Sunny California produces just over 80% of U.S. lemon production annually. Most of that production occurs between December and June when imports from overseas begin to enter ports including Philadelphia.

Find loads and trucks on the largest load board network in North America.

Note: All rates exclude fuel unless otherwise noted.

Imported lemons typically begin to trickle in starting June as the West Coast produce season slows. Around 7% of the annual production comes from Mexico, Argentina and Chile. Most of the imports arrive on the U.S. East Coast where just over 71% land in the Port of Philadelphia. Port Canaveral, FL receives 4% and Wilmington, DE receives 1% of imports.

Argentina has already doubled its fresh lemon exports to the U.S. increasing imported tons from 33,536 in 2020 to 75,420 tons by the end of September, 2021. This is only the third year that Argentina has exported to the U.S. after the reopening of that market following a court ruling in 2001 excluded the product amid pressure from California producers. The market reopened in 2016, but it wasn’t until August of 2017 that it became operational.

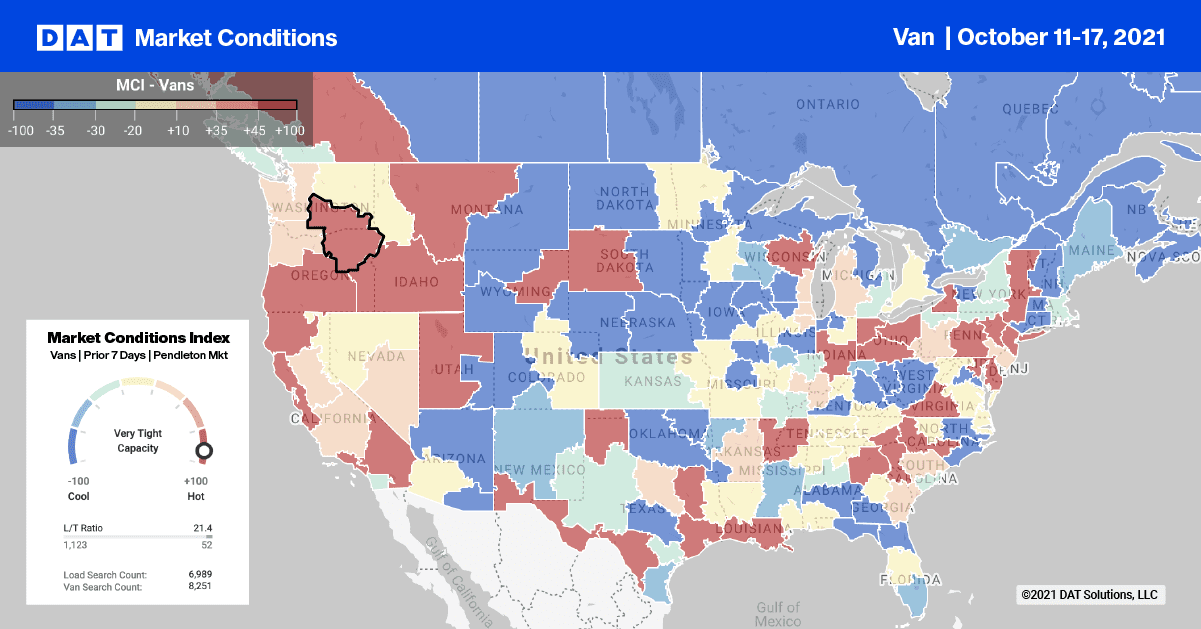

As the number of total markets producing fruit and vegetables decreases for the U.S. domestic market, the number of markets experiencing a shortage of trucks is on the rise. According to the latest report from the USDA, a total of 21 produce markets are being tracked this week compared to 31 just before the July 4 break. That’s a 32% decrease in total markets.

Truck shortage continues to affect reefer markets

A shortage of trucks was reported for loads in several key markets last week:

- Apples in New York

- Sweet potatoes in Eastern North Carolina

- Apples and pears in Yakima Valley in Washington

The potato harvesting season is well underway with a shortage of trucks also reported for loads out of the San Luis Valley in Colorado, Twin Falls ID, Columbia Basin WA, and Central Wisconsin.

In Wisconsin, the nation’s third largest potato producer, reefer capacity is very tight in the Eau Claire market following a 10% increase in load posts last week. Reefer spot rates skyrocketed by $1.19/mile last week to an average outbound rate of $4.37/mile.

Loads to Atlanta hit a new 12-month high of 3.88/mile or just over $0.09/mile higher than this time last year. Capacity was even tighter on the 1,131-mile haul to Hunts Point, NY, where spot rates on this lane topped out at $4.21/mile last week after being on the rise since June this year (up $0.83/mile).

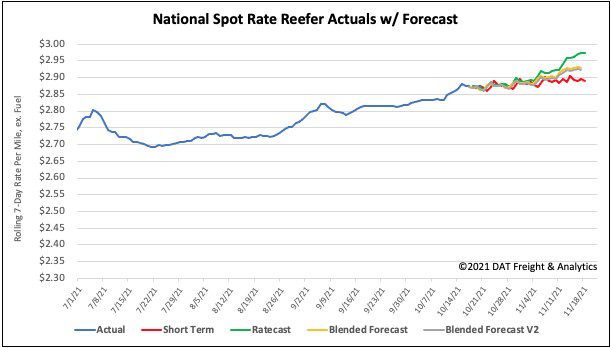

Spot rates

Reefer spot rates increased for the third week in a row moving up by just under a penny per mile last week. The national average now stands at $2.88/mile, which is still 17% or $0.50/mile higher than this time last year.

Of our Top 70 lanes (for loads moved), spot rates:

- Increased on 27 lanes (compared to 28 the week prior)

- Remained neutral on 29 lanes (compared to 28)

- Decreased on 15 lanes (compared to 15)

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset

- Blended Scenario: More heavily weighted towards the longer-term models

- Blended Scenario v2: More heavily weighted towards the shorter-term models