Single-family residential construction showed modest improvement in July 2025. Single-family housing starts rose to a seasonally adjusted annual rate (SAAR) of 939,000, a 2.8% increase from June and a 7.8% increase from July last year. Permits, an indicator of future activity, edged up 0.5% from June to 870,000 but were down 7.9% year-over-year.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

A significant increase was observed in single-family completions, up 11.6% from June to 1,022,000 units. This was primarily due to builders clearing a backlog of homes already under construction, pushing to finish projects despite ongoing challenges, though this rate is still below last year’s pace. The growth in starts was entirely driven by a 13% month-over-month increase in the South, while the Midwest, Northeast, and West experienced monthly and annual declines.

The impact of this latest housing data on truckload carriers is moderately positive, though not dramatic. The small gains in single-family home completions and starts in July translate to incremental increases in demand for hauling materials, appliances, and finished goods. Overall, this data supports a steady, but not rapid, increase in freight activity for truckload carriers, particularly noticeable in lanes serving construction materials and finished home goods.

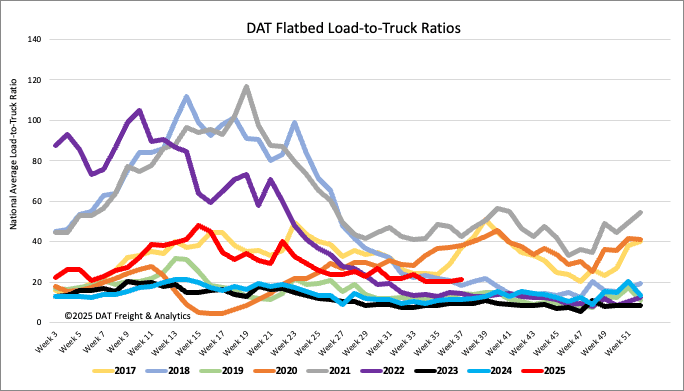

Load-to-Truck Ratio

Flatbed load post volumes remained consistent last week, marking the fourth consecutive week of stability and a 25% year-over-year increase. This, combined with a 4% drop in carrier equipment posts, led to a 4% rise in the load-to-truck ratio, reaching 21.27.

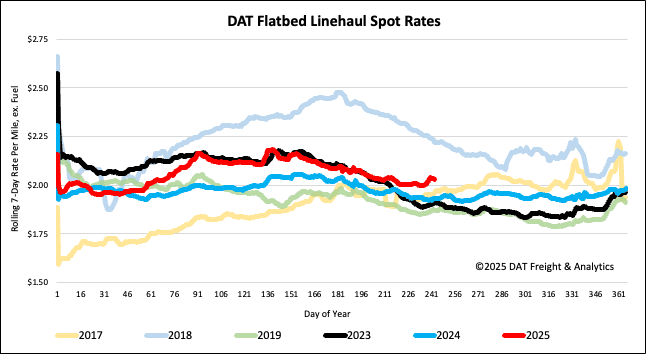

Spot rates

Last week, the national average flatbed spot rate, excluding fuel, rose by $0.02 per mile to $2.05 per mile. This national average is $0.10 per mile higher than the same week in 2024 and $0.12 per mile higher than in 2023.