The recent U.S. Census Bureau release of residential construction for July surprised most of us who watch this data as an indicator of future flatbed demand. Climbing mortgage rates to near-two-decade highs continue to slow the overall housing market improvement. Meanwhile, new home construction continues to grow amid an acute shortage of existing homes. Single-family housing starts increased by almost 7% in July. Permits, an indicator of future single-family construction, increased by almost 1%.

Single-family housing starts, which account for the bulk of homebuilding, increased to 983,000 units last month, 9.5% higher, but 129,000 fewer single-family home starts compared to last year. Compared to 2019, last month’s total was 108,000 higher. The increase in starts was led by the West, where single-family starts jumped 28.5% m/m. Starts rose 12.5% m/m in the Midwest but fell 3.4% m/m in the Northeast and declined 1.3% m/m in the densely populated South, which accounted for 60% of new single-family homes in July.

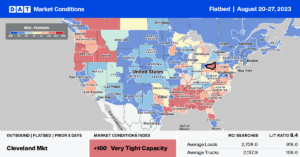

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

Flatbed capacity was generally tight in the PNW region last week, especially in the Portland market, following last week’s $0.07/mile increase to an outbound average of $2.56/mile. Loads to Stockton, CA, paid carriers $2.34/mile, while Denver loads averaged $2.21/mile, $0.21/mile higher than last month and $0.11/mile higher than in 2022. Oregon outbound rates averaged $2.66/mile last week, $0.03/mile higher than in 2022 and the highest for week 34 going back as far as 2016.

Capacity tightened rapidly last week along the southern border in the Tucson market; rates jumped $0.23/mile to $1.70/mile. Carriers reported solid gains for import loads from Nogales to Las Vegas, with rates at their highest in 12 months at $2.57/mile. In Pittsburgh, outbound spot rates jumped $0.17/mile to $2.56/mile, with short-haul loads to Cleveland paying carriers $570/load, or the equivalent of $2.15/mile for the round-trip of 264 miles. Outbound Indiana spot rates are around $0.10/mile higher than in 2019 at $2.35/mile last week, while nearby Ohio flatbed rates followed a similar long-term trend at $2.32/mile.

Load-to-Truck Ratio (LTR)

After dropping over the previous four weeks, flatbed volumes increased by 14% last week but remain around half what they were at this time last year. Carrier equipment posts were down by just over 4% w/w, resulting in the flatbed load-to-truck ratio (LTR) increasing from 5.29 to 6.31, which is only half the 2019 flatbed LTR.

Spot Rates

After dropping by $0.27/mile since the start of June, the national average flatbed spot rate was flat last week at $1.92/mile. Last week’s average was $0.35/mile lower than in 2018 and 2022 and $0.03/mile higher than in 2019.