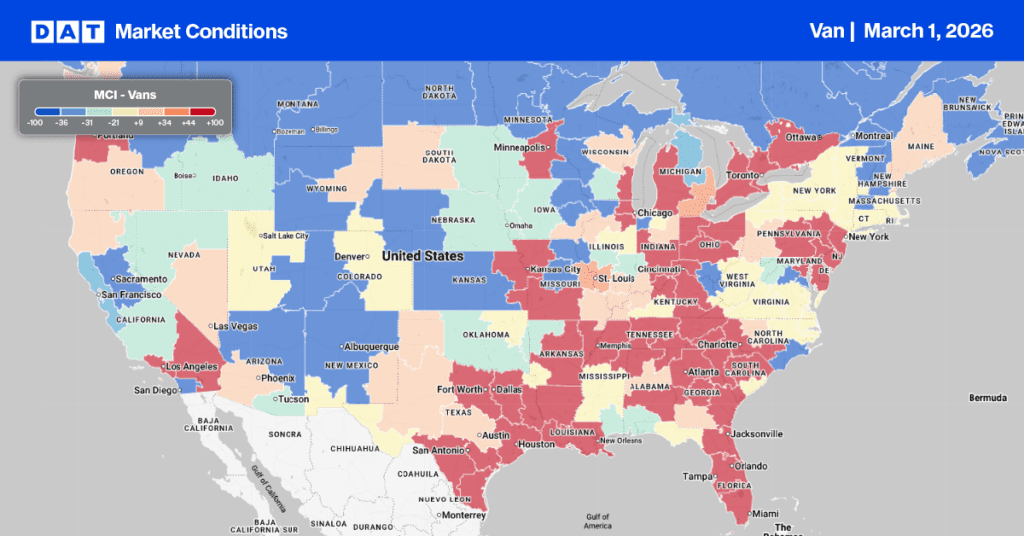

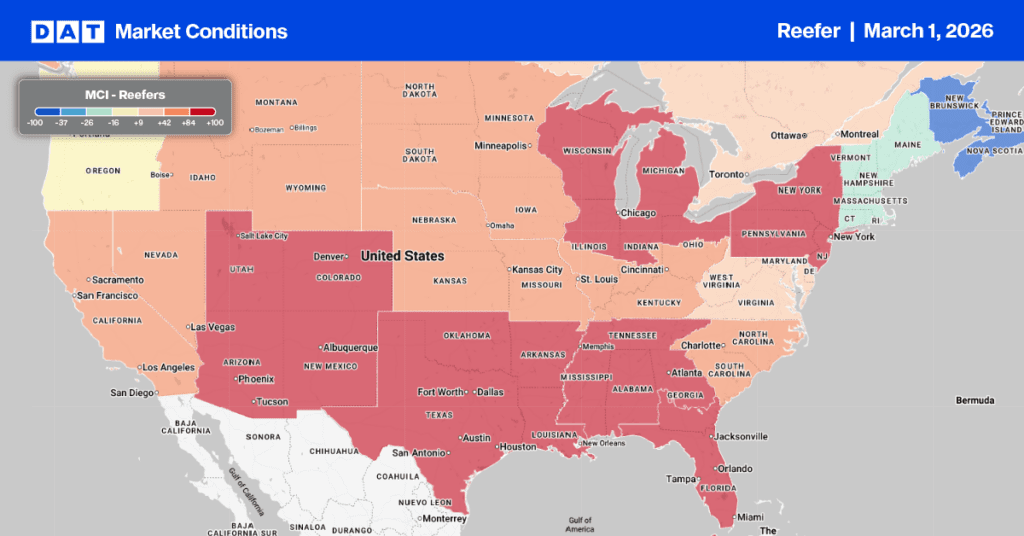

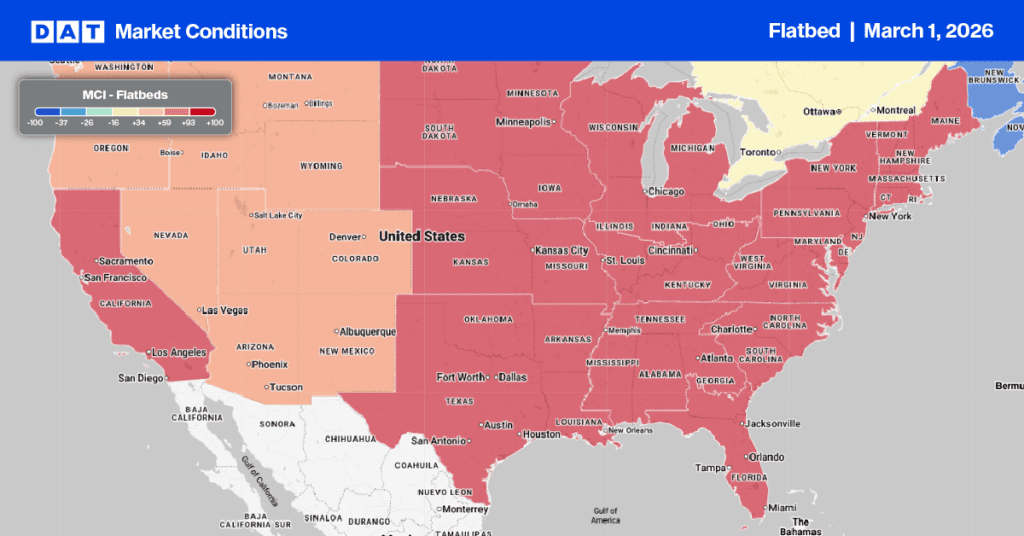

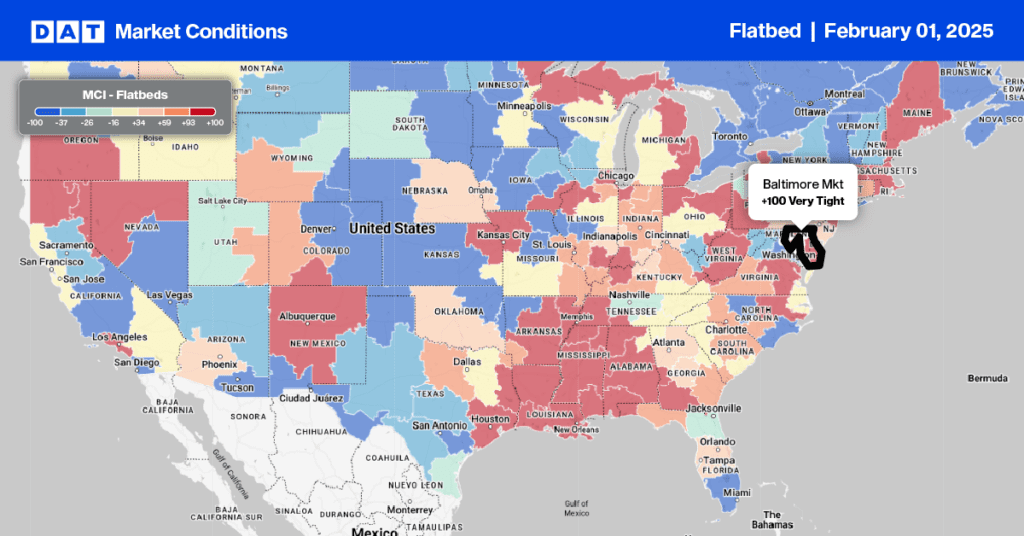

This week, we focus on the Baltimore freight market, where DATs Market Condition Index (MCI) expects available capacity to remain very tight this week. Baltimore is the number one port for imported machinery, which typically peaks in March each year ahead of planting and construction seasons. Flatbed and specialized carriers are looking to have a better year following a decline in the sales of tractors and combine harvesters last year. According to the Association of Equipment Manufacturers (AEM), U.S. sales of agricultural tractors decreased by 11.3% in December, while combine sales dropped by 26.4% compared to 2023.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

“December’s sales of agricultural tractors and combines reflect the trends we observed throughout 2024, indicating a softness in the market,” said AEM Senior Vice President