Recent research highlights strategies to attract more women to the trucking industry. According to the American Transportation Research Institute (ATRI), the challenges identified in the research were industry image and perception, training school completion, truck parking shortages and restroom access, and gender harassment and discrimination. The Women In Trucking Association (WIT) is America’s leading industry association for women in the trucking industry, with more than 6,000 members in 10+ countries worldwide.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

WIT conducted this survey to provide context to its most recent 2019 WIT Index (by FreightWaves), which found that women comprised 10.2% of the industry’s driver workforce. When asked about the most critical aspect the trucking industry should focus on to increase the percentage of drivers, safety tied to family/ home time was the females’ top response, underscoring the industry’s commitment to their well-being.

The ATRI analysis found that carriers implementing women-specific recruiting and retention initiatives have a higher percentage of women drivers (8.1%) than those without (5.0%), indicating a significant potential for growth. The report details how fleets can implement such initiatives.

Market watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

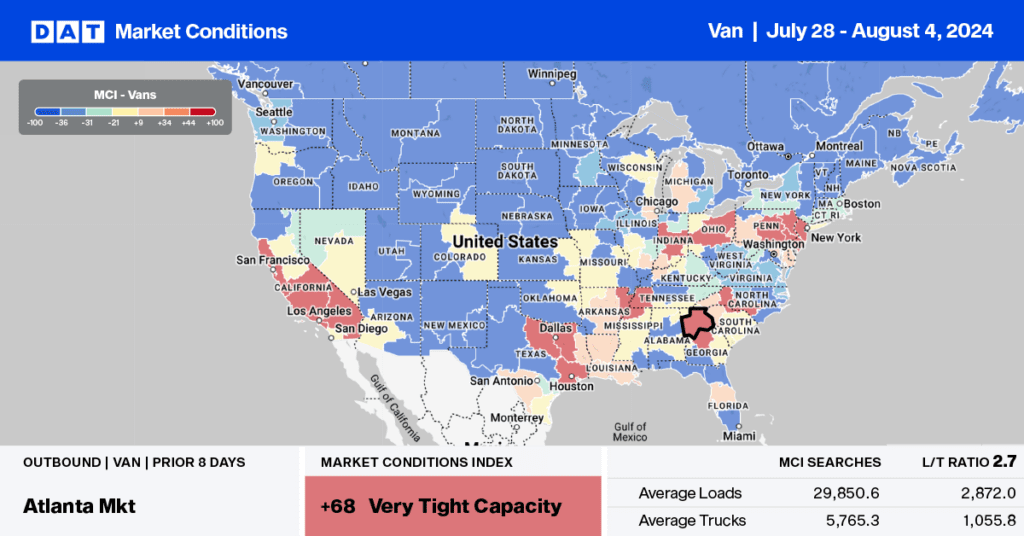

This week we’re taking at look at the Lone Star State where dry van capacity tightened last week in Houston following a 4% statewide increase in loads moved. Outbound spot rates are $0.06/mile higher than last year. There was a substantial increase in volume to Dallas last week; loads moved were up 15% w/w, increasing spot rates by $0.02/mile to an average of $2.44/mile or $575/load, almost identical the the June average and $27/load higher than last year. Capacity was also tight on the Houston to Laredo regional lane – linehaul rates increased by $0.09/mile on a 15% higher volume.

