Legend has it the garden strawberry was created in Brittany, France, although English settlers who landed in Jamestown, VA, discovered an abundance of wild strawberries in the early 1600s. Today, the strawberry is the leading small fruit crop in the U.S., with California and Florida being the principal strawberry-growing regions: Florida for winter berries in the Lakeland freight market, California for spring, summer, and fall fruit in the San Francisco, Fresno, and Los Angeles DAT markets. Fresh strawberries are one of the first fruits to ripen each spring, so May is also National Strawberry Month, coinciding with the start of the peak shipping season. Last season 26% of strawberries were shipped in May and June alone.

Even though strawberries are grown in most states in the U.S., according to the USDA, 90% of the strawberries grown in the U.S. originate in California along the central coast from Santa Cruz to Santa Maria and Ventura. The largest strawberry-growing region in California is the Salinas-Watsonville region producing around 45% of state volume, followed by Santa Maria (37%) and Oxnard (17%). The U.S. also imported 9% of its annual volume from Mexico last year, with 52% arriving in Otay Mesa, CA, in the San Diego freight market and another 42% crossing into the U.S. in Pharr, TX, in the McAllen market.

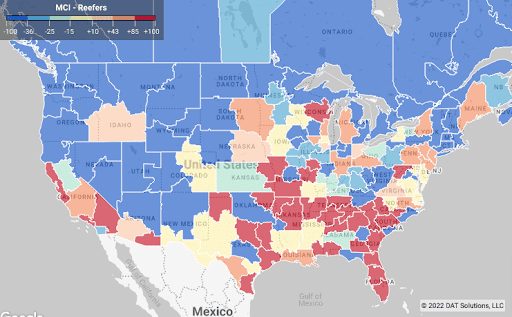

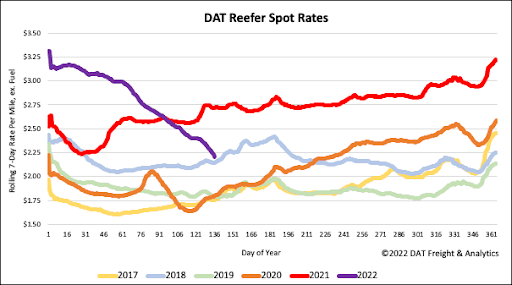

California’s strawberry growers are seeing substantially lower reefer spot rates this season as outbound rates dropped another $0.07/mile last week to $2.26/mile excl. FSC. That’s the fifth week of decreasing spot rates and the third successive week of lower load post volumes following last week’s 10% decrease. Spot rates for loads from Fresno to Chicago dropped under $2.00/mile excl. FSC for the first time in 12-months and are now averaging $1.87/mile excl. FSC or $0.51/mile lower y/y. Fresno to Hunts Point, NY, followed a similar trend last week, dropping $0.12/mile to $2.04/mile excl. FSC or $0.83/mile lower y/y. Following Mother’s Day, reefer spot rates in the Miami and Lakeland markets dropped by $0.40/mile to $2.14/mile excl. FSC last week.

Capacity was tight on a few lanes, though, including Lakeland to Atlanta, where rates jumped by $0.50/mile above the April average to $2.30/mile excl. FSC this week. That’s $0.22/mile lower than the previous year. The Southeast produce season has started, and even though it’s producing higher volumes, growers are finding plenty of available reefer capacity. At the regional level, spot rates dropped by $0.32/mile to an outbound average of $2.22/mile excl. FSC. while on some lanes, capacity was much tighter, including the Savannah and Macon markets, where spot rates increased by $0.08/mile last week to $2.78/mile excl. FSC. Truckload capacity is particularly tight on the 600-mile Macon to Miami lane where spot rates are averaging $3.74/mile excl. FSC or about $0.40/mile higher y/y.

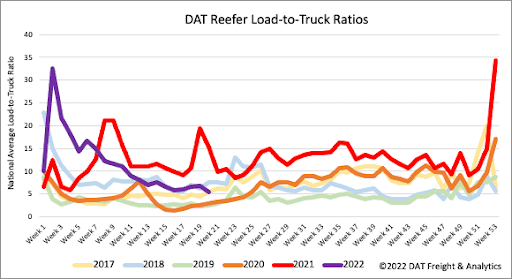

The reefer load-to-truck (LTR) ratio is almost identical to 2017 after dropping 20% w/w from 6.74 to 5.40 loads per truck. Load post volumes are about half what they were the previous year and 8% lower than in 2018. Equipment posts hit their highest level this year following last week’s 7% increase.

At a time when reefer rates typically heat up, they’re cooling down following another weekly drop of $0.08/mile. The national average is now $2.26/mile excl. FSC after dropping by $0.90/mile since the start of the year. The current national average is still $0.51/mile lower than the same time in the previous year and just $0.06/mile higher than in 2018.