A significant warning sign for Canadian and U.S. flatbed truckers is emerging from the decline in lumber prices. This decline is leading to substantial production cuts by sawyers. Interfor, the third-largest lumber producer in North America, announced on Thursday that it plans to reduce its output by 12%. This reduction, totaling approximately 145 million board feet by year-end, or the equivalent of 12,000 to 14,000 flatbed truckloads. This will involve cuts across its sawmills in the U.S. South, Pacific Northwest, British Columbia, and eastern Canada. The company will achieve this by reducing hours, reconfiguring shifts, and extending holiday breaks and maintenance shutdowns.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Domtar, a major producer, is implementing significant operational changes, including indefinite downtime at its Glenwood, Ark., sawmill, indefinite idling of another in Maniwaki, Quebec, and the elimination of a shift at its Côte-Nord facility in Quebec. Industry analysts and traders anticipate further production cuts will be necessary to address the current wood surplus. This may be a manageable issue, as increased duties have raised Canadian sawmills’ break-even prices at a time of decreasing demand.

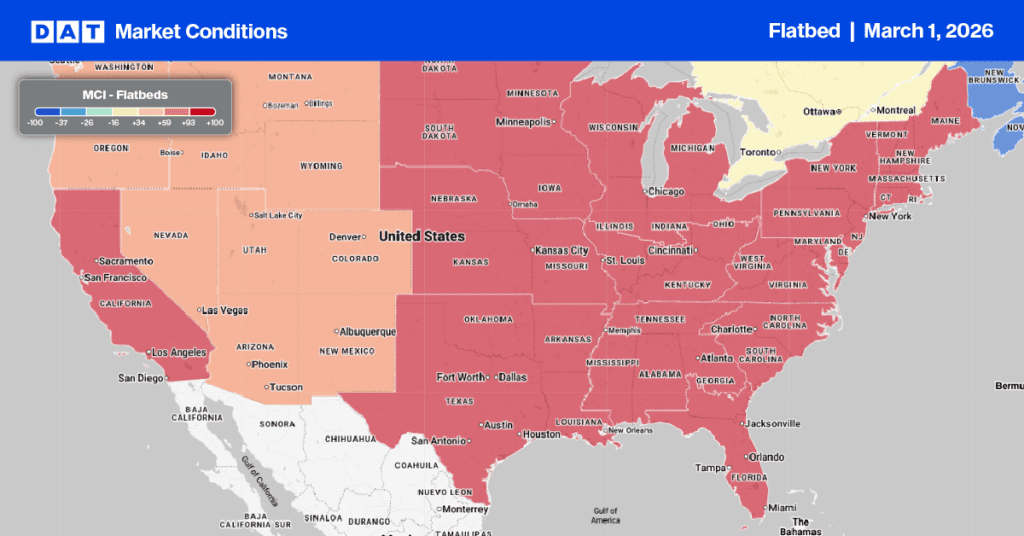

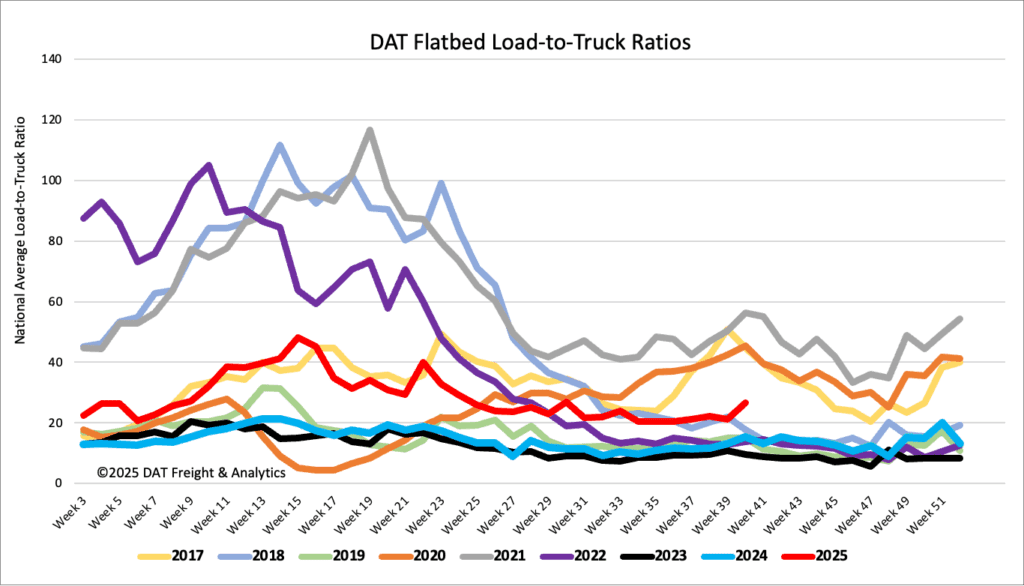

Load-to-Truck Ratio

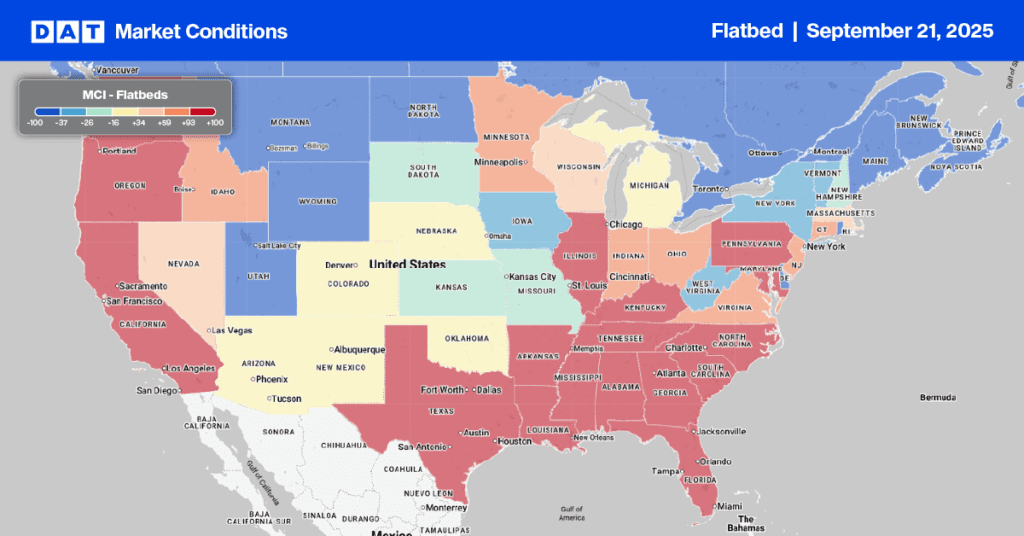

Last week saw another surge in flatbed load post volumes, up 25% in the last month following last week’s 17% increase. Carriers equipment posts dropped 6% resulting in the flatbed load-to-truck ratio held steady at 26.68.

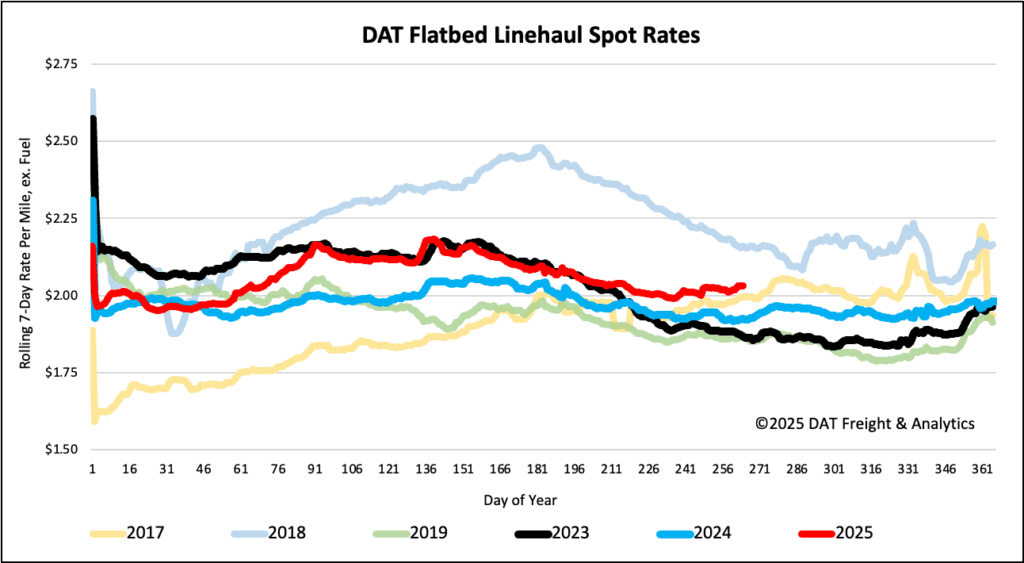

Spot rates

Last week, flatbed rates rose to $2.05 per mile, an increase of just over a penny. This rate is $0.11 higher than last year, $0.16 higher than in 2023, and maintains a $0.04 per mile lead over 2017—a year that saw a very strong industrial economy for flatbed carriers. We are monitoring this trend closely, although it may simply be a coincidence.