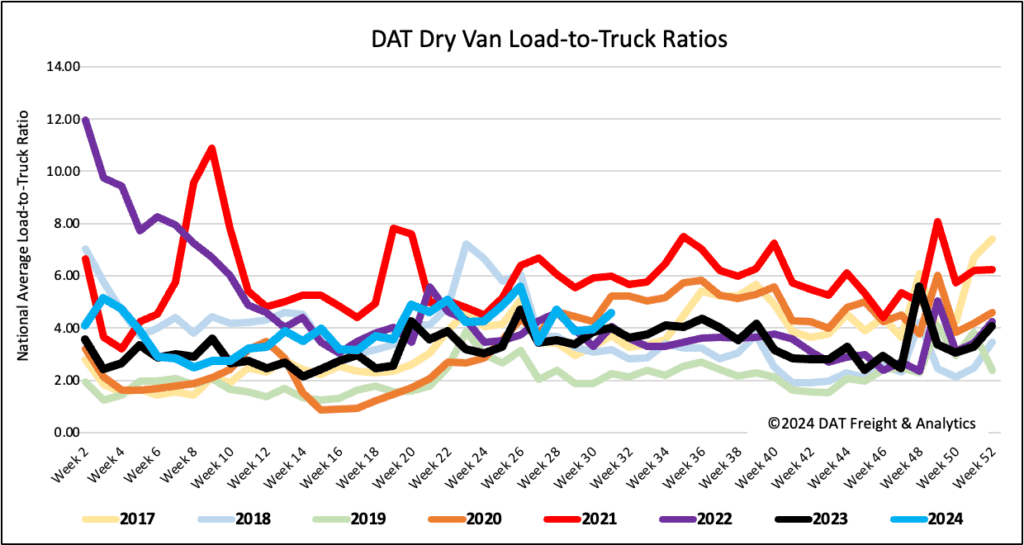

Load-to-Truck Ratio

The typical month-end boost in shipping volume resulted in spot market dry van load postings increasing by 5% w/w but 8% lower compared to last year. In contrast, last week’s volumes were 10% higher than the levels in Week 31 over the last seven years, excluding the years affected by the pandemic in 2020 and 2021. Capacity tightened on higher volume, resulting in a 9% w/w decrease in equipment posts by carriers, leading to an increase of 16% in the dry van load-to-truck ratio (LTR) to 4.57.

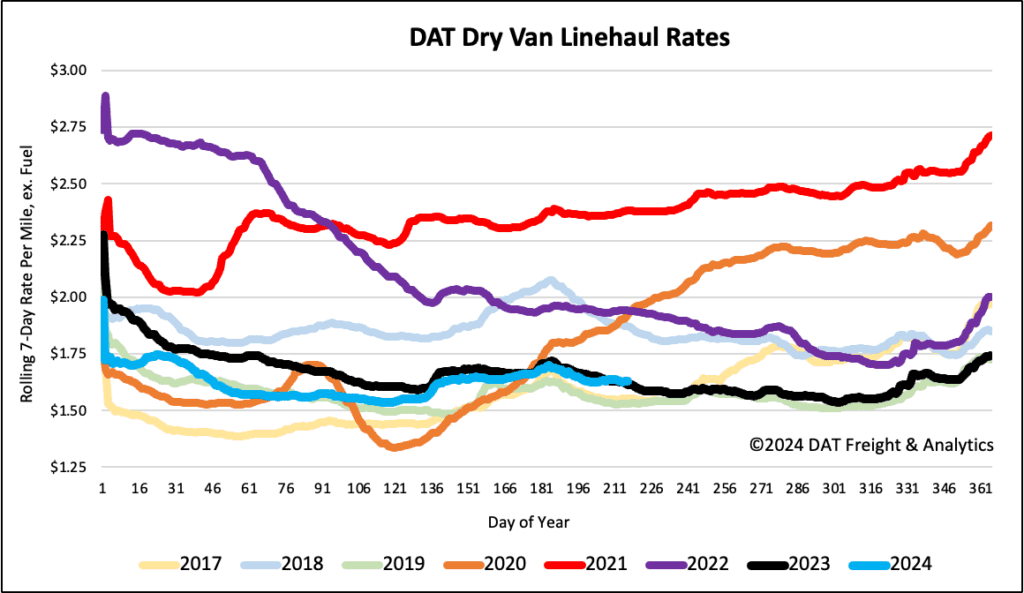

Linehaul spot rates

Dry van linehaul rates remained flat last week at $1.64 per mile, around a penny per mile higher than last year. According to DAT’s Top 50 lanes, based on the volume of loads moved, the rates have dropped by $0.02 per mile to $2.02 per mile. This is $0.38 per mile, higher than the national average.