Curt Blades. “The past year has been characterized by high interest rates and uncertainty in the overall agricultural economy. However, AEM is optimistic about the potential for 2025 and will continue to advocate for policies that positively impact the industry. AEM is looking forward to the potential in 2025 and will continue to advocate for policies focused on positively impacting the industry.”

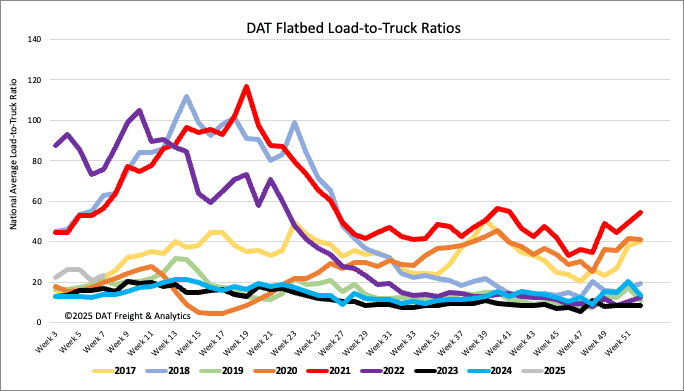

Load-to-Truck Ratio

Flatbed load post volumes are around 11% higher than last year following last week’s 17% increase. Equipment posts were mostly flat, resulting in last week’s flatbed load-to-truck ratio (LTR), which ended the week at 23.09

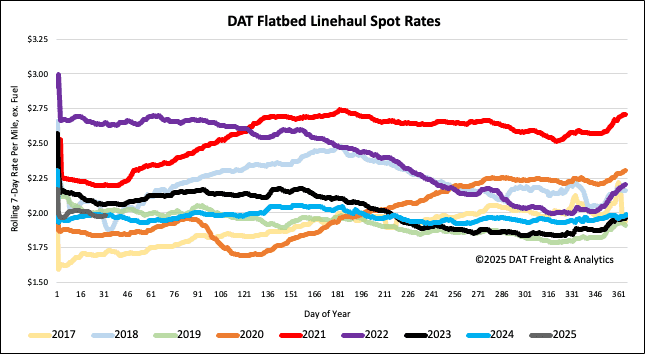

Spot rates

There was no change in last week’s national average flatbed rate, which has averaged $2.00/mile for the last two years, and that’s precisely where flatbed spot rates ended last week. At $2.00/mile, linehaul rates were identical to last year and $0.03/mile lower than 2019.