The Manufacturing PMI dipped to 48.5 percent in May, falling from April’s 48.7 percent, as reported in the Manufacturing ISM Report On Business. This marks the manufacturing sector’s third straight month of contraction, a reversal from the brief two-month expansion that followed 26 months of decline. According to Susan Spence, MBA, Chair of the ISM Manufacturing Business Survey Committee, the broader economy continues its 61-month expansion, uninterrupted since the April 2020 contraction.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Specifically, the New Orders Index fell for the fourth consecutive month, registering 47.6 percent. The Production Index showed a slight improvement to 45.4 percent, but remained in contraction. The Prices Index held strong in ‘increasing’ territory at 69.4 percent. The Backlog of Orders Index climbed to 47.1 percent, and the Employment Index rose to 46.8 percent, although both remained in contraction.

Growth was observed in several industries: Plastics & Rubber Products, Nonmetallic Mineral Products, Petroleum & Coal Products, Furniture & Related Products, Electrical Equipment, Appliances & Components, Fabricated Metal Products, and Machinery. In contrast, contraction was noted in Paper Products, Wood Products, Printing & Related Support Activities, Food, Beverage & Tobacco Products, Transportation Equipment, Chemical Products, and Primary Metals.

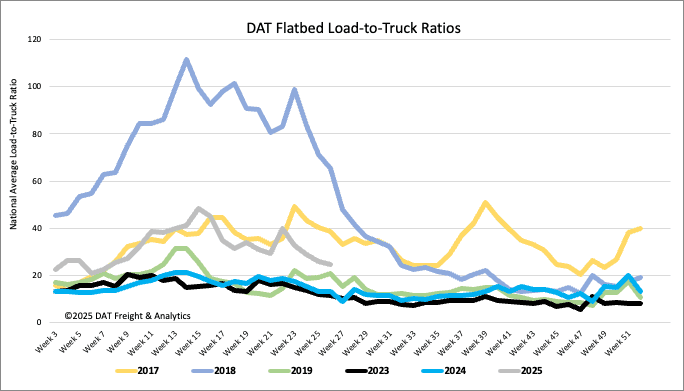

Load-to-Truck Ratio

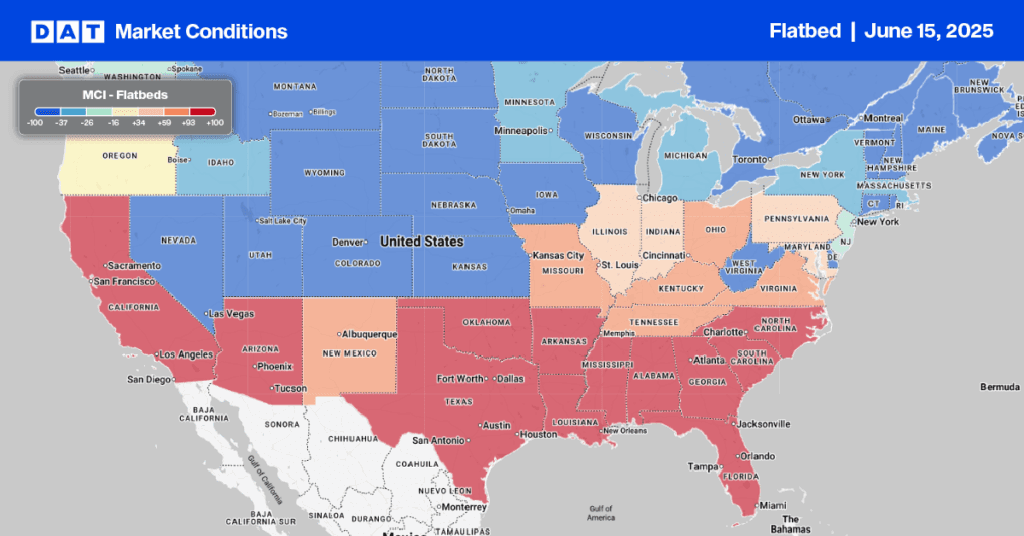

Last week, flatbed load post volume saw a 10% decrease, aligning with typical seasonal patterns. Despite this weekly drop, volume remains 7% higher compared to last year. Carrier equipment posts held steady, leading to a slight 5% decrease in the flatbed load-to-truck ratio, which settled at 24.56.

Spot rates

Last week, the average flatbed spot rate (excluding fuel) held steady at approximately $2.17 per mile. This rate reflects an increase of $0.11 per mile compared to the same week in 2024. However, it is $0.38 per mile lower than the bull market rate recorded in 2018.