefer load posts dropped by 8% last week, which is 38% lower than the previous year. Even though there was little change last week, carrier equipment posts are at their highest level in the previous six years, following last week’s surpassing 2018 levels by 6% but almost identical to 2019. As a result, the reefer load-to-truck (LTR) decreased by 7% w/w from 7.36 to 6.81.

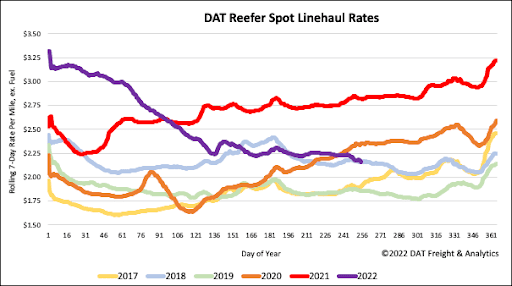

Reefer linehaul rates are now identical to 2018 spot rates following last week’s decrease of $0.05/mile to a national average of $2.19/mile. Reefer spot rates are $0.66/mile lower than the previous year after dropping by almost $1.00/mile or 31% since the start of the year. Last week’s average spot rate is still $0.25/mile higher than the pre-pandemic average for the first week of September.