The McAllen freight market is located on the southernmost tip of Texas, right on the U.S.-Mexican border, and is one of the busiest for Texas reefer carriers. On the U.S. side of the border is the Rio Grande Valley (RGV), and to the south is the Mexican border town of Reynosa, one of the three fastest-growing cities in Mexico for over 10 consecutive years. In between is the customs port for international commercial traffic via the Pharr-Reynosa International Bridge, where most produce imports from Mexico pass each year. International Bridge is the third-ranked commercial crossing zone behind Laredo (38%) and Otay Mesa (15%), processing around 10% of commercial truck traffic between the two countries yearly.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

However, according to the USDA, it is the busiest for produce carriers, representing 43% of imported produce truckload volume last week. Leading imported commodities include tomatoes (14%), avocados (13%), and limes (11%), all ingredients that will work their way into holiday festivities over the holidays extending to Super Bowl Sunday on Feb 11, 2024. Because the Super Bowl is in the Southwest again this year (in Las Vegas), carriers can expect produce volumes to be elevated in the Tucson freight market, where seasonal volumes will enter the U.S. via the Mariposa/Nogales border crossing zone. Produce imports from Mexico are currently around 2% higher than last year.

Market watch

All rates cited below exclude fuel surcharges unless otherwise noted.

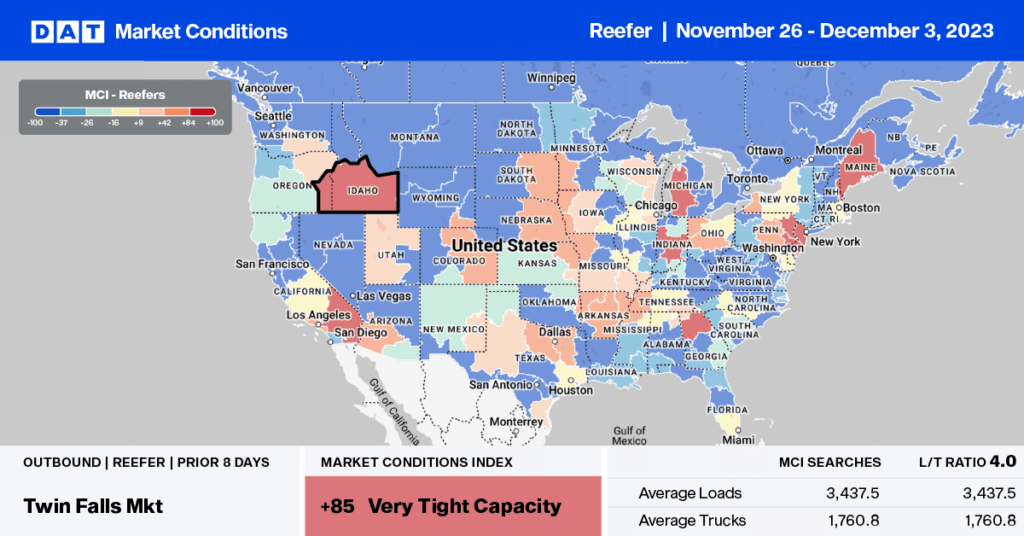

Reefer capacity in the Midwest (Arkansas, Iowa, Missouri, Nebraska, and Oklahoma), or the “meat patch,” as carriers refer to it, was very tight last week, with outbound spot rates increasing by $0.18/mile to $2.43/mile last week. Oklahoma and Kansas outbound reefer rates spiked by $0.30/mile to $1.97/mile and $2.55/mile, respectively. Kansas City, KS, to Allentown, PA, loads paid carriers $2.40/mile, while long-haul loads west to Los Angeles averaged $1.64/mile, the highest since May.

Texas outbound reefer rates at $1.91/mile are identical to 2018 following last week’s $0.05/mile gain. To offset declining rates in Houston, Dallas to Houston loads averaged $3.41/mile, the highest in 12 months. Outbound Houston reefer loads decreased by $0.03/mile to $1.55/mile last week.

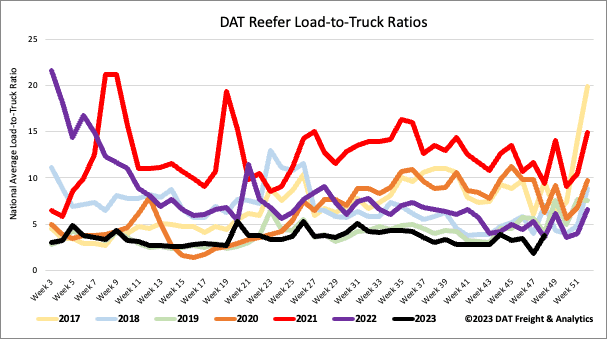

Load to Truck Ratio (LTR)

Reefer load post (LP) volume more than doubled last week compared to past years during the first 5-day shipping week after Thanksgiving. Carrier equipment posts (EP) increased by 6% w/w, resulting in last week’s reefer load-to-truck ratio (LTR) increasing to 3.78.

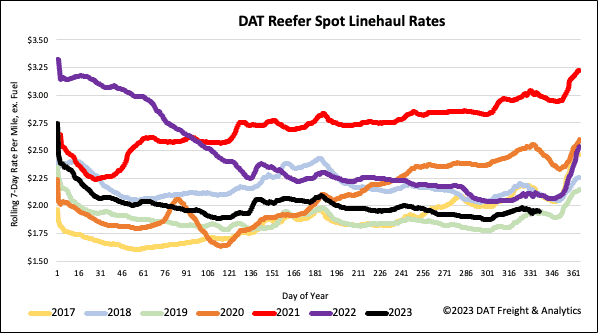

Spot rates

Following a month of gains in the lead-up to Thanksgiving, reefer spot rates followed seasonal trends, dropping by $0.01/mile to a national average of $1.99/mile last week. Compared to last year, reefer spot market rates are $0.15/mile lower and only $0.02/mile higher than in 2019.