At $1.68/mile excluding fuel, refrigerated outbound spot rates in Washington state are almost identical to this time in 2019 – but as usual, they are expected to increase at least another 20% by the end of the year. Over the next few months, during late summer and fall, the Pacific Northwest (PNW) produce season ramps up, creating higher demand for reefer carriers. They haul loads of cherries, potatoes, apples, and onions. According to the USDA, apples account for 60% of annual carrier volume, followed by onions and then potatoes.

According to the Washington State Tree Fruit Association, the 2023 apple crop is expected to be 5% above the previous 6-year average. The association predicts a 28% increase from the previous year’s crop at 134 million 49-pound boxes of apples – or the equivalent of 145,000 truckloads – between domestic and export markets. “There is a lot of excitement as we are seeing a more normal harvest and excellent fruit quality this year,” said Jon DeVaney, WSTFA president, in the release. “A moderate spring and a warm early summer created near-perfect growing conditions, so our domestic and foreign customers will see great size, color, and overall good quality in our apples. The harvest is just underway now, and our growers look forward to bringing in a great harvest that will benefit consumers around the state, country, and world.”

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

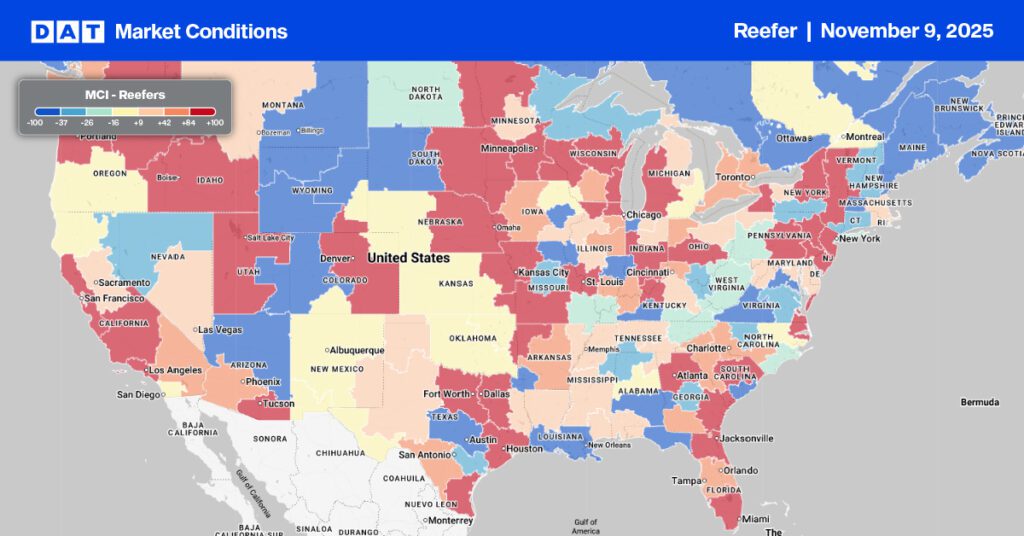

The apple harvest typically begins in August and continues into November, and PNW reefer load post volume has started to climb following last week’s 12% increase. Volumes in the larger Pendleton reefer market were up 14% last week, with rates on the high-volume lane to Los Angeles paying carriers $1.36/mile, which is $0.20/mile higher than last year. In 2022, reefer rates on this lane doubled between July and November’s peak at $2.27/mile. This year, Ratecast forecasts a peak of $2.47/mile in mid-November, around $0.20/mile higher than the previous November peak.

State-level spot rates in Pendleton averaged $2.08/mile last week, just $0.07/mile lower than last year, while in Washington and Oregon, spot rates averaged $1.71/mile. Further south in California, reefer loads paid carriers $2.48/mile (rates have been parked there since the July 4 break). In the larger Fresno, CA market, rates were flat at $2.20/mile.

In the Midwest, Grand Rapids, MI, capacity continues to tighten following last week’s $0.018/mile increase to $2.62/mile, while across Lake Michigan in Milwaukee, rates increased a penny per mile to $2.04/mile.

Load to Truck Ratio (LTR)

Reefer spot market volumes suffered a 20% w/w decrease – the third week of decreases. Monthly refrigerated truckloads of produce are slightly lower than last year; more importantly, they are the weakest since 2017. Lower beef production is also impacting spot national volumes, which are down 4% y/y, offset slightly by 1% higher pork production – the net is fewer truckloads of protein in the market. Carrier equipment posts were down last week, resulting in last week’s reefer load-to-truck ratio (LTR) increasing slightly from 4.19 to 4.32, slightly lower than in 2019.

Spot Rates

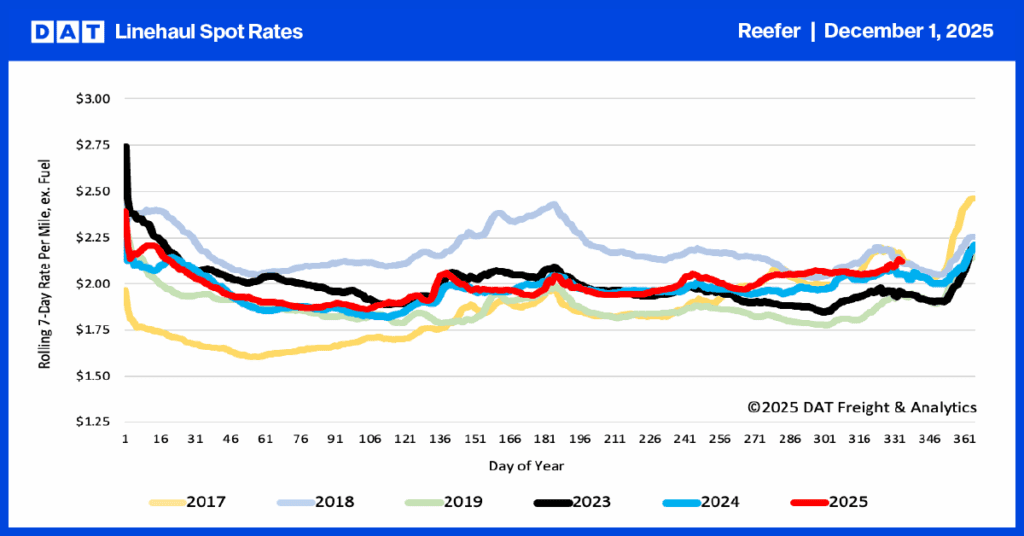

Reefer linehaul spot rates remained flat for the second week at $1.95/mile, $0.35/mile lower than in 2022, and only around $0.07/mile higher than in 2019.