Caterpillar Inc. is the world’s leading manufacturer of construction and mining equipment, off-highway diesel and natural gas engines, industrial gas turbines and diesel-electric locomotives. For flatbed and specialized truckload carriers, Caterpillar is viewed as a bellwether for global economic growth since it supplies heavy equipment to the construction, mining and energy industries around the world. Last week, Caterpillar Inc. (NYSE: CAT) announced fourth-quarter and full-year results for 2024.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Sales and revenues for the fourth quarter of 2024 were $16.2 billion, a 5% decrease compared with $17.1 billion in the fourth quarter of 2023. Full-year sales and revenues in 2024 were $64.8 billion, down 3% compared with $67.1 billion in 2023. Lower sales volume was primarily driven by lower sales of equipment to end users. According to Bloomberg, “investors have been concerned by elevated inventories of Caterpillar machines at dealerships that sell to consumers. Such stockpiles provide an insight into demand — high inventories suggest customers aren’t buying machines off dealer lots and low levels indicate strong consumption.”

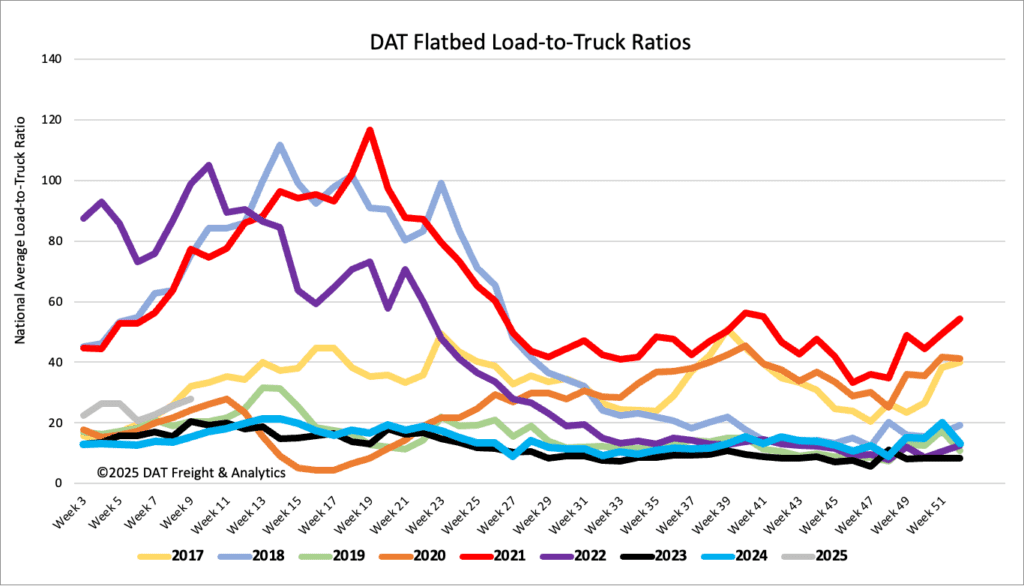

Load-to-Truck Ratio

Flatbed load post volumes were flat last week, 9% higher than last year but 20% lower than the Week 7 average going back to 2016 (excluding 2020, 2021, and 2022). Last week’s flatbed load-to-truck ratio (LTR) ended mostly unchanged at 27.96.

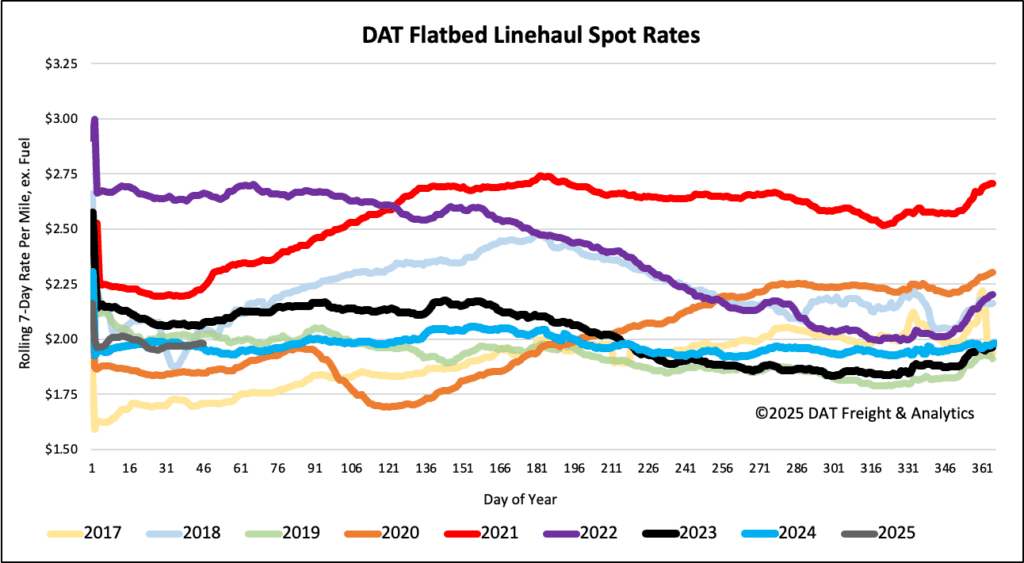

Spot rates

There was no change in last week’s national average flatbed rate for the fourth week, which paid carriers an average of $2.00/mile. That’s identical to the flatbed spot rate for the last two years. At $2.00/mile, linehaul rates were $0.02/mile higher than last year and $0.07/mile lower than in 2018 as that year’s rate rally got underway.