Based on the latest data from the Association of Equipment Manufacturers (AEM), sales of 4-wheel-drive tractors in the United States increased by 4.8% in August 2024 compared to the previous year. Year-to-date, there has been a 5.2% increase in sales. However, total U.S. agricultural tractor sales decreased by 19.4% compared to 2023, and combine sales dropped by 19.6%. Last month’s total sales were almost 20% lower compared to the 5-year average for August.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

AEM Senior Vice President Curt Blades stated, “While the increase in 4-wheel-drive tractors is modest, it indicates the industry’s resilience and the continued demand for agricultural equipment. The overall decline in the tractor market emphasizes the urgent need for a robust farm bill to support rural America and our agricultural community.”

In Canada, sales of 4-wheel-drive tractors increased by 29.4% in August 2024 compared to 2023 and are up by 18.1% year-to-date. However, total Canadian agricultural tractor sales fell by 26.1% compared to last year, while total combine sales dropped by 36.5%.combine sales dropped 36.5%.

Market watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

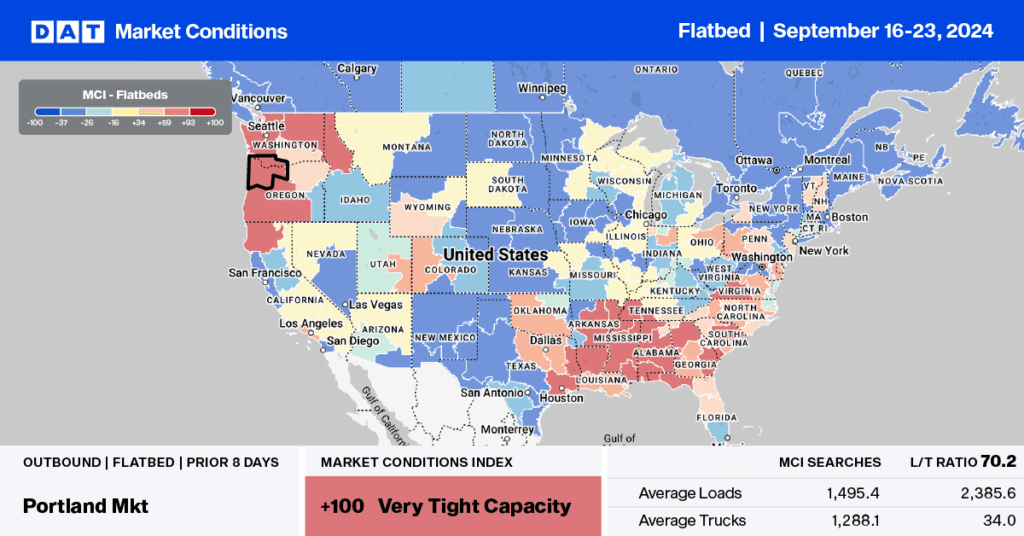

This week, we are focusing on the Pacific Northwest (PNW), where there is a high demand for flatbed capacity. Outbound volumes are approximately 5% higher than last month, and capacity is starting to tighten due to a 7% increase in linehaul rates last week. Most of the volume is transported regionally to Seattle, Twin Falls, Medford, and Stockton markets.

On the busy route between Seattle and Stockton, CA, carriers are being paid an average of $1.98 per mile, the highest rate this year but approximately $0.16 per mile lower than last year. Tighter capacity was also reported on the Medford, OR, to Stockton route, where linehaul rates averaged $2.95 per mile last week, the highest since May but almost $0.50 per mile lower than last year.

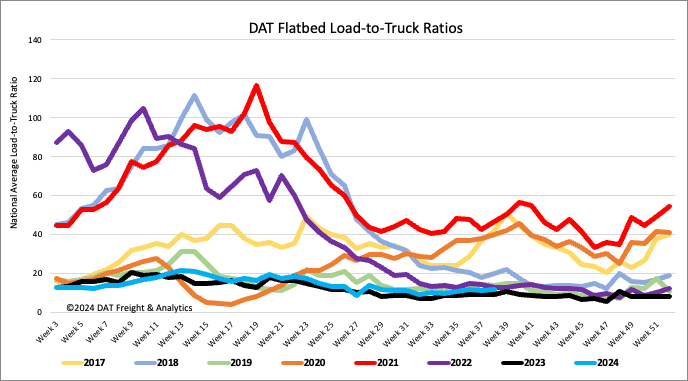

Load-to-Truck Ratio

The volume of flatbed load posts lost some ground following last week’s 2% decrease. Volumes are just 3% lower than last year and 2019. Carriers’ equipment dropped by 8% w/w, resulting in last week’s flatbed load-to-truck ratio increasing by 6% to 12.11.

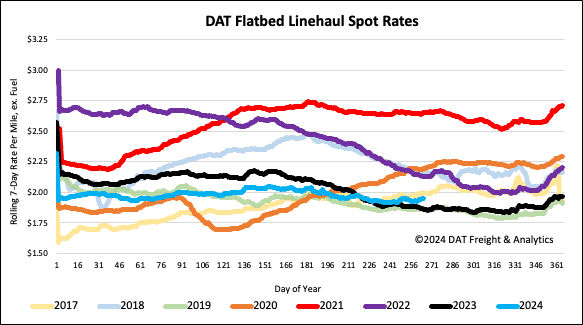

Spot rates

Flatbed linehaul rates remained flat last week, averaging $1.97/mile, which is close to the average over the past six weeks. Flatbed linehaul rates are $0.09/mile higher than last year and 2019, $0.11/mile higher than 2019, and $0.03/mile lower than the three-month trailing average. Compared to 2017, when the flatbed rate rally started and continued well into 2018, last week’s linehaul rate was $0.05/mile lower.