The fall produce season in the Pacific Northwest significantly impacts the refrigerated truckload market, with peak activity typically occurring in September and October. This surge in demand for reefers to transport perishable goods from Washington, Oregon, and Idaho farms to distribution centers nationwide leads to a capacity crunch and higher spot rates due to the specialized equipment required.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Onion and potato harvests, considered “storage crops,” begin in August and reach their peak in September and October. These crops generate substantial, consistent freight demand as they are harvested, shipped, and then stored and distributed across the country for several months. As the season progresses towards the holidays, the region’s diverse produce basket expands, adding more freight. Key items that begin moving heavily in early fall include:

- Apples and pears: The Pacific Northwest is a prime growing region for these fruits, with the harvest and shipping season for many varieties starting in September.

- Christmas trees: While not a typical produce item, the Christmas tree season is a major freight event for the region. Shipping, particularly from Oregon and Washington, usually starts in late October and early November. This creates a massive but short-lived increase in demand for refrigerated vans, dry vans, and even flatbeds. This demand often overlaps with the peak fall produce season, putting significant pressure on truckload capacity and driving rates up.

Reefer market watch

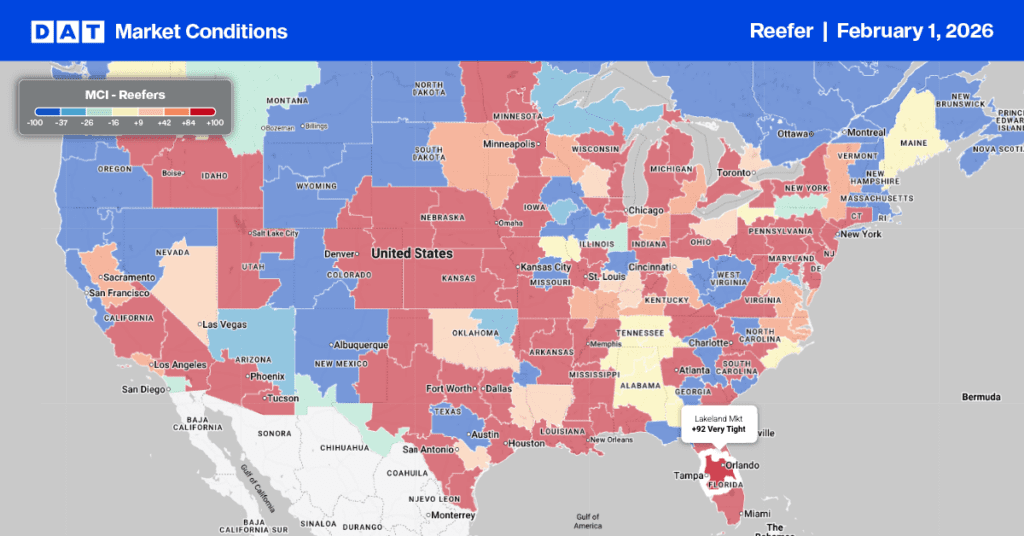

Reefer load post volumes saw a slight increase last week, while equipment posts dropped 5% leading to the reefer load-to-truck ratio ending the week at 13.48. Brokers experienced regional capacity tightness, especially in border temperature controlled markets despite this being the low point in the produce season for cross-border imports. For example, load post volumes surged by 15% week over week in southern Texas where Immigration and Customs Enforcement (ICE) is very active. Outbound McAllen reefer rates were up $0.03 per mile last week but up $0.16 per mile on the 1,600 mile long haul lane west to Los Angeles, the source of the majority of capacity in that market.

In neighboring Laredo, reefer rates were up $0.08 per mile last week and $0.17 per mile for loads to Portland. Closer to Los Angeles, a similar story played out in the Tucson market where capacity was tight in Nogales. Spot rates surged $0.25 per mile.

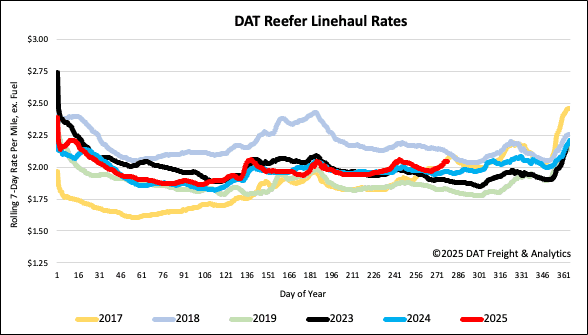

Reefer national spot rates

At month-end, the national 7-day rolling average for reefer carriers saw a $0.05 per mile surge, reaching $2.05 per mile across all temperature zones. Reefer spot rates, which had previously mirrored the past two years, now show a distinct upward trend, marking an increase of $0.08 compared to the previous year and $0.15 over 2023.