The recent weak earnings performance reported by Home Depot, stemming from softer home improvement demand and a slowdown in the housing market, suggests a negative impact on truckload flatbed demand. Flatbed trucking is highly correlated with the health of the construction and industrial sectors, as it is used for transporting heavy, bulky materials such as lumber, steel, roofing supplies, and various commodities essential for construction and major renovations. It also hauls machinery used on construction sites or for industrial projects. Flatbed demand is therefore a key gauge of the industrial economy’s health, and based on the latest earnings call from the multinational home improvement retailer Home Depot, the outlook for flatbed carriers in 2026 appears unfavorable.Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Home Depot’s Chief Financial Officer, Richard McPhail, pointed to higher interest rates and borrowing costs as the reason homeowners are in a “deferral mindset,” reluctant to undertake high-dollar projects such as remodels or major additions that require significant, often flatbed-shipped, building materials. McPhail acknowledged that the company’s guidance had failed to materialize, stating, “When we set guidance, we had anticipated that demand would begin to accelerate gradually in the back half of the year as interest rates and mortgage rates eased. But what we saw was that ongoing consumer uncertainty and continued pressure in housing are disproportionately impacting home improvement demand.”

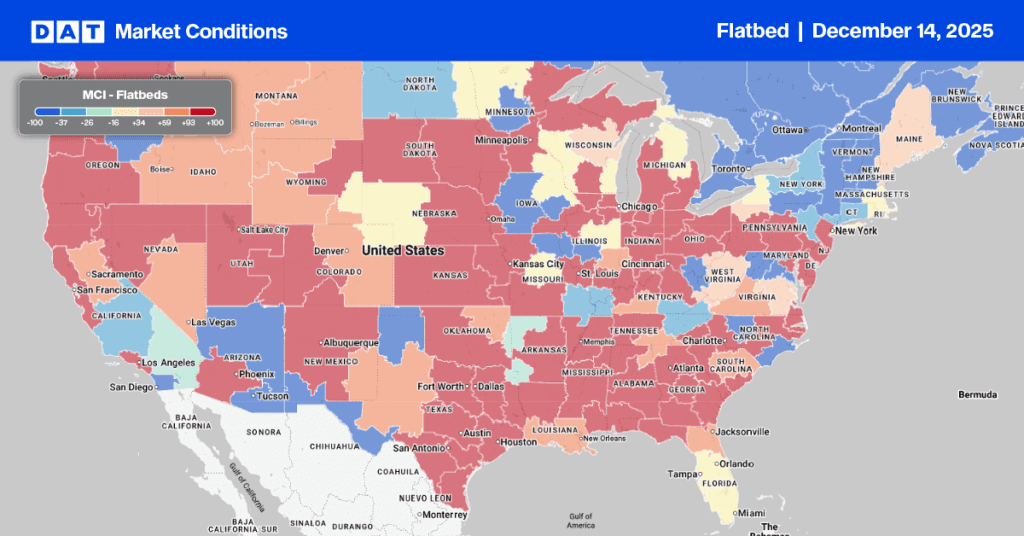

Flatbed Market Conditions

Flatbed load post volumes dropped 5% last week, yet they are still up over 80% year-over-year. This high volume is attributed to the extreme cold and the ongoing multi-week winter storms impacting the Midwest Region. Last week, the flatbed load-to-truck ratio was 26.67.

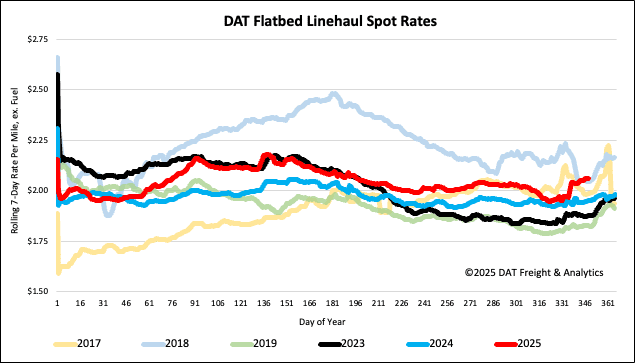

National flatbed spot rates

Last week, the national average flatbed spot rate increased by $0.02, reaching $2.07 per mile. This rise was primarily due to severe weather conditions in the Rocky Mountains and Midwest, where flatbed spot rates saw an $0.08 per mile jump. Currently, the national average rate is $0.11 per mile, or about 5%, higher than the rate recorded during the same period last year and matches the rate from 2018.