The National Oceanic and Atmospheric Administration (NOAA) predicts a 60% likelihood of an above-normal Atlantic hurricane season in 2025, which spans from June 1 to November 30. They also anticipate a 30% chance of a near-normal season and a 10% chance of a below-normal season.Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

NOAA forecasts between 13 to 19 named storms with winds reaching 39 mph or higher. Within this range, they expect 6-10 storms to intensify into hurricanes with winds of 74 mph or higher, and 3-5 of these to become major hurricanes, categorized as 3, 4, or 5, with wind speeds exceeding 111 mph. These projections come with a 70% confidence level.

Commerce Secretary Howard Lutnick stated that NOAA and the National Weather Service are employing advanced weather models and hurricane tracking technologies to deliver real-time forecasts and warnings, ensuring heightened preparedness.

Acting NOAA Administrator Laura Grimm highlighted that hurricane impacts, evidenced by inland flooding from hurricanes Helene and Debby in the previous year, extend beyond coastal regions. She emphasized NOAA’s crucial role in providing timely and precise forecasts and warnings, along with scientific expertise, to safeguard lives and property.

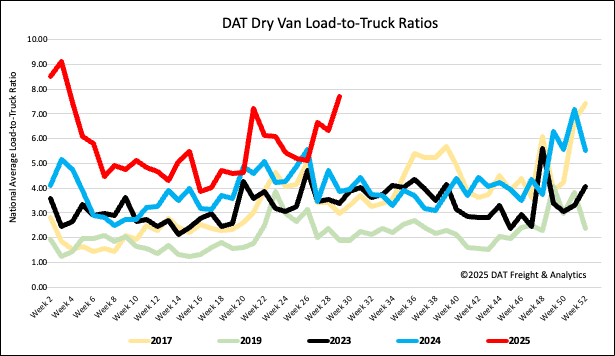

Load-to-Truck Ratio

Last week, load post volumes experienced a significant surge, increasing by 34% week-over-week and 14% year-over-year This uptick is attributed to the market catching up after a shortened week due to Independence Day celebrations. Simultaneously, carrier equipment posts rose by 10% week-over-week. As a result of these changes, the dry van load-to-truck ratio saw a 22% jump, reaching 7.71.

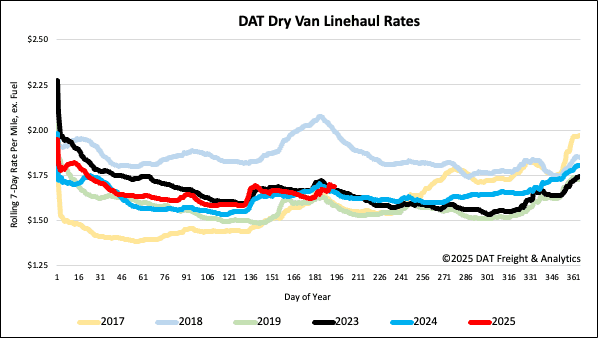

Linehaul spot rates

Dry van linehaul spot rates saw a $0.01 decrease last week, reaching just over $1.69 per mile. This is $0.03 higher than the rate at the same time last year.

The average rate for DAT’s top 50 lanes by load volume remained at $2.03 per mile and $0.34 higher than the national 7-day rolling average spot rate.

In the 13 key Midwest states, which represent 46% of national load volume and often indicate future national trends, spot rates rose by $0.05 per mile as volumes surged by 52% last week. Carriers in these states earned an average of $1.97 per mile, which is $0.28 above the national 7-day rolling average.