The United States imports hundreds of millions of lithium-ion batteries each year, and according to IHS Markit/PIERS, refrigerated import volumes through the Port of Mobile, AL, have increased 62% year-over-year (y/y). Lithium batteries account for 20% of import volume, with over 70% imported in the last 12 months, arriving on the Gulf Coast in the last six months, mainly from Mainland China. Seafood imports (mostly Tilapia) from China account for the highest refrigerated imports at 30% of annual volume.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

In addition to being a central import hub for refrigerated carriers, Alabama is the second largest producer of poultry in the United States and exports a majority of the product globally. The Port of Mobile has 14.6 million cubic feet of cold storage warehousing and 47,500+ pallet positions at the two central near-dock refrigerated cargo facilities.

Outbound reefer truckload volumes in the Mobile market have increased 14% year over year (y/y), with nearly all of the lithium-ion battery import volume destined for Birmingham, while most seafood imports head for Chicago.

Market watch

All rates cited below exclude fuel surcharges unless otherwise noted.

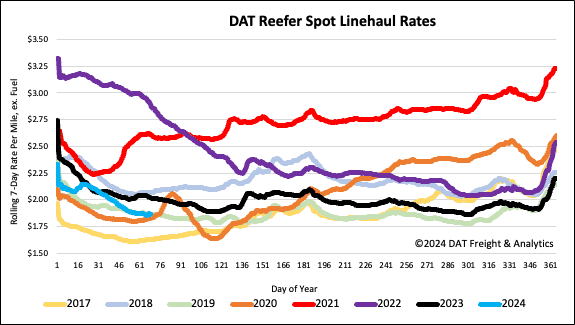

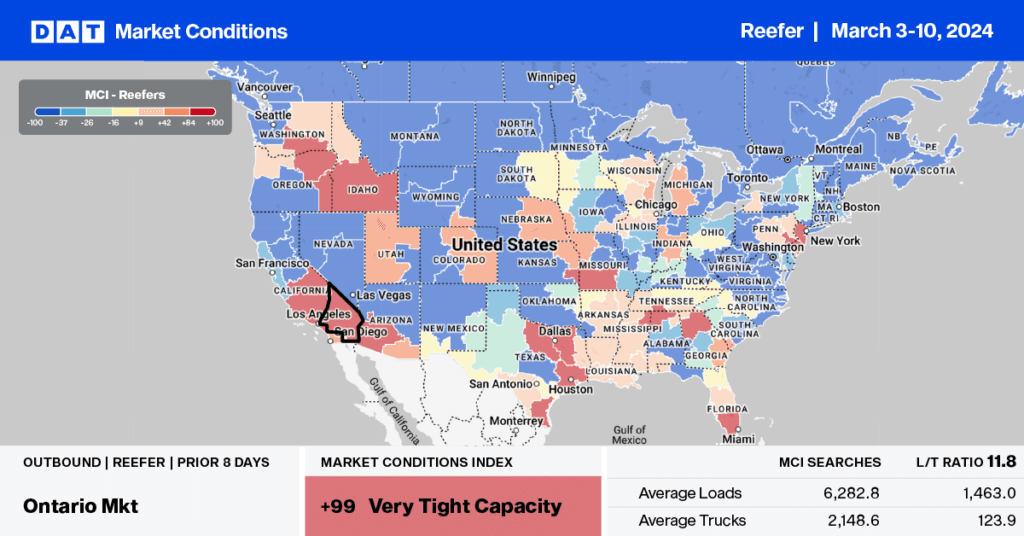

After dropping $0.43/mile since the start of the year, outbound California linehaul rates reversed course last week, increasing by $0.03/mile to $2.00/mile. This is around $0.07/mile lower than last year, although the turnaround timing is consistent with prior years as the reefer market comes off the bottom at the start of March.

Solid gains were reported in Fresno, the largest produce market in the state, where spot rates increased $0.01/mile to $1.85/mile on a 4% higher volume of loads moved. According to the USDA, the volume of produce loads moved has recovered to be just 8% lower than last year. However, next week is typically when the market starts to see a material increase in outbound volumes between now and the seasonal peak in mid-August.

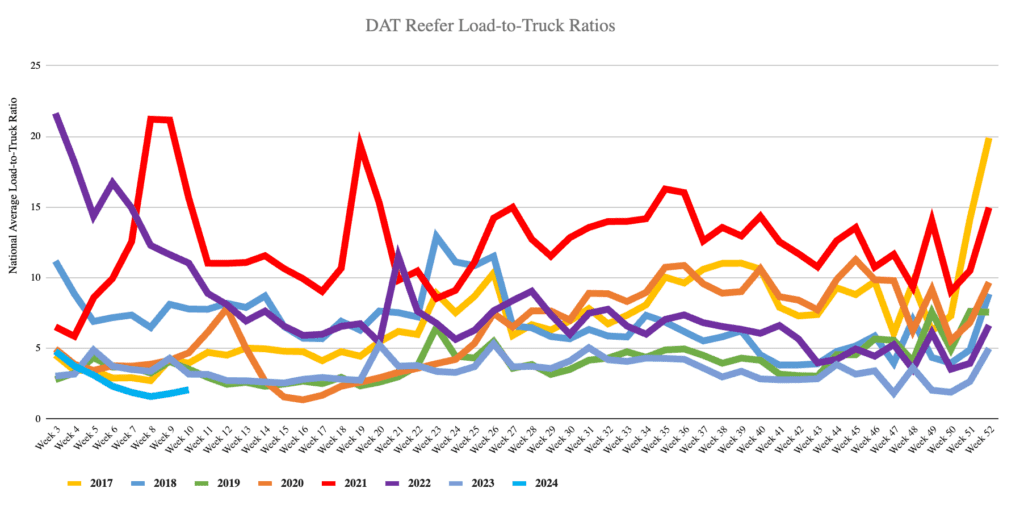

Load-to-Truck Ratio

Reefer load post volume increased by 14% last week but trailed last year by 11%. Volumes are within 6% of this time in 2020, the week before the global pandemic was declared four years ago. Available capacity increased following last week’s 8% gain in equipment posts, increasing the load-to-truck ratio by 6% to 4.55.

Spot rates

With produce volumes around 17% lower than the start of March last year, the volume of reefer loads for all commodity types is just under 16% lower year-over-year (y/y) following last week’s 7% week-over-week (w/w) decrease in loads moved. Despite the lower volumes, reefer spot rates were primarily flat, averaging $1.89/mile last week. Compared to last year, reefer linehaul rates are $0.15/mile lower and $0.04/mile higher than in 2020 as the freight market continued to soften before the pandemic.