Driving through Indiana on I-80, the sheer number of RVs near Elkhart, the “RV Capital of the World,” was striking. This observation aligns with the notion that RV sales serve as an economic indicator, declining when consumer confidence or the economy weakens, according to Ball State University’s Michael Hicks.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Conversely, strong RV sales suggest a positive outlook for recreational travel. The RV Industry Association’s April 2025 survey indicated a 3.4% increase in total RV shipments to 35,375 units compared to April 2024. Year-to-date, shipments are up 10.9% with 133,223 units.

RV Industry Association President & CEO Craig Kirby noted that with the summer travel season approaching and 44 million Americans RV trips, manufacturers are focused on providing new and innovative products. He added that the availability of new RVs at dealerships offers numerous options for experiencing the outdoors’ benefits.

Towable RVs, primarily conventional travel trailers, saw a 4.2% increase in shipments in April compared to last year, reaching 31,982 units. However, motorhome shipments decreased by 3.4% over the same period, totaling 3,393 units.

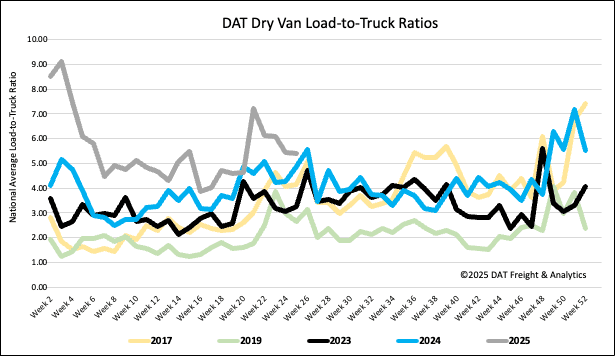

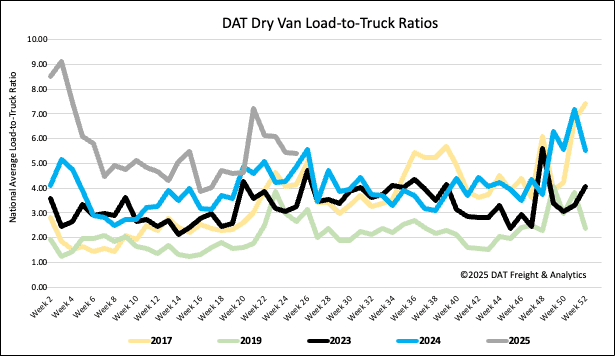

Load-to-Truck Ratio

Last week, the dry van load-to-truck ratio stayed largely consistent at 5.39, as both dry van load postings and truck postings on DAT saw similar decreases. Load postings were down 7% week-over-week and 5% compared to last year.

Linehaul spot rates

Dry van linehaul spot rates averaged just over $1.68/mile last week, remaining mostly flat for the third consecutive week. This rate is $0.03 higher than the same period last year and $0.01 higher than 2023.

The average rate on DAT’s top 50 lanes, determined by load volume, was $2.02/mile, consistent with the previous week and $0.34 higher than the national 7-day rolling average spot rate.

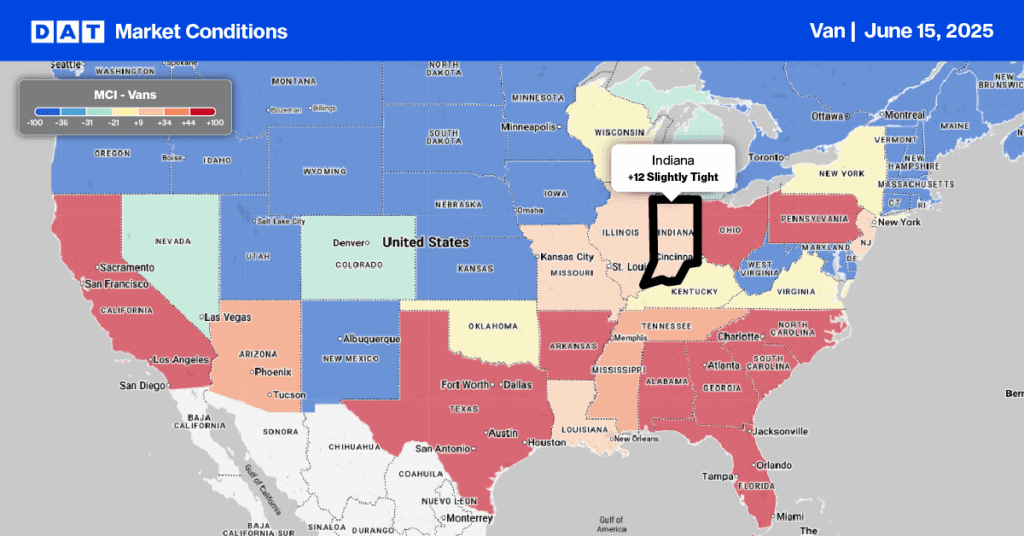

In 13 key Midwest states, which account for 44% of national load volume and typically reflect national trends, spot rates declined by $0.03 per mile. This decrease coincided with a 4% reduction in outbound load volume. Carriers in this region earned an average of $1.87 per mile, exceeding the national 7-day rolling average by $0.19.