Tyson Foods, Inc. (TSN), one of the world’s largest food companies and a recognized leader in protein with brands including Tyson, Jimmy Dean, and Ball Park, reported lower earnings in the first quarter due to falling beef and pork sales. Chris Casey at Fooddive reports, “In a call with analysts, CEO Donnie King said supply and demand dynamics in the retail meat space and higher cattle prices led to challenges throughout the quarter, with market fluctuations and operational issues leading to lower profits. We got hit in the mouth in Q1 because of all the protein on the market.”

In addition to lower volumes of fresh fruit and vegetables this year due to recent extreme weather on the West Coast, lower volumes of beef, pork, and chicken contribute to lower temperature-controlled freight volumes in February. Tyson reported that beef sales were down 5.6% in the first quarter due to more beef being on the market than expected. Pork sales were also down by 6%, while the fresh chicken category posted a 9.6% gain in the first quarter. According to the 2023 outlook from the United States Department of Agriculture (USDA), domestic protein production (beef, pork, chicken, and turkey) should be relatively flat compared to fiscal 2022 levels. USDA projects domestic beef production will decrease by approximately 5%, pork production will be relatively flat, and chicken production will increase by around 3% in 2023 compared to 2022.

The impact of Americans consuming less meat and poultry is increased meat in cold storage. According to the USDA, total red meat supplies in freezers at the end of 2022 were up 2% m/m and 11% y/y. Total pounds of beef in freezers were up 4% m/m and 7% y/y, frozen pork supplies were up 1% m/m and 16% y/y, and frozen poultry supplies were up 7% m/m 23% y/y.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

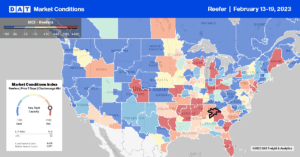

Reefer capacity has been slowly tightening over the last month in Atlanta following the previous week’s $0.03/mile increase to $1.90/mile. Loads moving between Atlanta and Lakeland, FL, have increased by 12% over the last month, but with sufficient capacity on this high-volume lane, spot rates continue to decline, averaging $2.64/mile last week, the lowest in 12 months. Atlanta to Miami loads followed a similar downward trend at $2.45/mile last week, although spot rates in the opposite direction at $1.42/mile were the highest since June.

After dropping by $0.31/mile since the start of the year, outbound spot rates at $2.12/mile in California are showing signs of plateauing around 2018 and 2019 levels. Volumes in Los Angeles and Ontario markets were up by 5% w/w while available capacity continues to loosen, with rates down for the fourth week to $1.87/mile. Loads from Los Angeles to Phoenix at $2.08/mile were paying almost 60% lower than the previous year, down $2.77/mile to $2.08/mile last week. Loads to Dallas follow a similar trend, down by just over 50% y/y to an average of $1.64/mile.

Truckload volumes from the U.S. into Canada continue to surge. According to DAT partner company Loadlink, inbound Canadian volumes were up 52% in January, marking the fourth consecutive month of growth. Reduced ocean traffic on the often frozen St Lawrence Seaway during winter typically sees import volumes routed to ports like Philadephia and then onto Toronto. On this lane, spot rates have been steadily climbing all winter and, at $2.81/mile, are the highest since last July but almost $1.00/mile lower than the previous year. DAT Ratecast forecasts rates to end the winter shipping season closer to $3.00/mile by the end of March before cooling off over the summer.

Load to Truck Ratio (LTR)

Reefer load posts were over three times lower than the previous year and have dropped for the third week following last week’s 10% decrease. National produce volumes are around 12% lower than last year, contributing to fewer load posts in the reefer market. Reefer equipment posts decreased by 4% last week and are still at the highest level in seven years, resulting in the reefer load-to-truck (LTR) decreasing slightly from 3.73 to 3.50.

Spot Rates

National average reefer linehaul rates have decreased by $0.33/mile since the start of the year, following another $0.02/mile decrease last week. At $2.04/mile, reefer spot rates are $1.03/mile lower than the previous year, $0.08/mile higher than in 2019, and lower by the same amount compared to 2018.