Since the Great Recession in 2007, Las Vegas has sought to “recession-proof” itself and, in the process, started a construction boom that created significant demand for flatbed carriers to haul millions of tons of freight into the city each month.

In addition to local demand for belly dumpers, construction, and earthmoving machinery, long-haul flatbed demand seems to be tracked closely with the development of major construction projects. In recent years, the city has seen the completion of the new Las Vegas Raiders NFL Stadium, the 87-acre $7 billion Resort World Casino, and the $1 billion Las Vegas Convention Center (LVCC) expansion.

The recently announced demolition of the famous 67-year-old Tropicana Resort on April 2nd this year will make way for the new Oaklands A’s baseball stadium. The 33,000-seat ballpark will be built on 9 acres of the 35-acre Tropicana site. Plans call for the ballpark to feature an 18,000-square-foot jumbotron, the largest stadium screen in major league baseball. Plans also call for 2,500 parking spots on the site, with a plaza leading up to the stadium. All included, this means a substantial amount of freight for long-haul flatbed carriers, including machinery, steel, cabling, and lumber, when the A’s begin construction on the ballpark in April 2025.

Find dry van loads and trucks on North America’s largest on-demand freight network.

All rates cited below exclude fuel surcharges unless otherwise noted.

After dropping for the last three weeks, outbound spot rates in the combined Gary and South Bend, IN, markets were flat last week at $2.36/mile. This region accounts for around 30% of national steel production, which is up 1% nationally, according to the American Iron and Steel Institute (AISI). Outbound load volume is up 27% in the last month as we head into construction season, although spot rates are down 3% over the same timeframe.

In neighboring Ohio, there’s also an excess of available capacity, and despite a 34% increase in loads moved, state average spot rates decreased by $0.03/mile. In the larger Cleveland flatbed market, the volume of loads increased by 13% last week while rates dropped 2% to an average of $2.51/mile.

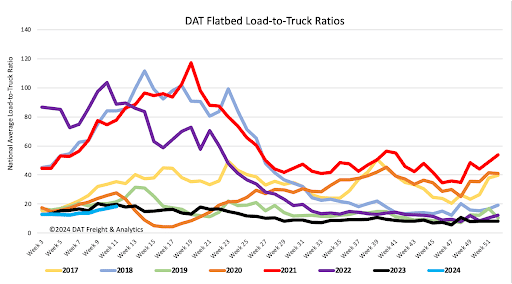

Flatbed load post volume increased for the seventh week following last week’s 1% w/w gain. Spot market volumes have increased 21% in the last month but trailed last year by 17%. Available capacity decreased following the 8% drop in equipment posts, increasing the load-to-truck ratio by 9% to 18.41.

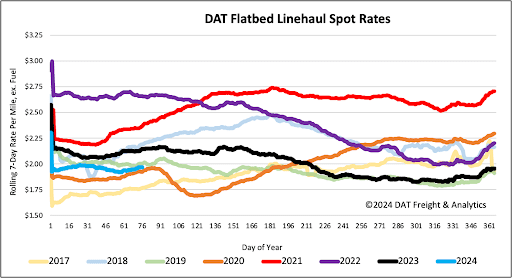

The volume of flatbed loads moved has increased by 21% in the last month following last week’s 12% gain. Freight moving in the spot market is just over 6% higher than last year, with spot rates remaining flat last week at $1.99/mile. Flatbed linehaul rates are 0.18/mile lower than last year and $0.04/mile higher than in 2020.