Market analysts are closely monitoring the demand for cardboard, especially in the corrugated sector, as an unconventional yet significant economic indicator. Recent data shows a decline in sales of corrugated cardboard, which is commonly used for shipping consumer goods. Nearly half of surveyed box producers reported worsening demand compared to three months earlier, suggesting potential warning signs for retail demand at large and indicating a possible broader economic slowdown.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

The industry is grappling with cost pressures stemming from tariffs and ongoing inflation. Tariffs introduced in early 2025 have disrupted trade, leading to increased prices for key raw materials like containerboard, which rose by about $70 per ton in the first half of the year. Despite these price increases, shipments of corrugated containerboard saw a 2.1% year-over-year decline in Q1 2025, although there were signs of recovery in Q2, with shipments exceeding those of the previous year’s quarter.

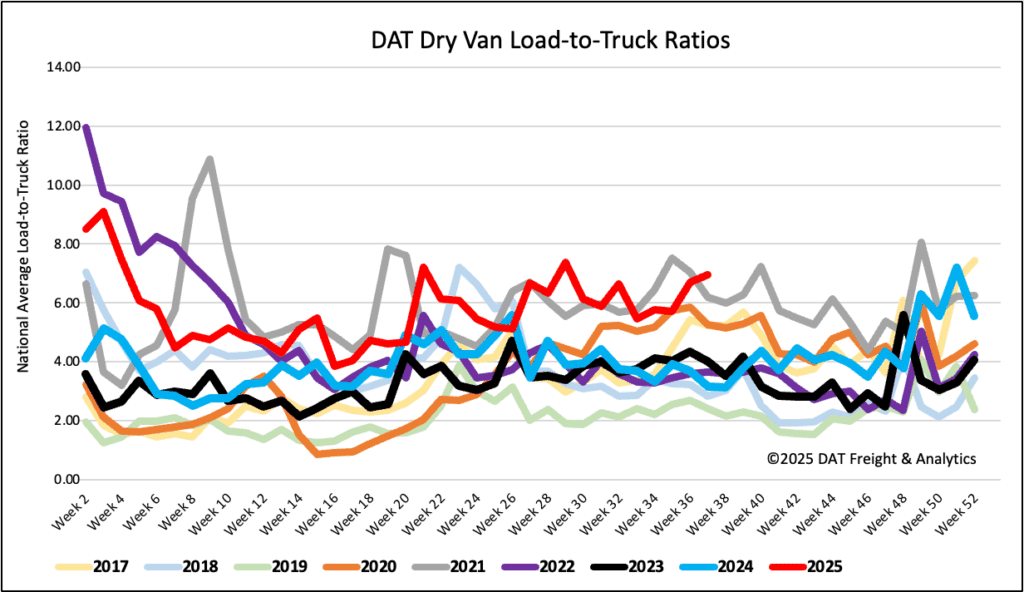

Load-to-Truck Ratio

Following the Labor Day long weekend, dry van load posts decreased significantly by 17% week over week. The short workweek also led to fewer trucks being posted by carriers on DAT’s load board. As a result, the dry van load-to-truck ratio saw a slight increase to 6.94.

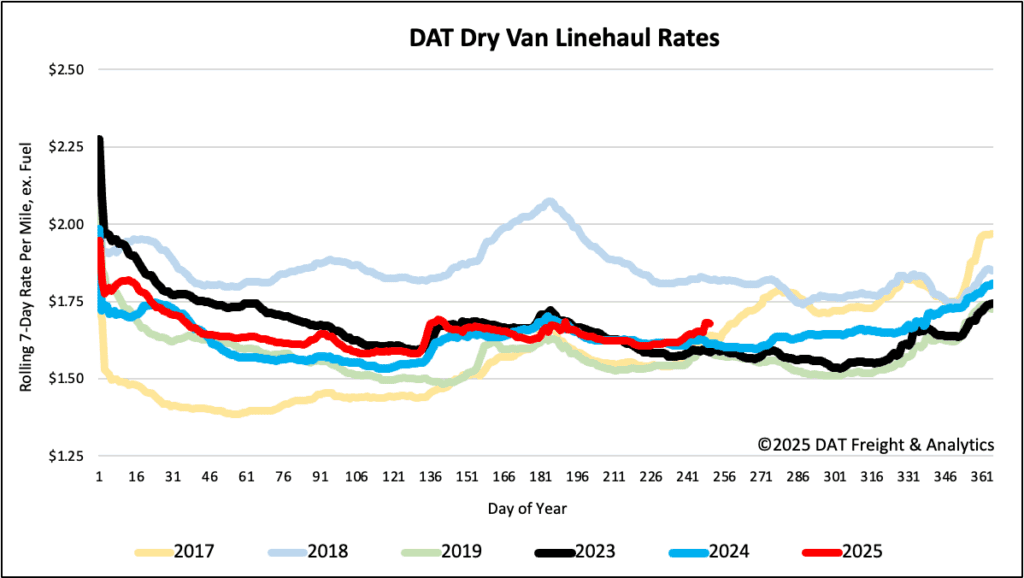

Linehaul spot rates

Dry van linehaul spot rates increased by just over $0.01 per mile last week, averaging $1.69 per mile, $0.07 higher than the same time last year and 2023.

The average rate for DAT’s top 50 lanes by load volume remained flat last week, averaging $2.03 per mile and $0.34 higher than the national 7-day rolling average spot rate.

In the 13 key Midwest states, which represent 46% of national load volume and often indicate future national trends, spot rates were up $0.02 on an 18% lower volume of loads moved due to the short workweek. Carriers in these states earned an average of $1.92 per mile, which remained $0.23 above the national 7-day rolling average.