According to the USDA, weekly truckload volumes of produce are currently around 2016 levels and down by 13% compared to the previous year. In the Pacific Northwest, where the Fall produce season is still underway, weekly volumes before Thanksgiving were up by 13% compared to last year and almost identical to 2020 volumes. In Idaho’s Upper Valley and Twin Falls-Burley Districts, the USDA reported a slight shortage of trucks for loads of potatoes. In contrast, a slight shortage was reported for onions and potatoes in the nearby Columbia Basin in Washington. Further north in the Yakima Valley, a slight shortage was also noted for apples and pears.

The only region reporting a shortage of trucks before Thanksgiving was eastern North Carolina, home to the nation’s largest sweet potato crop. In the Southeast, following Hurricane Ian’s devastating impact on Florida’s planting season in late September, there was a surplus of trucks for loads of winter vegetables. According to the latest USDA data, weekly truckload volumes of produce in Florida were down 58% y/y at the end of November.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

Atlanta was the number one market for reefer load posts last week, following a 31% w/w increase, followed by Chicago (up 59% w/w) and Elizabeth (up 88% w/w). The outbound reefer spot rate for the three markets combined averaged $1.90/mile following last week’s $0.06/mile increase. Chicago to Atlanta loads was paying $3.25/mile, up $0.07/mile w/w, while loads west from Elizabeth to Chicago were flat at $1.40/mile. One of DATs top spot market lanes for reefers between Atlanta and Orlando, loads moved decreased by 2% w/w driving down rates by $0.16/mile last week to $2.92/mile while Florida’s average outbound reefer rate also dropped by the same amount to $1.31/mile.

Last week, Reefer volumes surged in Twin Falls, ID, more than doubling, resulting in a surge in spot rates, which increased by $0.29/mile to $1.72/mile. Loads to Phoenix increased by $0.11/mile last week to an average of $2.64/mile, and even though rates on this lane have increased by almost $1.00/mile since June, they are still $1.00/mile lower than the previous year. In Los Angeles, spot rates were flat at $2.01/mile, and on the high-volume lane east to Phoenix, rates decreased by $0.13/mile to $3.01/mile even though the volume of loads being moved increased by 4% w/w.

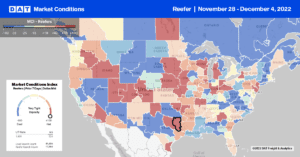

Load to Truck Ratio (LTR)

Reefer load posts were at their highest level in eight weeks following last week’s 117% w/w increase. Volumes have increased 22% in the previous month and are tracking closely with 2019 post-Thanksgiving levels. Last week’s volume was still 51% lower than the previous year, while carrier equipment posts bounced back, increasing by 24% w/w. As a result of higher volumes and an increase in equipment posts, last week’s reefer load-to-truck (LTR) increased by 74% from 3.51 to 6.10.

Spot Rates

Last week’s national average reefer linehaul rate, at $2.08/mile, is almost identical to 2017 and 2018 post-Thanksgiving levels following last week’s penny-per-mile decrease. Reefer spot rates decreased by $0.88/mile in the year’s first half but have only reduced by $0.20/mile since then, boosted by stronger seasonality in the second half. Reefer linehaul rates are $0.91/mile lower y/y and just $0.14/mile higher than the oversupplied 2019 reefer market.