On top of the solid report on mortgage volume earlier today comes another hopeful report from the construction industry. The National Association of Home Builders (NAHB) says builder confidence in the new home market has improved for the first time in January after 12 straight months of declines. According to NAHB’s chief economist Robert Dietz, “an increase which was due in part to a modest drop in interest rates; however, builder sentiment remains in the bearish territory as builders continue to grapple with elevated construction costs, building material supply chain disruptions, and challenging affordability conditions. The rise in builder sentiment also means that cycle lows for permits and starts are likely near, and a rebound for the single-family home building sector could be underway later in 2023.”

NAHB forecasts that single-family starts in 2023 will still be lower than in 2022, but in what could be good news for flatbed carriers, a turning point for housing is finally on the horizon. In addition to builder sentiment improving, December’s single-family housing starts rebounded to 909,000 units, an increase of 11.3% m/m but still 294,000 fewer than in December 2021. Comparing total single-family housing starts for the calendar year, 1.4m fewer homes were started in 2022 compared to 2021. That’s the equivalent of approximately 280,000 fewer truckloads over the entire year. Single-family building permits, a leading indicator of flatbed demand, declined 6.5% m/m and ended the year 35% lower than in December 2021.

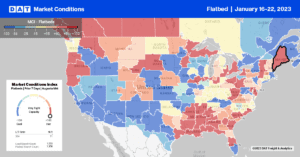

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

Flatbed capacity tightened in Florida last week following a surge in load posts, which increased by 59% w/w. Outbound flatbed linehaul rates increased by $0.24/mile to $1.61/mile, driven by solid gains in the Tallahassee market, where rates jumped to $2.69/mile. Demand was strong for loads to Lakeland, which were paying $3.11/mile or $0.11/mile higher than the previous year, and on the Miami lane, where rates were up slightly to $2.55/mile.

Even though Oregon state rates were flat at $2.43/mile last week, solid gains were reported in the Portland market, where rates increased by $0.09/mile to $2.53/mile. In nearby Medford, load posts were up 11% w/w, but with sufficient available capacity, linehaul rates for outbound loads dropped by $0.13/mile to $2.33/mile last week. In Los Angeles and San Diego flatbed markets, load posts increased by 4% w/w, with spot rates increasing by $0.09/mile to $1.95/mile. Los Angeles outbound loads to Las Vegas and Phoenix were at 12-month lows of $2.65/mile and $2.69/mile, respectively, last week.

In Prince George, British Columbia market, load post surged last week, driven by high volumes shipped to Stockton, CA. Loads on this 1,400-mile haul were at a 12-month high of $2.90/mile, which is $0.73/mile higher than in December and the same time last year.

Load-to-Truck Ratio (LTR)

Flatbed load posts are currently at the lowest level in seven years, in stark contrast to the previous year’s flurry of activity, where volumes were almost five times higher. Load posts are 53% lower than the six-year average for Week 3 of the shipping year, and with carrier equipment posts also at their highest level in seven years, it was no surprise to see the last week’s load-to-truck (LTR) ratio at 11.19, the lowest since 2016.

Spot Rates

Flatbed national average linehaul rates at $2.10/mile are $0.58/mile lower y/y following last week’s $0.03/mile decrease. Flatbed rates continued to track closely with the 2018 market and were within a penny-per-mile the previous week and $0.20/mile higher than in pre-pandemic years for Week 3 of the shipping year.